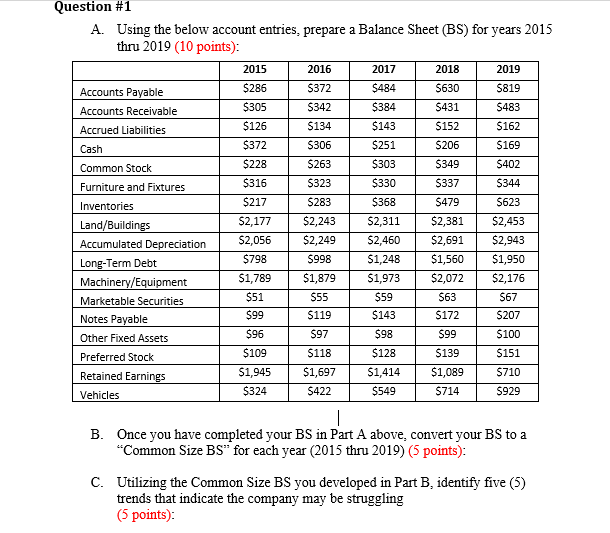

Question: Question #1 A. Using the below account entries, prepare a Balance Sheet (BS) for years 2015 thru 2019 (10 points): 2015 2016 2017 2018 2019

Question #1 A. Using the below account entries, prepare a Balance Sheet (BS) for years 2015 thru 2019 (10 points): 2015 2016 2017 2018 2019 Accounts Payable $286 $372 $484 5630 $819 Accounts Receivable $305 $342 $384 S431 5483 Accrued Liabilities $126 $134 $143 $152 $162 Cash $372 $306 $251 $206 $169 Common Stock $228 $263 $303 $349 $402 Furniture and Fixtures $316 $323 $330 5337 5344 Inventories $217 $283 $368 $479 5623 Land/Buildings $2,177 $2,243 $2,311 $2,381 $2,453 Accumulated Depreciation $2,249 $2,056 52,460 $2,691 $2,943 Long-Term Debt $798 $998 $1,248 $1,560 $1,950 Machinery/Equipment $1,789 $1,879 $1,973 $2,072 $2,176 Marketable Securities $51 $55 563 $67 Notes Payable $99 $119 $143 S172 $207 Other Fixed Assets $96 $97 $98 599 $100 Preferred Stock $109 S118 ] $128 S139 S151 Retained Earnings $1,945 $1,697 $1,414 | $1,089 $710 Vehicles | $324 | $422 | $549 714 T 5929 $59 B. Once you have completed your BS in Part A above, convert your BS to a "Common Size BS" for each year (2015 thru 2019) (5 points): C. Utilizing the Common Size BS you developed in Part B, identify five (5) trends that indicate the company may be struggling (5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts