Question: Question 1 As a financial analyst, you are tasked with pricing a common stock (the intrinsic value). You have gathered these data. Current annual

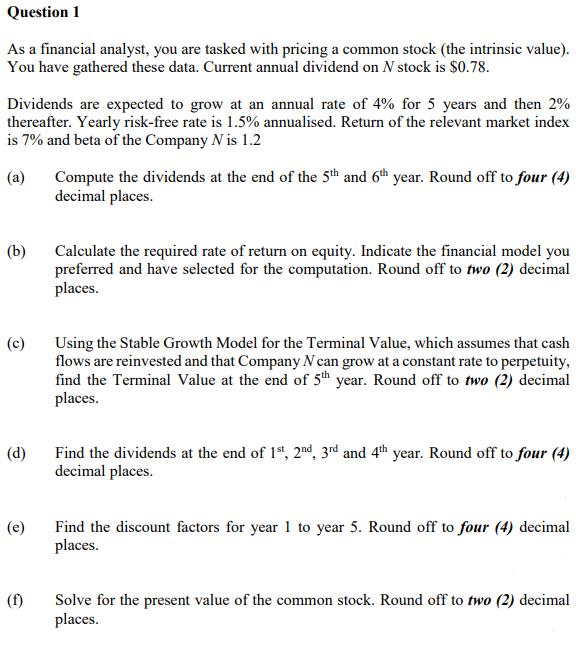

Question 1 As a financial analyst, you are tasked with pricing a common stock (the intrinsic value). You have gathered these data. Current annual dividend on N stock is $0.78. Dividends are expected to grow at an annual rate of 4% for 5 years and then 2% thereafter. Yearly risk-free rate is 1.5% annualised. Return of the relevant market index is 7% and beta of the Company N is 1.2 (a) (b) (d) (e) Compute the dividends at the end of the 5th and 6th year. Round off to four (4) decimal places. Calculate the required rate of return on equity. Indicate the financial model you preferred and have selected for the computation. Round off to two (2) decimal places. Using the Stable Growth Model for the Terminal Value, which assumes that cash flows are reinvested and that Company N can grow at a constant rate to perpetuity, find the Terminal Value at the end of 5th year. Round off to two (2) decimal places. Find the dividends at the end of 1st, 2nd, 3rd and 4th year. Round off to four (4) decimal places. Find the discount factors for year 1 to year 5. Round off to four (4) decimal places. Solve for the present value of the common stock. Round off to two (2) decimal places.

Step by Step Solution

There are 3 Steps involved in it

a Dividends at the end of the 5th year 078 1045 09256 Dividends at the end of the 6th year 092... View full answer

Get step-by-step solutions from verified subject matter experts