Question: Question 1 Adobe Systems, the second largest computer software company in the United States, dominates the graphic design, imaging, dynamic media, and authoring-tool software markets.

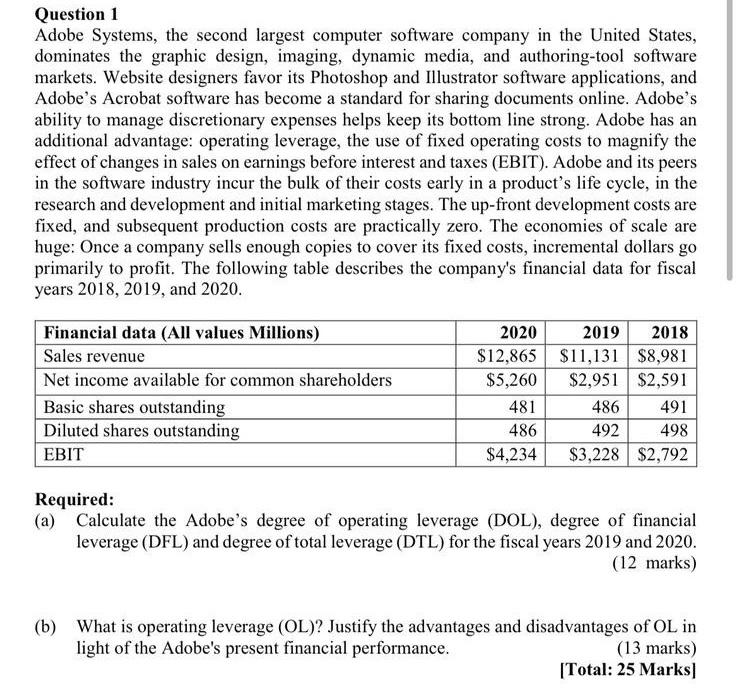

Question 1 Adobe Systems, the second largest computer software company in the United States, dominates the graphic design, imaging, dynamic media, and authoring-tool software markets. Website designers favor its Photoshop and Illustrator software applications, and Adobe's Acrobat software has become a standard for sharing documents online. Adobe's ability to manage discretionary expenses helps keep its bottom line strong. Adobe has an additional advantage: operating leverage, the use of fixed operating costs to magnify the effect of changes in sales on earnings before interest and taxes (EBIT). Adobe and its peers in the software industry incur the bulk of their costs early in a product's life cycle, in the research and development and initial marketing stages. The up-front development costs are fixed, and subsequent production costs are practically zero. The economies of scale are huge: Once a company sells enough copies to cover its fixed costs, incremental dollars go primarily to profit. The following table describes the company's financial data for fiscal years 2018, 2019, and 2020. Financial data (All values Millions) Sales revenue Net income available for common shareholders Basic shares outstanding Diluted shares outstanding EBIT 2020 2019 2018 $12,865 $11,131 $8,981 $5,260 $2,951 $2,591 481 486 491 486 492 498 $4,234 $3,228 $2,792 Required: (a) Calculate the Adobe's degree of operating leverage (DOL), degree of financial leverage (DFL) and degree of total leverage (DTL) for the fiscal years 2019 and 2020. (12 marks) (b) What is operating leverage (OL)? Justify the advantages and disadvantages of OL in light of the Adobe's present financial performance. (13 marks) [Total: 25 Marks Question 1 Adobe Systems, the second largest computer software company in the United States, dominates the graphic design, imaging, dynamic media, and authoring-tool software markets. Website designers favor its Photoshop and Illustrator software applications, and Adobe's Acrobat software has become a standard for sharing documents online. Adobe's ability to manage discretionary expenses helps keep its bottom line strong. Adobe has an additional advantage: operating leverage, the use of fixed operating costs to magnify the effect of changes in sales on earnings before interest and taxes (EBIT). Adobe and its peers in the software industry incur the bulk of their costs early in a product's life cycle, in the research and development and initial marketing stages. The up-front development costs are fixed, and subsequent production costs are practically zero. The economies of scale are huge: Once a company sells enough copies to cover its fixed costs, incremental dollars go primarily to profit. The following table describes the company's financial data for fiscal years 2018, 2019, and 2020. Financial data (All values Millions) Sales revenue Net income available for common shareholders Basic shares outstanding Diluted shares outstanding EBIT 2020 2019 2018 $12,865 $11,131 $8,981 $5,260 $2,951 $2,591 481 486 491 486 492 498 $4,234 $3,228 $2,792 Required: (a) Calculate the Adobe's degree of operating leverage (DOL), degree of financial leverage (DFL) and degree of total leverage (DTL) for the fiscal years 2019 and 2020. (12 marks) (b) What is operating leverage (OL)? Justify the advantages and disadvantages of OL in light of the Adobe's present financial performance. (13 marks) [Total: 25 Marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts