Question: QUESTION 1 Amount Assets Cash Five - year rate sensitive assets Fixed rate loans One - year rate sensitive assets Liabilities & Equity 400 One

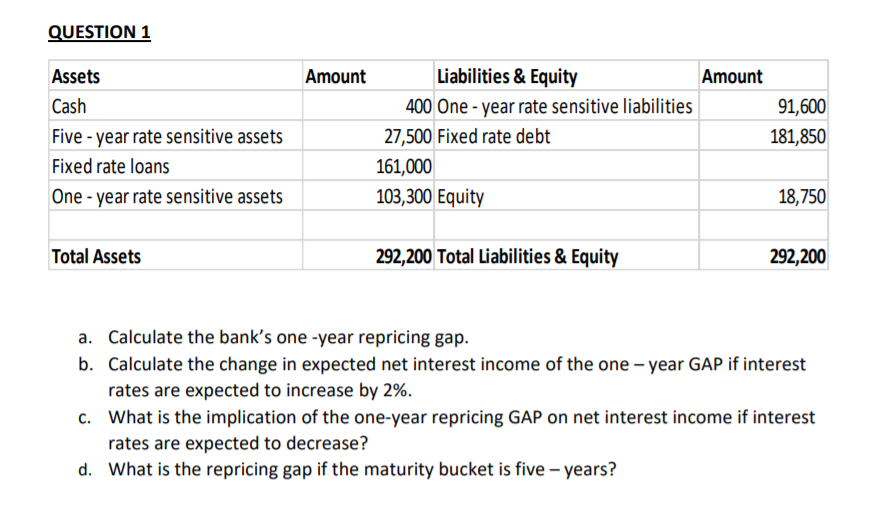

QUESTION 1 Amount Assets Cash Five - year rate sensitive assets Fixed rate loans One - year rate sensitive assets Liabilities & Equity 400 One - year rate sensitive liabilities 27,500 Fixed rate debt 161,000 103,300 Equity Amount 91,600 181,850 18,750 Total Assets 292,200 Total Liabilities & Equity 292,200 a. Calculate the bank's one -year repricing gap. b. Calculate the change in expected net interest income of the one-year GAP if interest rates are expected to increase by 2%. C. What is the implication of the one-year repricing GAP on net interest income if interest rates are expected to decrease? d. What is the repricing gap if the maturity bucket is five-years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts