Question: Question 1 A,B,C : Floating Lookback Call uses: O A Lowest stock price during the life of the option as K O BHighest stock price

Question 1 A,B,C :

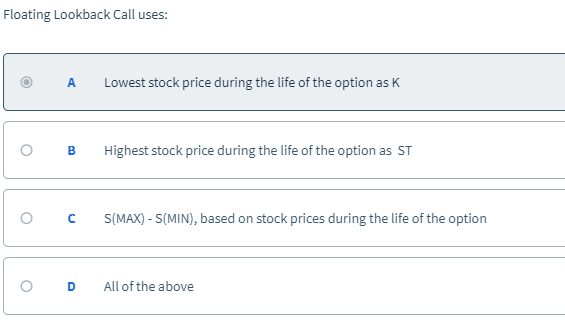

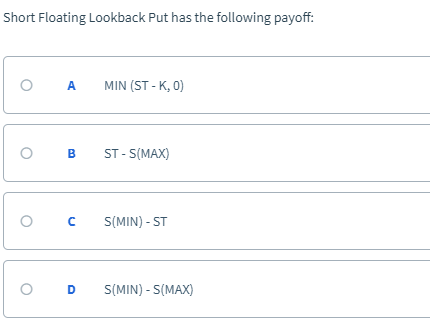

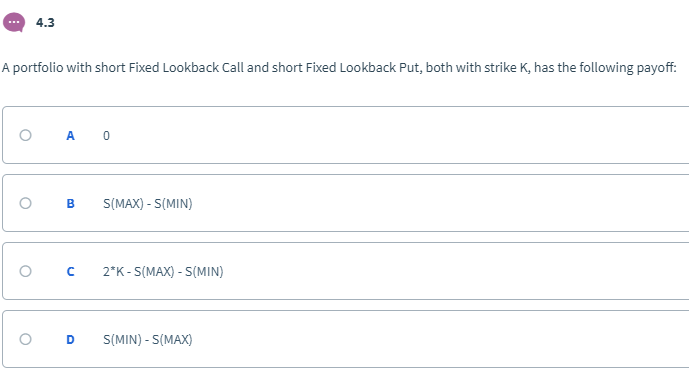

Floating Lookback Call uses: O A Lowest stock price during the life of the option as K O BHighest stock price during the life of the option as ST OCS(MAX) -S(MIN), based on stock prices during the life of the option O D All of the above Short Floating Lookback Put has the following payoff: O A MIN (ST-K, 0) O B ST- S(MAX) O S(MIN)-ST O D S(MIN)-S(MAX) 4.3 A portfolio with short Fixed Lookback Call and short Fixed Lookback Put, both with strike K, has the following payoff: O BS(MAX) -S(MIN) O c 2"K-S(MAX-S(MIN) O D S(MIN) -S(MAX) Floating Lookback Call uses: O A Lowest stock price during the life of the option as K O BHighest stock price during the life of the option as ST OCS(MAX) -S(MIN), based on stock prices during the life of the option O D All of the above Short Floating Lookback Put has the following payoff: O A MIN (ST-K, 0) O B ST- S(MAX) O S(MIN)-ST O D S(MIN)-S(MAX) 4.3 A portfolio with short Fixed Lookback Call and short Fixed Lookback Put, both with strike K, has the following payoff: O BS(MAX) -S(MIN) O c 2"K-S(MAX-S(MIN) O D S(MIN) -S(MAX)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts