Question: Question 1 Answer the following: (a) Calculate the weekly arithmetic (discrete) and geometric (continuously compounded) returns for each of the three assigned stocks and the

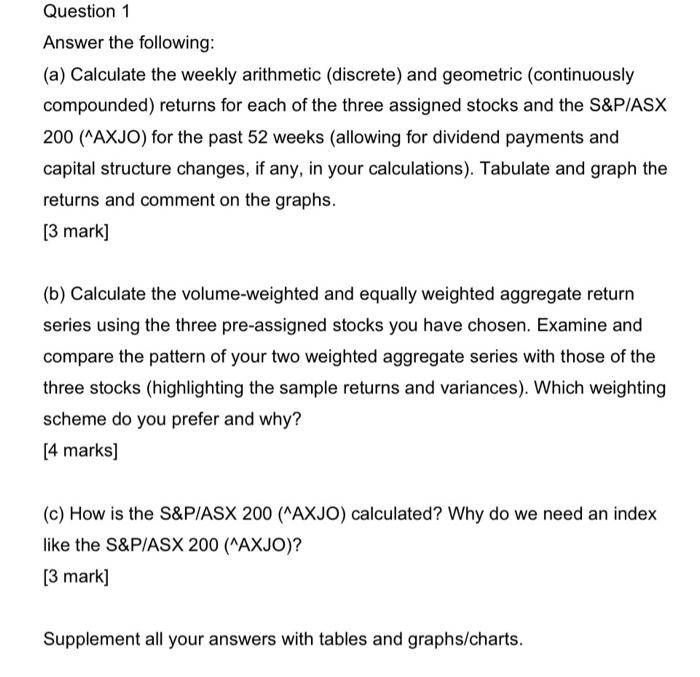

Question 1 Answer the following: (a) Calculate the weekly arithmetic (discrete) and geometric (continuously compounded) returns for each of the three assigned stocks and the S\&P/ASX 200 (^AXJO) for the past 52 weeks (allowing for dividend payments and capital structure changes, if any, in your calculations). Tabulate and graph the returns and comment on the graphs. [3 mark] (b) Calculate the volume-weighted and equally weighted aggregate return series using the three pre-assigned stocks you have chosen. Examine and compare the pattern of your two weighted aggregate series with those of the three stocks (highlighting the sample returns and variances). Which weighting scheme do you prefer and why? [4 marks] (c) How is the S\&P/ASX 200 ( AXJO ) calculated? Why do we need an index like the S\&P/ASX 200 (^AXJO)? [3 mark] Supplement all your answers with tables and graphs/charts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts