Question: Question 1 Answer the following questions as TRUE or False: a) A discharge in bankruptcy results in all debts being discharged. If a creditor continues

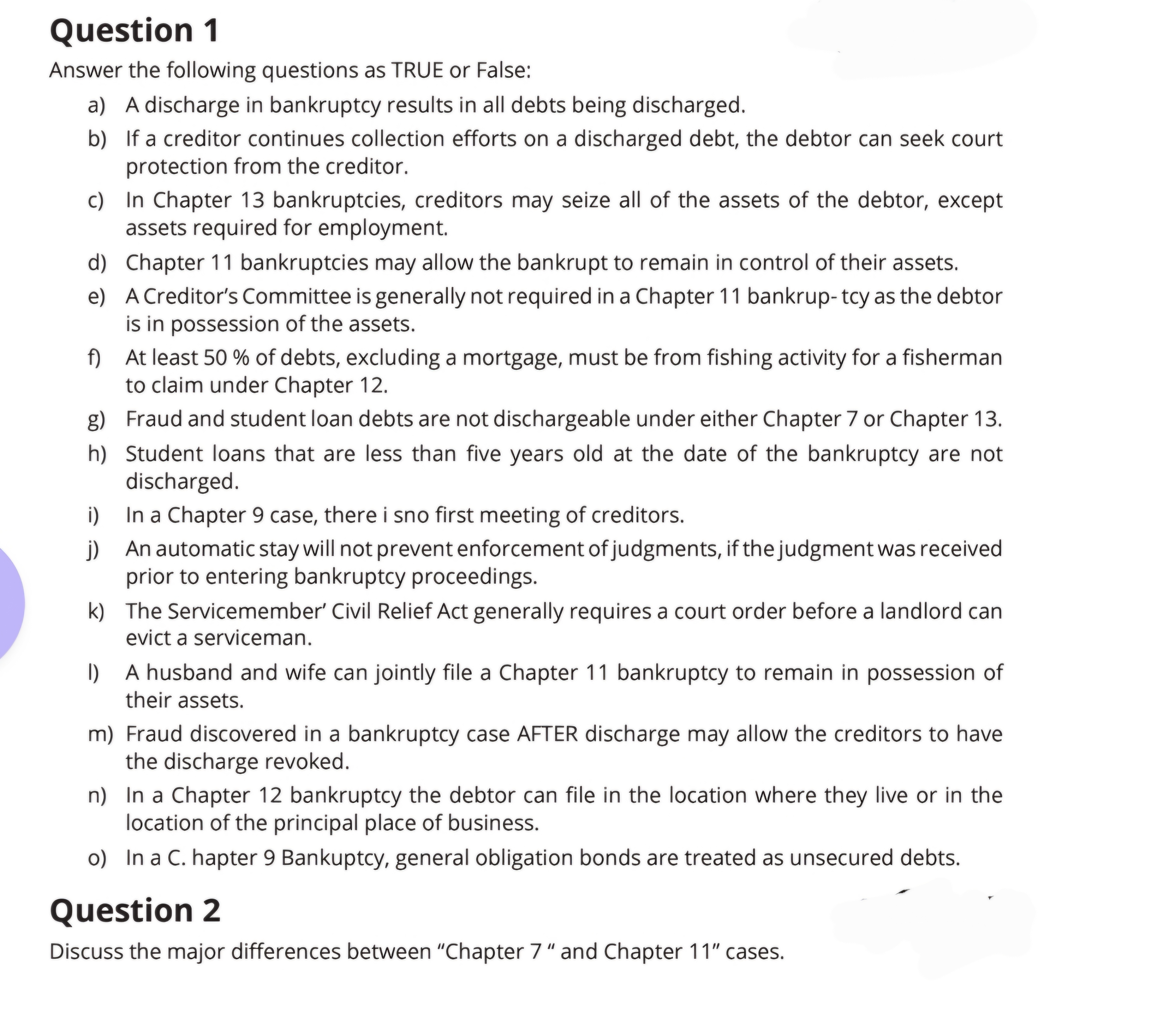

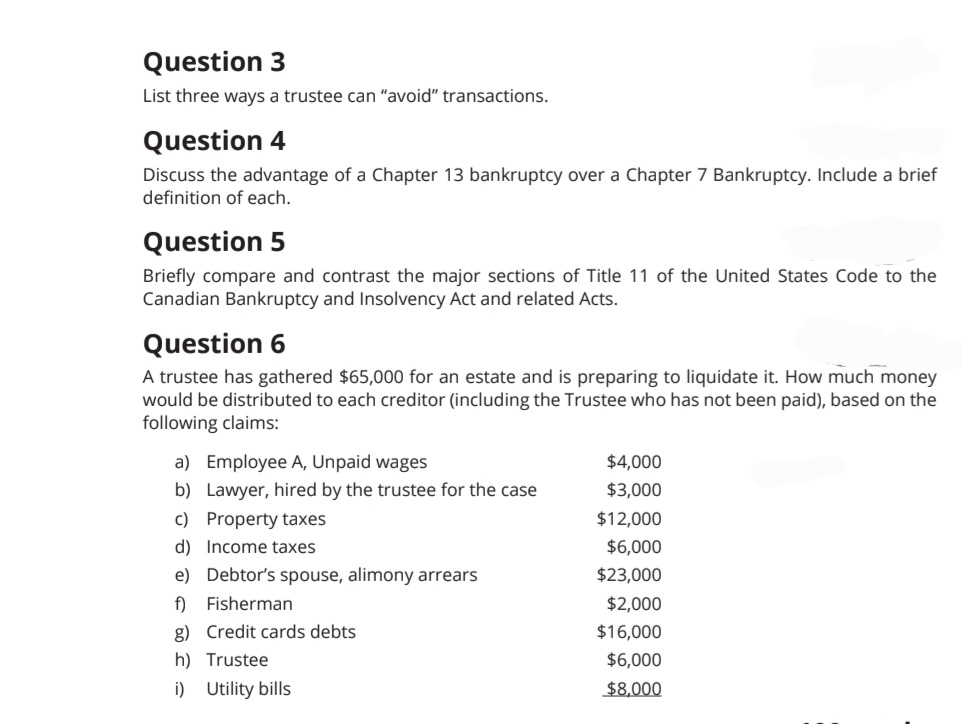

Question 1 Answer the following questions as TRUE or False: a) A discharge in bankruptcy results in all debts being discharged. If a creditor continues collection efforts on a discharged debt, the debtor can seek court protection from the creditor. In Chapter 13 bankruptcies, creditors may seize all of the assets of the debtor, except assets required for employment. Chapter 11 bankruptcies may allow the bankrupt to remain in control of their assets. A Creditor's Committee is generally not required in a Chapter 11 bankrup- tcy as the debtor is in possession of the assets. At least 50 % of debts, excluding a mortgage, must be from fishing activity for a fisherman to claim under Chapter 12. Fraud and student loan debts are not dischargeable under either Chapter 7 or Chapter 13. Student loans that are less than five years old at the date of the bankruptcy are not discharged. In a Chapter 9 case, there i sno first meeting of creditors. An automatic stay will not prevent enforcement of judgments, if the judgment was received prior to entering bankruptcy proceedings. The Servicemember' Civil Relief Act generally requires a court order before a landlord can evict a serviceman. A husband and wife can jointly file a Chapter 11 bankruptcy to remain in possession of their assets. Fraud discovered in a bankruptcy case AFTER discharge may allow the creditors to have the discharge revoked. In a Chapter 12 bankruptcy the debtor can file in the location where they live or in the location of the principal place of business. In aC. hapter 9 Bankuptcy, general obligation bonds are treated as unsecured debts. - Question 2 Discuss the major differences between \"Chapter 7\" and Chapter 11\" cases. Question 3 List three ways a trustee can \"avoid\" transactions. Question 4 Discuss the advantage of a Chapter 13 bankruptcy over a Chapter 7 Bankruptcy. Include a brief definition of each. Question 5 Briefly compare and contrast the major sections of Title 11 of the United States Code to the Canadian Bankruptcy and Insolvency Act and related Acts. Question 6 A trustee has gathered $65,000 for an estate and is preparing to liquidate it. How much money would be distributed to each creditor (including the Trustee who has not been paid), based on the following claims: a) b) c) d) e) f) 8) h) i) Employee A, Unpaid wages Lawyer, hired by the trustee for the case Property taxes Income taxes Debtor's spouse, alimony arrears Fisherman Credit cards debts Trustee Utility bills $4,000 $3,000 $12,000 $6,000 $23,000 $2,000 $16,000 $6,000 $8,000

Question 1 Answer the following questions as TRUE or False: a) A discharge in bankruptcy results in all debts being discharged. If a creditor continues collection efforts on a discharged debt, the debtor can seek court protection from the creditor. In Chapter 13 bankruptcies, creditors may seize all of the assets of the debtor, except assets required for employment. Chapter 11 bankruptcies may allow the bankrupt to remain in control of their assets. A Creditor's Committee is generally not required in a Chapter 11 bankrup- tcy as the debtor is in possession of the assets. At least 50 % of debts, excluding a mortgage, must be from fishing activity for a fisherman to claim under Chapter 12. Fraud and student loan debts are not dischargeable under either Chapter 7 or Chapter 13. Student loans that are less than five years old at the date of the bankruptcy are not discharged. In a Chapter 9 case, there i sno first meeting of creditors. An automatic stay will not prevent enforcement of judgments, if the judgment was received prior to entering bankruptcy proceedings. The Servicemember' Civil Relief Act generally requires a court order before a landlord can evict a serviceman. A husband and wife can jointly file a Chapter 11 bankruptcy to remain in possession of their assets. Fraud discovered in a bankruptcy case AFTER discharge may allow the creditors to have the discharge revoked. In a Chapter 12 bankruptcy the debtor can file in the location where they live or in the location of the principal place of business. In aC. hapter 9 Bankuptcy, general obligation bonds are treated as unsecured debts. - Question 2 Discuss the major differences between \"Chapter 7\" and Chapter 11\" cases. Question 3 List three ways a trustee can \"avoid\" transactions. Question 4 Discuss the advantage of a Chapter 13 bankruptcy over a Chapter 7 Bankruptcy. Include a brief definition of each. Question 5 Briefly compare and contrast the major sections of Title 11 of the United States Code to the Canadian Bankruptcy and Insolvency Act and related Acts. Question 6 A trustee has gathered $65,000 for an estate and is preparing to liquidate it. How much money would be distributed to each creditor (including the Trustee who has not been paid), based on the following claims: a) b) c) d) e) f) 8) h) i) Employee A, Unpaid wages Lawyer, hired by the trustee for the case Property taxes Income taxes Debtor's spouse, alimony arrears Fisherman Credit cards debts Trustee Utility bills $4,000 $3,000 $12,000 $6,000 $23,000 $2,000 $16,000 $6,000 $8,000Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock