Question: QUESTION 1 Additional information: - Sunshine Ltd acquired 85000 shares in Rainbow Ltd on 1 January 2021 for R350 000. Rainbow Ltd had a retained

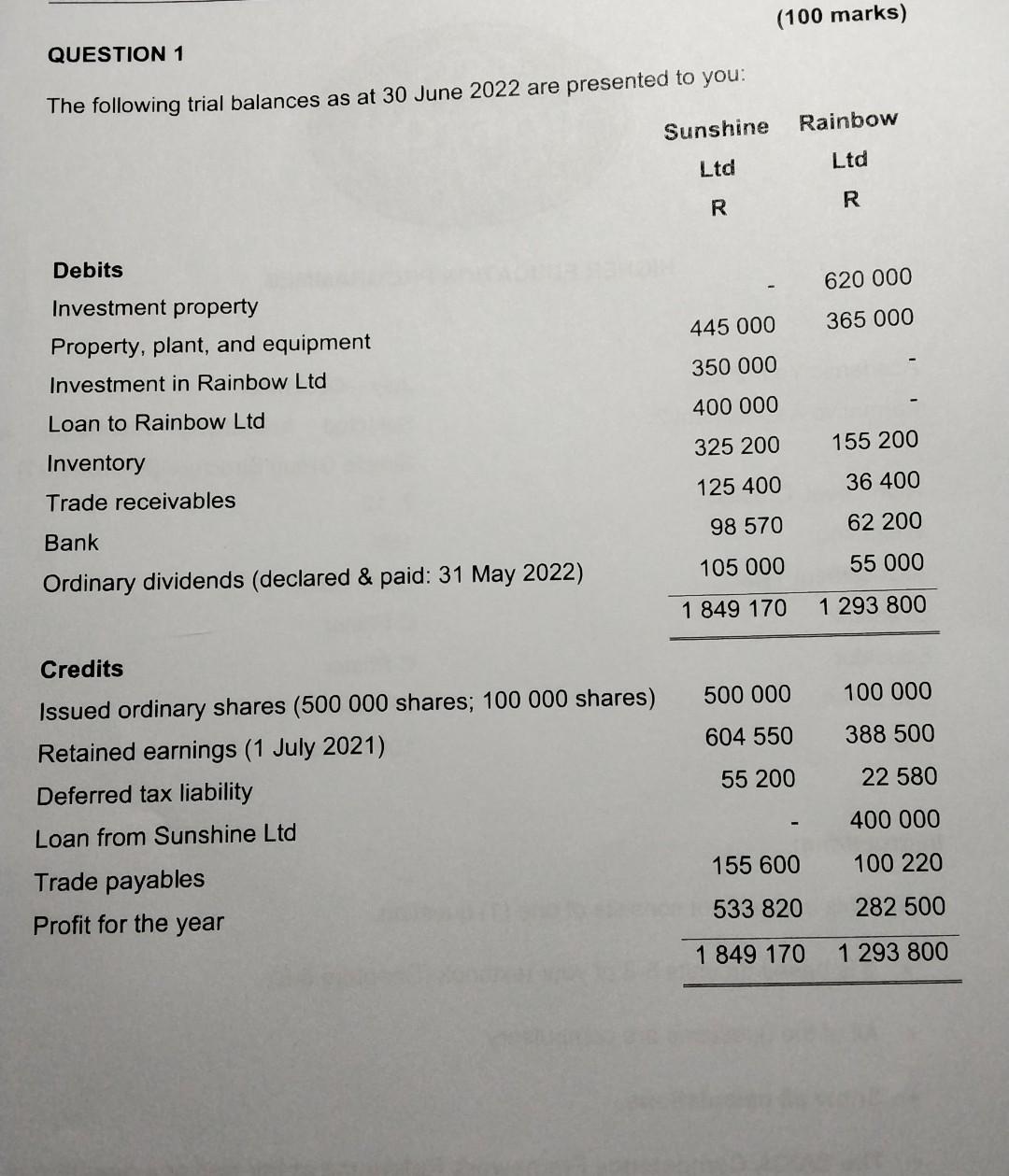

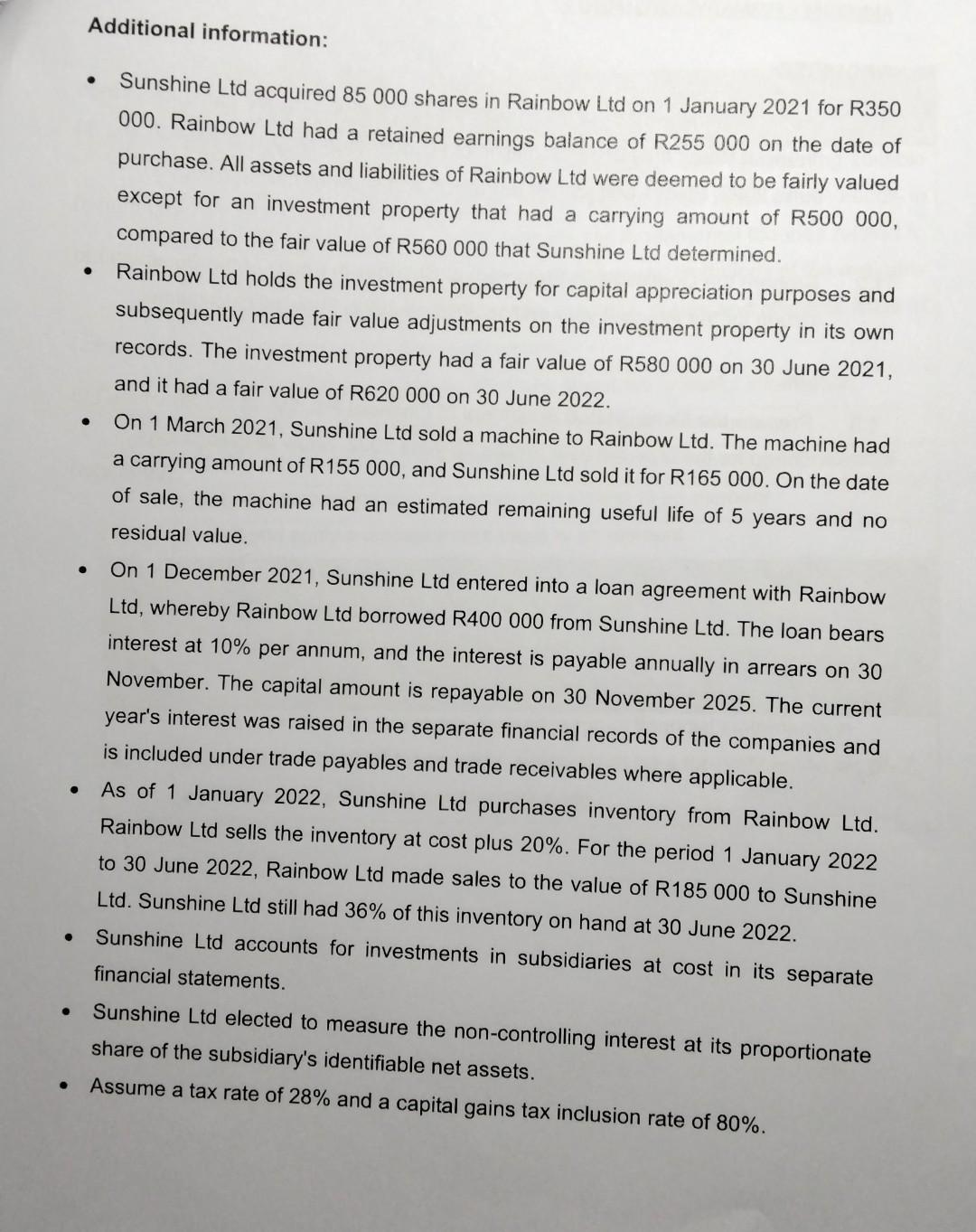

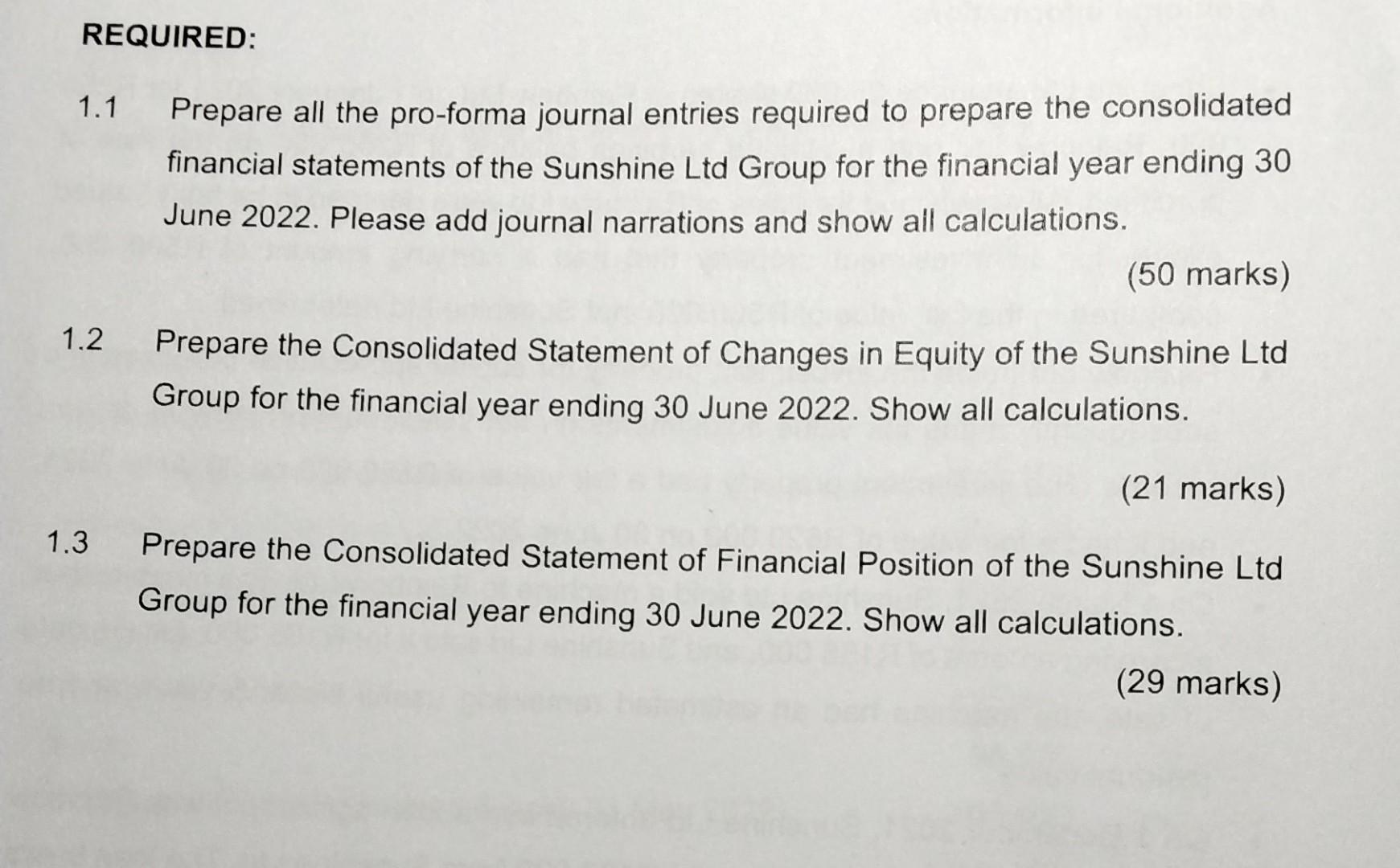

QUESTION 1 Additional information: - Sunshine Ltd acquired 85000 shares in Rainbow Ltd on 1 January 2021 for R350 000. Rainbow Ltd had a retained earnings balance of R255 000 on the date of purchase. All assets and liabilities of Rainbow Ltd were deemed to be fairly valued except for an investment property that had a carrying amount of R500 000 , compared to the fair value of R560 000 that Sunshine Ltd determined. - Rainbow Ltd holds the investment property for capital appreciation purposes and subsequently made fair value adjustments on the investment property in its own records. The investment property had a fair value of R580 000 on 30 June 2021 , and it had a fair value of R620 000 on 30 June 2022 . - On 1 March 2021, Sunshine Ltd sold a machine to Rainbow Ltd. The machine had a carrying amount of R155000, and Sunshine Ltd sold it for R165000. On the date of sale, the machine had an estimated remaining useful life of 5 years and no residual value. - On 1 December 2021, Sunshine Ltd entered into a loan agreement with Rainbow Ltd, whereby Rainbow Ltd borrowed R400 000 from Sunshine Ltd. The Ioan bears interest at 10% per annum, and the interest is payable annually in arrears on 30 November. The capital amount is repayable on 30 November 2025 . The current year's interest was raised in the separate financial records of the companies and is included under trade payables and trade receivables where applicable. - As of 1 January 2022, Sunshine Ltd purchases inventory from Rainbow Ltd. Rainbow Ltd sells the inventory at cost plus 20%. For the period 1 January 2022 to 30 June 2022 , Rainbow Ltd made sales to the value of R185000 to Sunshine Ltd. Sunshine Ltd still had 36% of this inventory on hand at 30 June 2022. - Sunshine Ltd accounts for investments in subsidiaries at cost in its separate financial statements. - Sunshine Ltd elected to measure the non-controlling interest at its proportionate share of the subsidiary's identifiable net assets. - Assume a tax rate of 28% and a capital gains tax inclusion rate of 80%. 1.1 Prepare all the pro-forma journal entries required to prepare the consolidated financial statements of the Sunshine Ltd Group for the financial year ending 30 June 2022. Please add journal narrations and show all calculations. (50 marks) 1.2 Prepare the Consolidated Statement of Changes in Equity of the Sunshine Ltd Group for the financial year ending 30 June 2022. Show all calculations. (21 marks) 1.3 Prepare the Consolidated Statement of Financial Position of the Sunshine Ltd Group for the financial year ending 30 June 2022 . Show all calculations. QUESTION 1 Additional information: - Sunshine Ltd acquired 85000 shares in Rainbow Ltd on 1 January 2021 for R350 000. Rainbow Ltd had a retained earnings balance of R255 000 on the date of purchase. All assets and liabilities of Rainbow Ltd were deemed to be fairly valued except for an investment property that had a carrying amount of R500 000 , compared to the fair value of R560 000 that Sunshine Ltd determined. - Rainbow Ltd holds the investment property for capital appreciation purposes and subsequently made fair value adjustments on the investment property in its own records. The investment property had a fair value of R580 000 on 30 June 2021 , and it had a fair value of R620 000 on 30 June 2022 . - On 1 March 2021, Sunshine Ltd sold a machine to Rainbow Ltd. The machine had a carrying amount of R155000, and Sunshine Ltd sold it for R165000. On the date of sale, the machine had an estimated remaining useful life of 5 years and no residual value. - On 1 December 2021, Sunshine Ltd entered into a loan agreement with Rainbow Ltd, whereby Rainbow Ltd borrowed R400 000 from Sunshine Ltd. The Ioan bears interest at 10% per annum, and the interest is payable annually in arrears on 30 November. The capital amount is repayable on 30 November 2025 . The current year's interest was raised in the separate financial records of the companies and is included under trade payables and trade receivables where applicable. - As of 1 January 2022, Sunshine Ltd purchases inventory from Rainbow Ltd. Rainbow Ltd sells the inventory at cost plus 20%. For the period 1 January 2022 to 30 June 2022 , Rainbow Ltd made sales to the value of R185000 to Sunshine Ltd. Sunshine Ltd still had 36% of this inventory on hand at 30 June 2022. - Sunshine Ltd accounts for investments in subsidiaries at cost in its separate financial statements. - Sunshine Ltd elected to measure the non-controlling interest at its proportionate share of the subsidiary's identifiable net assets. - Assume a tax rate of 28% and a capital gains tax inclusion rate of 80%. 1.1 Prepare all the pro-forma journal entries required to prepare the consolidated financial statements of the Sunshine Ltd Group for the financial year ending 30 June 2022. Please add journal narrations and show all calculations. (50 marks) 1.2 Prepare the Consolidated Statement of Changes in Equity of the Sunshine Ltd Group for the financial year ending 30 June 2022. Show all calculations. (21 marks) 1.3 Prepare the Consolidated Statement of Financial Position of the Sunshine Ltd Group for the financial year ending 30 June 2022 . Show all calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts