Question: QUESTION 1: After opening their computer sales and service store, the Millers completed the following four transactions: 1. They invested $100,000 in cash in the

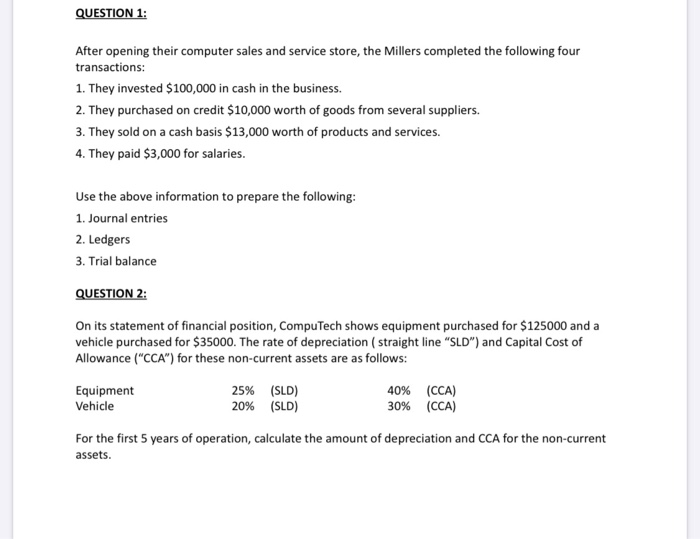

QUESTION 1: After opening their computer sales and service store, the Millers completed the following four transactions: 1. They invested $100,000 in cash in the business. 2. They purchased on credit $10,000 worth of goods from several suppliers. 3. They sold on a cash basis $13,000 worth of products and services. 4. They paid $3,000 for salaries. Use the above information to prepare the following: 1. Journal entries 2. Ledgers 3. Trial balance QUESTION 2: On its statement of financial position, CompuTech shows equipment purchased for $125000 and a vehicle purchased for $35000. The rate of depreciation (straight line "SLD") and Capital Cost of Allowance ("CCA") for these non-current assets are as follows: Equipment 25% (SLD) 40% (CCA) Vehicle 20% (SLD) 30% (CCA) For the first 5 years of operation, calculate the amount of depreciation and CCA for the non-current assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts