Question: QUESTION 1 (a) The most recent financial statements for Mandy Company are shown here: Income Statement Balance Sheet RM 11,980 Debt Sales Costs RM 20,300

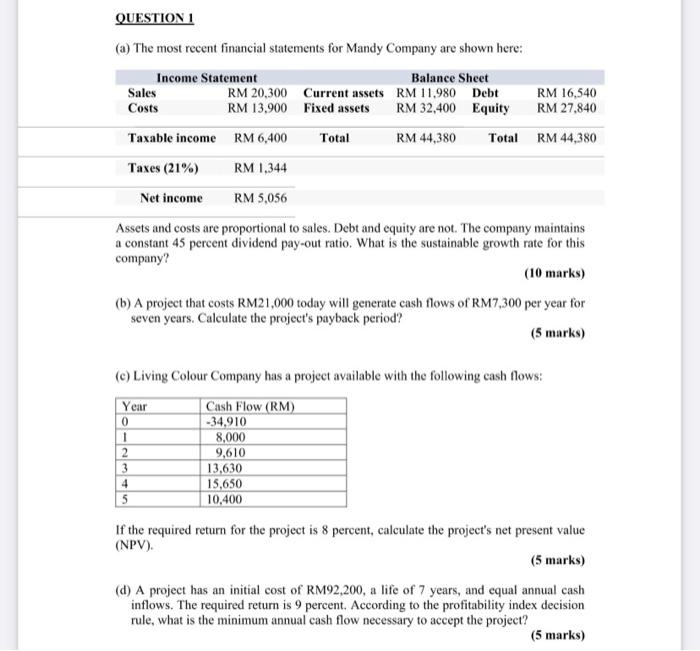

QUESTION 1 (a) The most recent financial statements for Mandy Company are shown here: Income Statement Balance Sheet RM 11,980 Debt Sales Costs RM 20,300 Current assets RM 13,900 RM 16,540 RM 27,840 Fixed assets RM 32,400 Equity Taxable income RM 6,400 Total RM 44,380 Total RM 44,380 Taxes (21%) RM 1,344 Net income RM 5,056 Assets and costs are proportional to sales. Debt and equity are not. The company maintains a constant 45 percent dividend pay-out ratio. What is the sustainable growth rate for this company? (10 marks) (b) A project that costs RM21,000 today will generate cash flows of RM7,300 per year for seven years. Calculate the project's payback period? (5 marks) (c) Living Colour Company has a project available with the following cash flows: Year Cash Flow (RM) 0 -34,910 1 8,000 2 9,610 3 13,630 4 15,650 5 10,400 If the required return for the project is 8 percent, calculate the project's net present value (NPV). (5 marks) (d) A project has an initial cost of RM92,200, a life of 7 years, and equal annual cash inflows. The required return is 9 percent. According to the profitability index decision rule, what is the minimum annual cash flow necessary to accept the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts