Question: Question 1 ACME Multinational Inc. is considering whether to set up a subsidiary in the principality of Grand Fenwick at a cost of 5,200,000. This

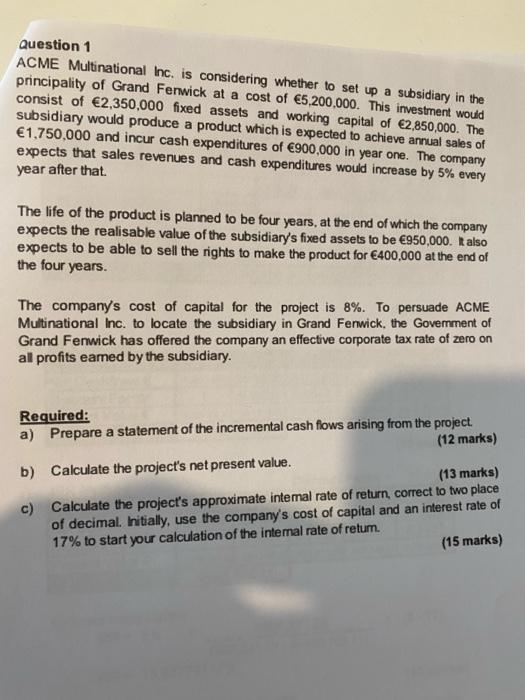

Question 1 ACME Multinational Inc. is considering whether to set up a subsidiary in the principality of Grand Fenwick at a cost of 5,200,000. This investment would consist of 2,350,000 fixed assets and working capital of 2,850,000. The subsidiary would produce a product which is expected to achieve annual sales of 1,750,000 and incur cash expenditures of 900,000 in year one. The company expects that sales revenues and cash expenditures would increase by 5% every year after that The life of the product is planned to be four years, at the end of which the company expects the realisable value of the subsidiary's fixed assets to be 950,000. I also expects to be able to sell the rights to make the product for 400,000 at the end of the four years. The company's cost of capital for the project is 8%. To persuade ACME Multinational Inc. to locate the subsidiary in Grand Fenwick, the Govemment of Grand Fenwick has offered the company an effective corporate tax rate of zero on al profits eamed by the subsidiary. Required: a) Prepare a statement of the incremental cash flows arising from the project (12 marks) b) Calculate the project's net present value. (13 marks) c) Calculate the project's approximate internal rate of return, correct to two place of decimal. Initially, use the company's cost of capital and an interest rate of 17% to start your calculation of the internal rate of retum (15 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts