Question: Question 1 Answer the following questions: a. Explain the no-arbitrage and risk-neutral valuation approaches to valuing a European option using a one- step binomial tree.

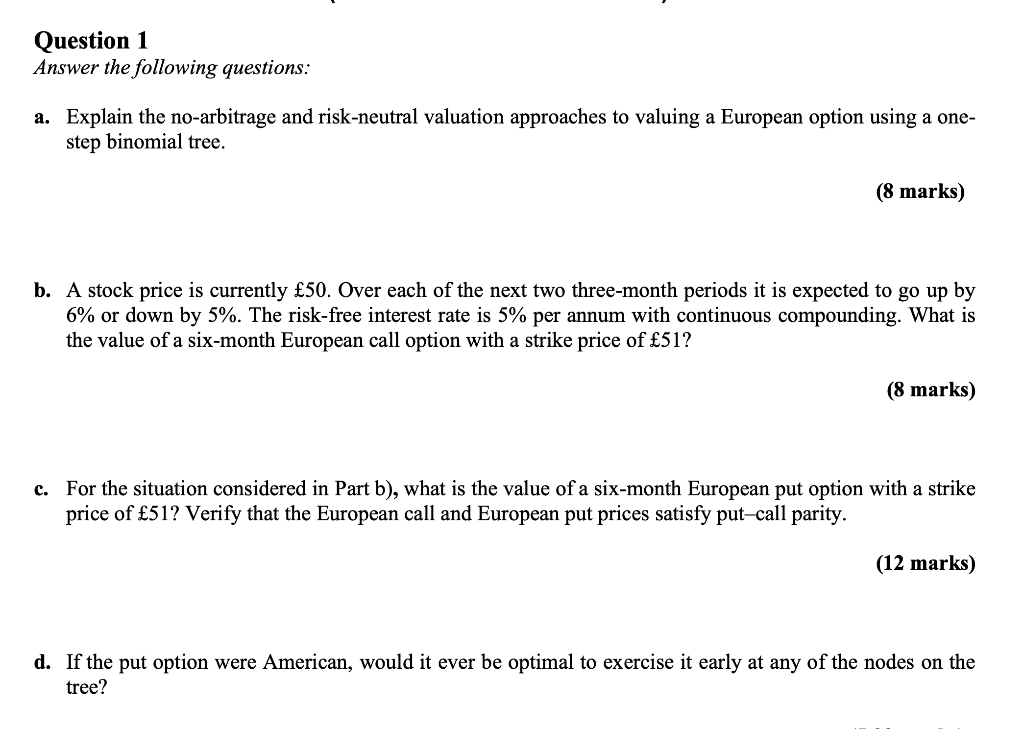

Question 1 Answer the following questions: a. Explain the no-arbitrage and risk-neutral valuation approaches to valuing a European option using a one- step binomial tree. (8 marks) b. A stock price is currently 50. Over each of the next two three-month periods it is expected to go up by 6% or down by 5%. The risk-free interest rate is 5% per annum with continuous compounding. What is the value of a six-month European call option with a strike price of 51? (8 marks) c. For the situation considered in Part b), what is the value of a six-month European put option with a strike price of 51? Verify that the European call and European put prices satisfy put-call parity. (12 marks) d. If the put option were American, would it ever be optimal to exercise it early at any of the nodes on the tree

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts