Question: Question 1: Alpha Traders LLC appoints you as their portfolio manager and your first task is to analyse the three stocks below including the Dow

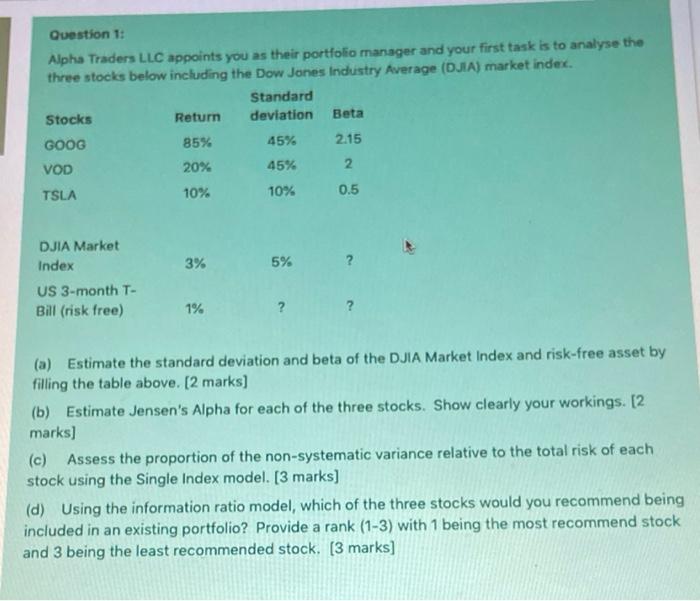

Question 1: Alpha Traders LLC appoints you as their portfolio manager and your first task is to analyse the three stocks below including the Dow Jones Industry Average (DJIA) market indet. Standard Stocks Return deviation Beta GOOG 85% 45% 2.15 VOD 20% 45% 2 TSLA 10% 10% 0.5 3% 5% ? DJIA Market Index US 3-month T- Bill (risk free) 1% ? (a) Estimate the standard deviation and beta of the DJIA Market Index and risk-free asset by filling the table above. [2 marks] (b) Estimate Jensen's Alpha for each of the three stocks. Show clearly your workings. [2 marks) (c) Assess the proportion of the non-systematic variance relative to the total risk of each stock using the Single Index model. [3 marks] (d) Using the information ratio model, which of the three stocks would you recommend being included in an existing portfolio? Provide a rank (1-3) with 1 being the most recommend stock and 3 being the least recommended stock. [3 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts