Question: Question 1: AR Management using Marginal Analysis Blueberry Ltd sells X-phones to its customers on credit terms. It is currently able to sell 120,000 X-phones

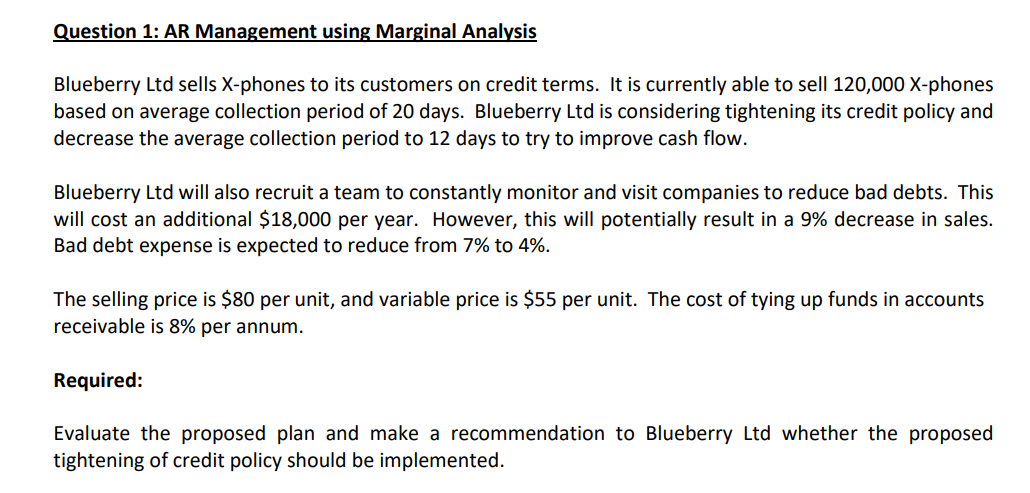

Question 1: AR Management using Marginal Analysis Blueberry Ltd sells X-phones to its customers on credit terms. It is currently able to sell 120,000 X-phones based on average collection period of 20 days. Blueberry Ltd is considering tightening its credit policy and decrease the average collection period to 12 days to try to improve cash flow. Blueberry Ltd will also recruit a team to constantly monitor and visit companies to reduce bad debts. This will cost an additional $18,000 per year. However, this will potentially result in a 9% decrease in sales. Bad debt expense is expected to reduce from 7% to 4%. The selling price is $80 per unit, and variable price is $55 per unit. The cost of tying up funds in accounts receivable is 8% per annum. Required: Evaluate the proposed plan and make a recommendation to Blueberry Ltd whether the proposed tightening of credit policy should be implemented

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts