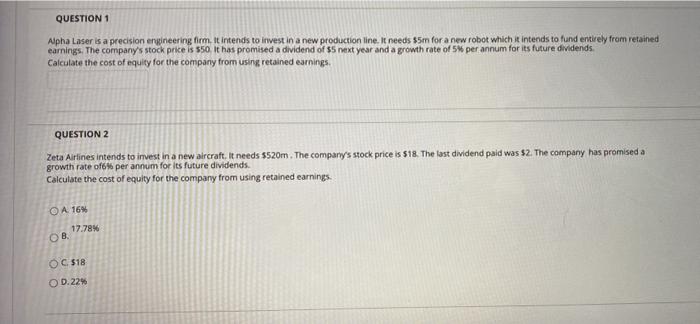

Question: QUESTION 1 Alpha Laser is a precision engineering firm. It intends to invest in a new production line. It needs $5m for a new robot

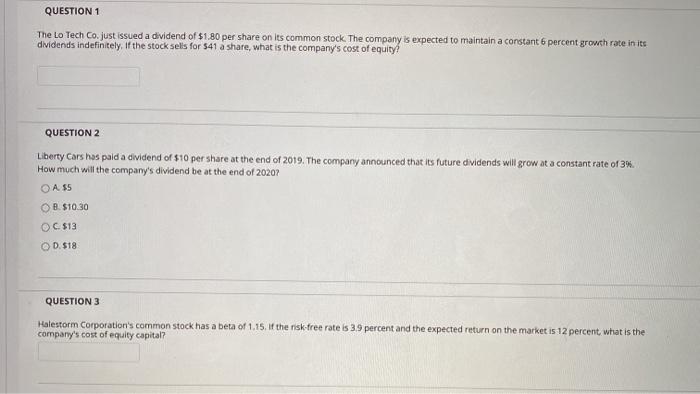

QUESTION 1 Alpha Laser is a precision engineering firm. It intends to invest in a new production line. It needs $5m for a new robot which it intends to fund entirely from retained earnings. The company's stock price is 550. It has promised a dividend of $5 next year and a growth rate of per annum for its future dividends. Calculate the cost of equity for the company from using retained earnings QUESTION 2 Zeta Airlines intends to invest in a new aircraft. It needs 5520m. The company's stock price is $18. The last dividend paid was $2. The company has promised a growth rate of6% per annum for its future dividends. Calculate the cost of equity for the company from using retained earnings O A 16 17.78% OB OC $18 OD.22% QUESTION 1 The Lo Tech Co. just issued a dividend of $1.80 per share on its common stock. The company is expected to maintain a constant 6 percent growth rate in its dividends indefinitely. If the stock sels for 541 a share, what is the company's cost of equity QUESTION 2 Liberty Cars hos palda dividend of $10 per share at the end of 2019. The company announced that its future dividends will grow at a constant rate of 3%. How much will the company's dividend be at the end of 2020? O A 55 OB. $10.30 OC. $13 OD.518 QUESTION 3 Halestorm Corporation's common stock has a beta of 1.15. If the risk free rate is 3.9 percent and the expected return on the market is 12 percent, what is the company's cost of equity capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts