Question: Question 1: Actuary and trustee reports indicate the following changes in the PBO and plan ascts of Brandie Cable during 2018: Prior service cost at

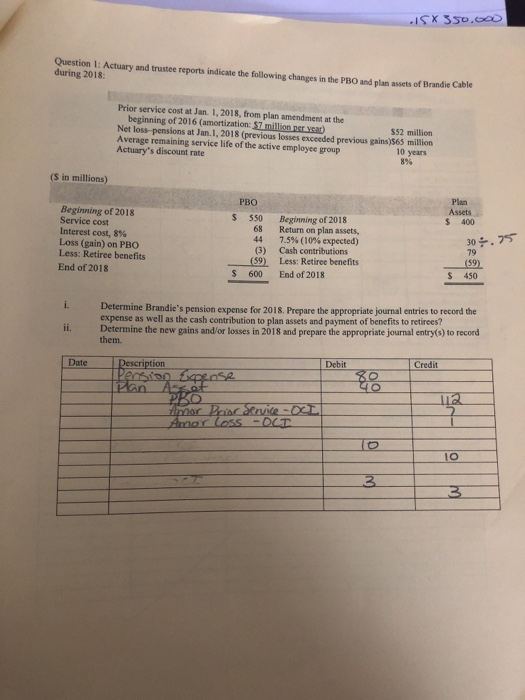

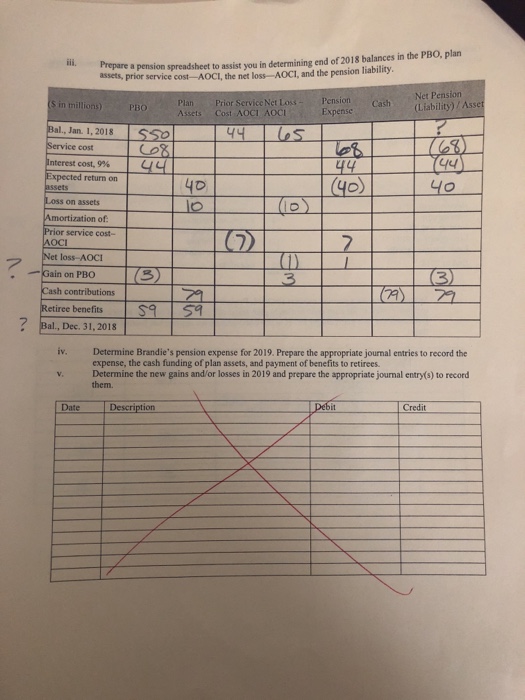

Question 1: Actuary and trustee reports indicate the following changes in the PBO and plan ascts of Brandie Cable during 2018: Prior service cost at Jan. 1, 2018, from plan amendment at the beginning of 2016 (amortization: 57 million per year) $52 million Net loss-pensions at Jan.1, 2018 (previous losses exceeded previous gains)s65 million Average remaining service life of the active employee group Actuary's discount rate 10 years 8% (S in millions) Plan Assets $ 400 ??? Beginning of 2018 Service cost Interest cost, 8% Loss (gain) on PBO Less: Retiree benefits End of 2018 $ 550 Beginning of 2018 68 44 (3) 59) Return on plan assets, 7.5% (10% expected) Cash contributions 79 59 Less: Retiree benefits S 600 End of 2018 S 450 Determine Brandie's pension expense for 2018. Prepare the appropriate journal entries to record the expense as well as the cash contribution to plan assets and payment of benefits to retirees? Determine the new gains and/or losses in 2018 and prepare the appropriate journal entry(s) to record them. i. ii. Debit Credit Date ion lo

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts