Question: Question 1 Answer all parts a) Using examples, critically appraise the importance of business strategy analysis in (10 marks) b) In analysing profitability of a

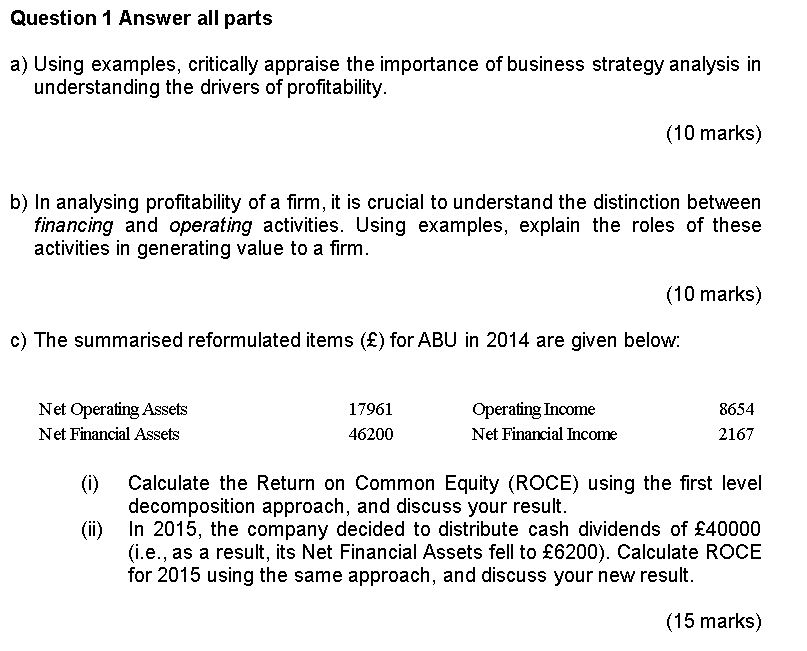

Question 1 Answer all parts a) Using examples, critically appraise the importance of business strategy analysis in (10 marks) b) In analysing profitability of a firm, it is crucial to understand the distinction between understanding the drivers of profitability financing and operating activities. Using examples, explain the roles of these activities in generating value to a firm. (10 marks) c) The summarised reformulated items (E) for ABU in 2014 are given below: Net Operating Assets Net Financial Assets 17961 46200 Operating Income Net Financial Income 8654 2167 (i) Calculate the Return on Common Equity (ROCE) using the first level (i) In 2015, the company decided to distribute cash dividends of 40000 decomposition approach, and discuss your result. (i.e., as a result, its Net Financial Assets fell to 6200). Calculate ROCE for 2015 using the same approach, and discuss your new resuit. (15 marks) Question 1 Answer all parts a) Using examples, critically appraise the importance of business strategy analysis in (10 marks) b) In analysing profitability of a firm, it is crucial to understand the distinction between understanding the drivers of profitability financing and operating activities. Using examples, explain the roles of these activities in generating value to a firm. (10 marks) c) The summarised reformulated items (E) for ABU in 2014 are given below: Net Operating Assets Net Financial Assets 17961 46200 Operating Income Net Financial Income 8654 2167 (i) Calculate the Return on Common Equity (ROCE) using the first level (i) In 2015, the company decided to distribute cash dividends of 40000 decomposition approach, and discuss your result. (i.e., as a result, its Net Financial Assets fell to 6200). Calculate ROCE for 2015 using the same approach, and discuss your new resuit. (15 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts