Question: QUESTION 1 Assume that Treasury bonds with a par value of $1,000,000 have 3 years to maturity and a coupon rate of 6%. The yield

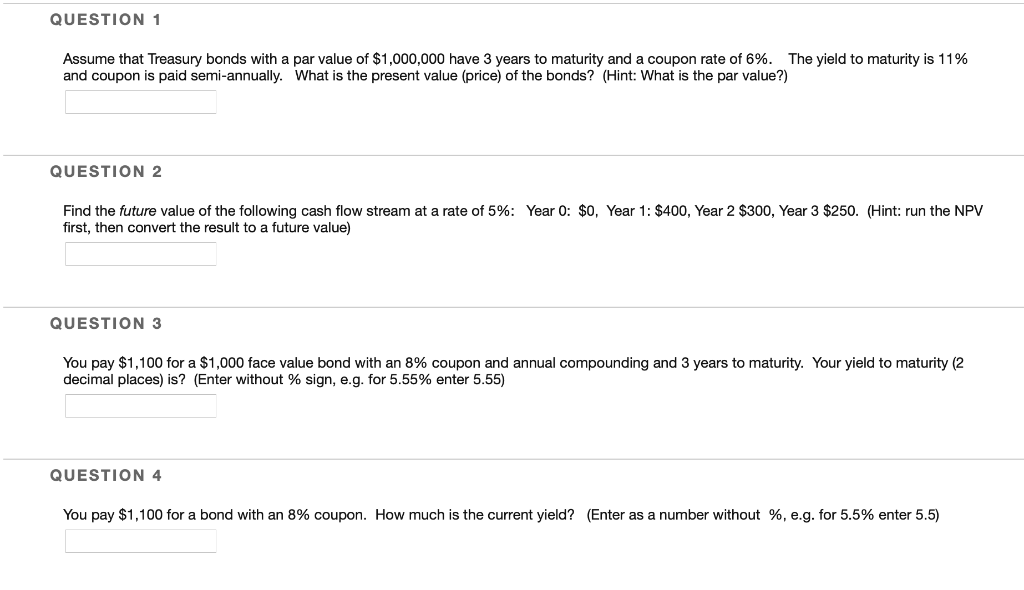

QUESTION 1 Assume that Treasury bonds with a par value of $1,000,000 have 3 years to maturity and a coupon rate of 6%. The yield to maturity is 11% and coupon is paid semi-annually. What is the present value (price) of the bonds? (Hint: What is the par value?) QUESTION 2 Find the future value of the following cash flow stream at a rate of 5%: Year 0: $0, Year 1: $400, Year 2 $300, Year 3 $250. (Hint: run the NPV first, then convert the result to a future value) QUESTION 3 You pay $1,100 for a $1,000 face value bond with an 8% coupon and annual compounding and 3 years to maturity. Your yield to maturity (2 decimal places) is? (Enter without % sign, e.g. for 5.55% enter 5.55) QUESTION 4 You pay $1,100 for a bond with an 8% coupon. How much is the current yield? (Enter as a number without %, e.g. for 5.5% enter 5.5)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts