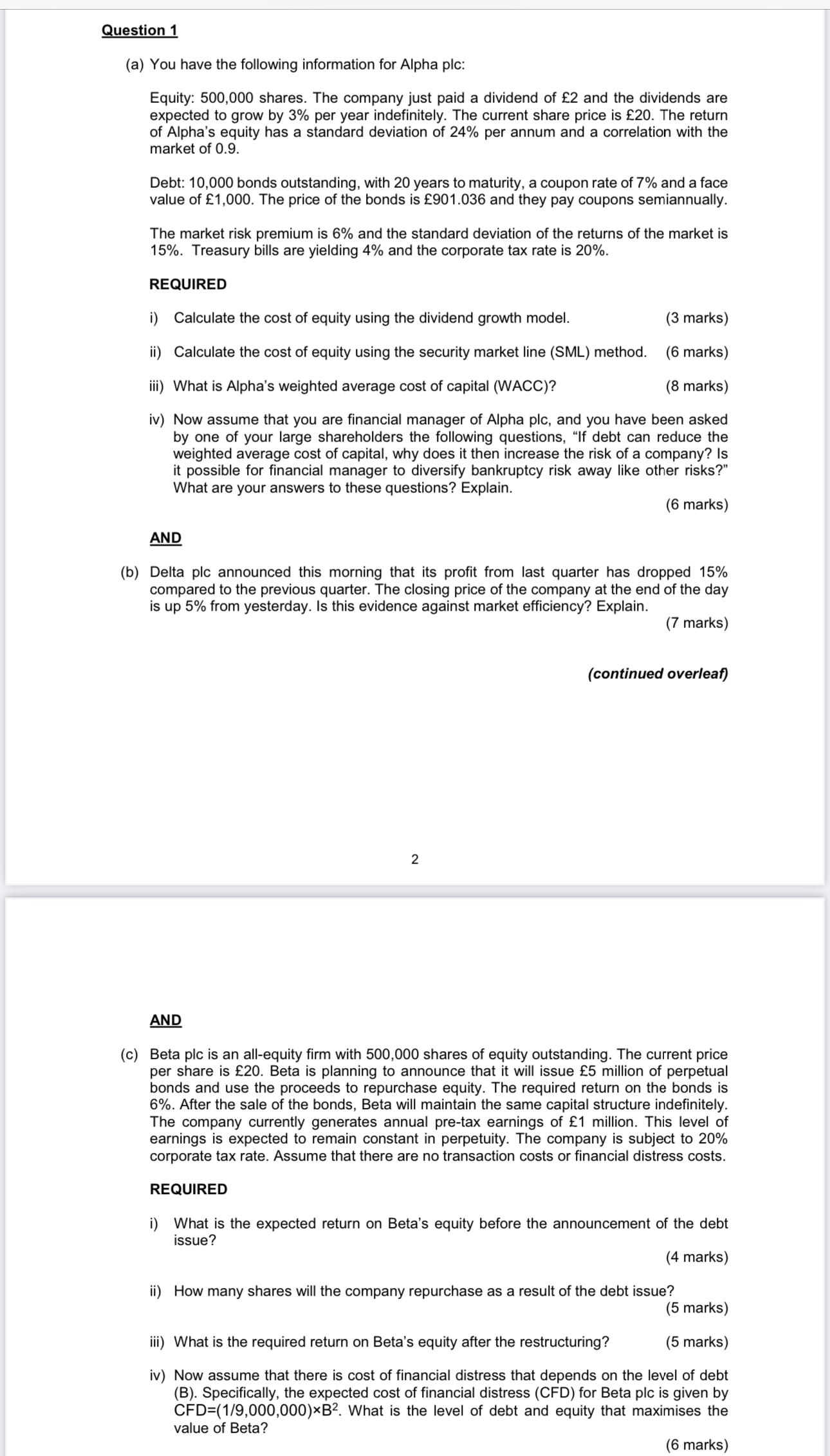

Question: Question 1 ( a ) You have the following information for Alpha plc: Equity: 5 0 0 , 0 0 0 shares. The company just

Question

a You have the following information for Alpha plc:

Equity: shares. The company just paid a dividend of and the dividends are expected to grow by per year indefinitely. The current share price is The return of Alpha's equity has a standard deviation of per annum and a correlation with the market of

Debt: bonds outstanding, with years to maturity, a coupon rate of and a face value of The price of the bonds is and they pay coupons semiannually.

The market risk premium is and the standard deviation of the returns of the market is Treasury bills are yielding and the corporate tax rate is

REQUIRED

i Calculate the cost of equity using the dividend growth model.

marks

ii Calculate the cost of equity using the security market line SML method.

marks

iii What is Alpha's weighted average cost of capital WACC

marks

iv Now assume that you are financial manager of Alpha plc and you have been asked by one of your large shareholders the following questions, If debt can reduce the weighted average cost of capital, why does it then increase the risk of a company? Is it possible for financial manager to diversify bankruptcy risk away like other risks?" What are your answers to these questions? Explain.

marks

AND

b Delta plc announced this morning that its profit from last quarter has dropped compared to the previous quarter. The closing price of the company at the end of the day is up from yesterday. Is this evidence against market efficiency? Explain.

marks

continued overleaf

AND

c Beta plc is an allequity firm with shares of equity outstanding. The current price per share is Beta is planning to announce that it will issue million of perpetual bonds and use the proceeds to repurchase equity. The required return on the bonds is After the sale of the bonds, Beta will maintain the same capital structure indefinitely. The company currently generates annual pretax earnings of million. This level of earnings is expected to remain constant in perpetuity. The company is subject to corporate tax rate. Assume that there are no transaction costs or financial distress costs.

REQUIRED

i What is the expected return on Beta's equity before the announcement of the debt issue?

marks

ii How many shares will the company repurchase as a result of the debt issue?

marks

iii What is the required return on Beta's equity after the restructuring?

marks

iv Now assume that there is cost of financial distress that depends on the level of debt B Specifically, the expected cost of financial distress CFD for Beta plc is given by CFD What is the level of debt and equity that maximises the value of Beta?

marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock