Question: Question 1 a) Today, ringgit Malaysia (RM) to is quoted at S$0.35/RM1. Next 1-month spot rate is expected to be S$0.45/RM1. Two investors (one is

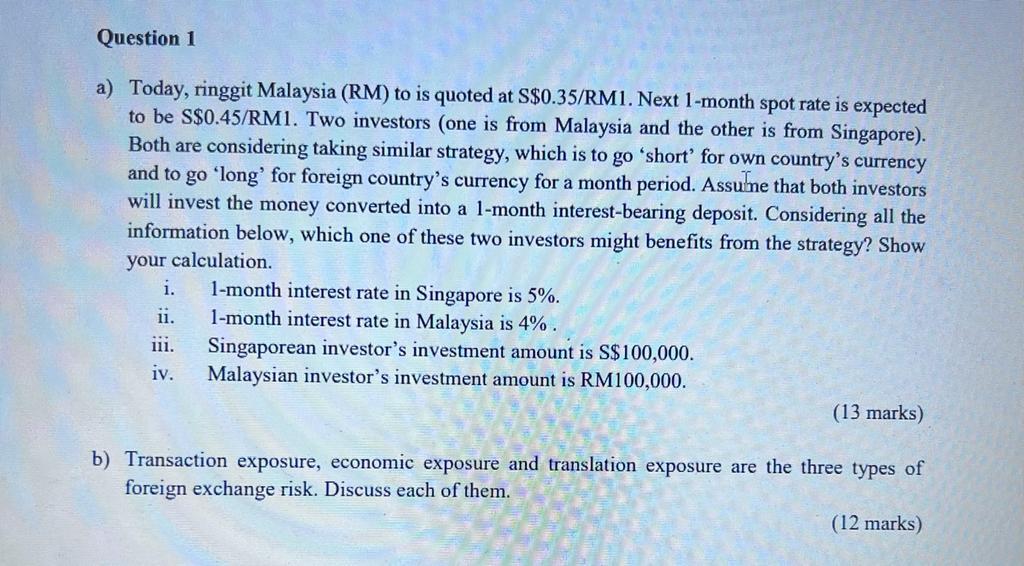

Question 1 a) Today, ringgit Malaysia (RM) to is quoted at S$0.35/RM1. Next 1-month spot rate is expected to be S$0.45/RM1. Two investors (one is from Malaysia and the other is from Singapore). Both are considering taking similar strategy, which is to go short for own country's currency and to go 'long' for foreign country's currency for a month period. Assume that both investors will invest the money converted into a 1-month interest-bearing deposit. Considering all the information below, which one of these two investors might benefits from the strategy? Show your calculation. i. 1-month interest rate in Singapore is 5%. ii. 1-month interest rate in Malaysia is 4% 111. Singaporean investor's investment amount is S$100,000. iv. Malaysian investor's investment amount is RM100,000. (13 marks) b) Transaction exposure, economic exposure and translation exposure are the three types of foreign exchange risk. Discuss each of them. (12 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts