Question: Question 1 (Amounts are small for testing purposes) On December 31, 2020, Parent Company purchased all shares (100%) of Subsidiary Company from the current owners

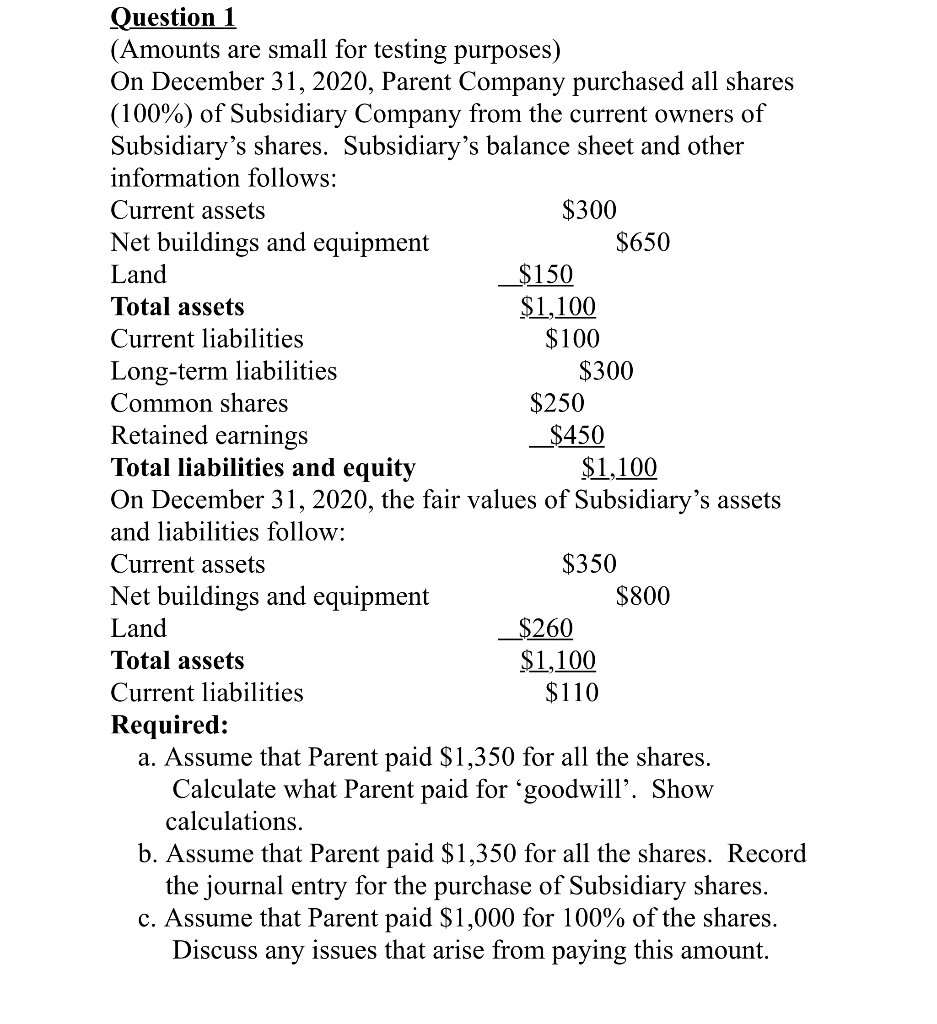

Question 1 (Amounts are small for testing purposes) On December 31, 2020, Parent Company purchased all shares (100%) of Subsidiary Company from the current owners of Subsidiary's shares. Subsidiary's balance sheet and other information follows: Current assets $300 Net buildings and equipment $650 Land $150 Total assets $1,100 Current liabilities $100 Long-term liabilities $300 Common shares $250 Retained earnings $450 Total liabilities and equity $1,100 On December 31, 2020, the fair values of Subsidiary's assets and liabilities follow: Current assets $350 Net buildings and equipment $800 Land $260 Total assets $1,100 Current liabilities $110 Required: a. Assume that Parent paid $1,350 for all the shares. Calculate what Parent paid for 'goodwill. Show calculations. b. Assume that Parent paid $1,350 for all the shares. Record the journal entry for the purchase of Subsidiary shares. c. Assume that Parent paid $1,000 for 100% of the shares. Discuss any issues that arise from paying this amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts