Question: Question 1 An investor models the excess return for Amazon via the market model. Suppose that the sample size is 48 observations, the value

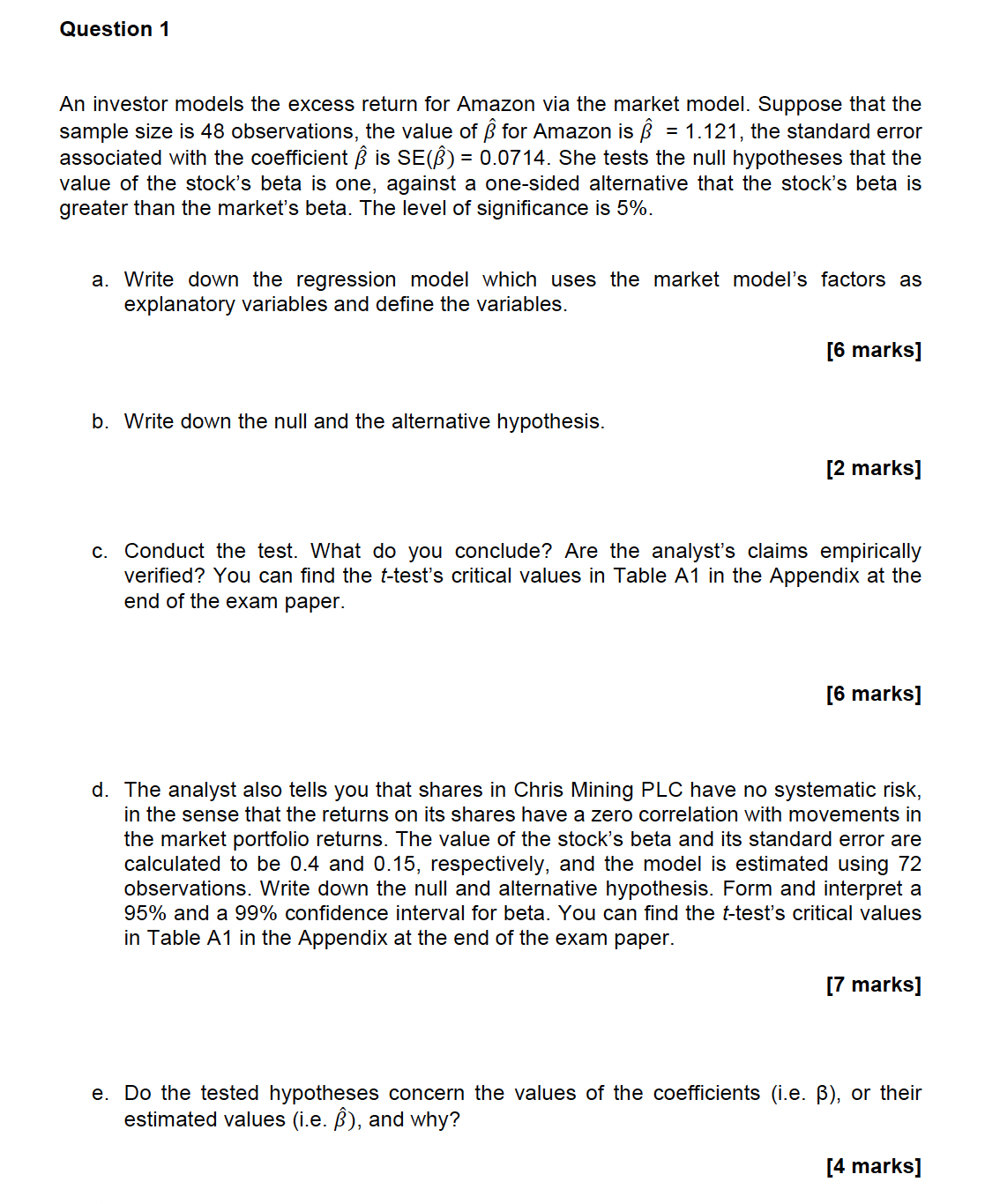

Question 1 An investor models the excess return for Amazon via the market model. Suppose that the sample size is 48 observations, the value of for Amazon is = 1.121, the standard error associated with the coefficient is SE() = 0.0714. She tests the null hypotheses that the value of the stock's beta is one, against a one-sided alternative that the stock's beta is greater than the market's beta. The level of significance is 5%. a. Write down the regression model which uses the market model's factors as explanatory variables and define the variables. b. Write down the null and the alternative hypothesis. [6 marks] [2 marks] c. Conduct the test. What do you conclude? Are the analyst's claims empirically verified? You can find the t-test's critical values in Table A1 in the Appendix at the end of the exam paper. [6 marks] d. The analyst also tells you that shares in Chris Mining PLC have no systematic risk, in the sense that the returns on its shares have a zero correlation with movements in the market portfolio returns. The value of the stock's beta and its standard error are calculated to be 0.4 and 0.15, respectively, and the model is estimated using 72 observations. Write down the null and alternative hypothesis. Form and interpret a 95% and a 99% confidence interval for beta. You can find the t-test's critical values in Table A1 in the Appendix at the end of the exam paper. [7 marks] e. Do the tested hypotheses concern the values of the coefficients (i.e. ), or their estimated values (i.e. ), and why? [4 marks]

Step by Step Solution

There are 3 Steps involved in it

a The regression model using the market models factors as explanatory variables can be written as Ri ... View full answer

Get step-by-step solutions from verified subject matter experts