Question: Question # 1 Based on BCE Inc. ' s 2 0 2 1 annual report See BCE Inc. ' s consolidated financial statements and accompanying

Question # Based on BCE Inc.s annual report

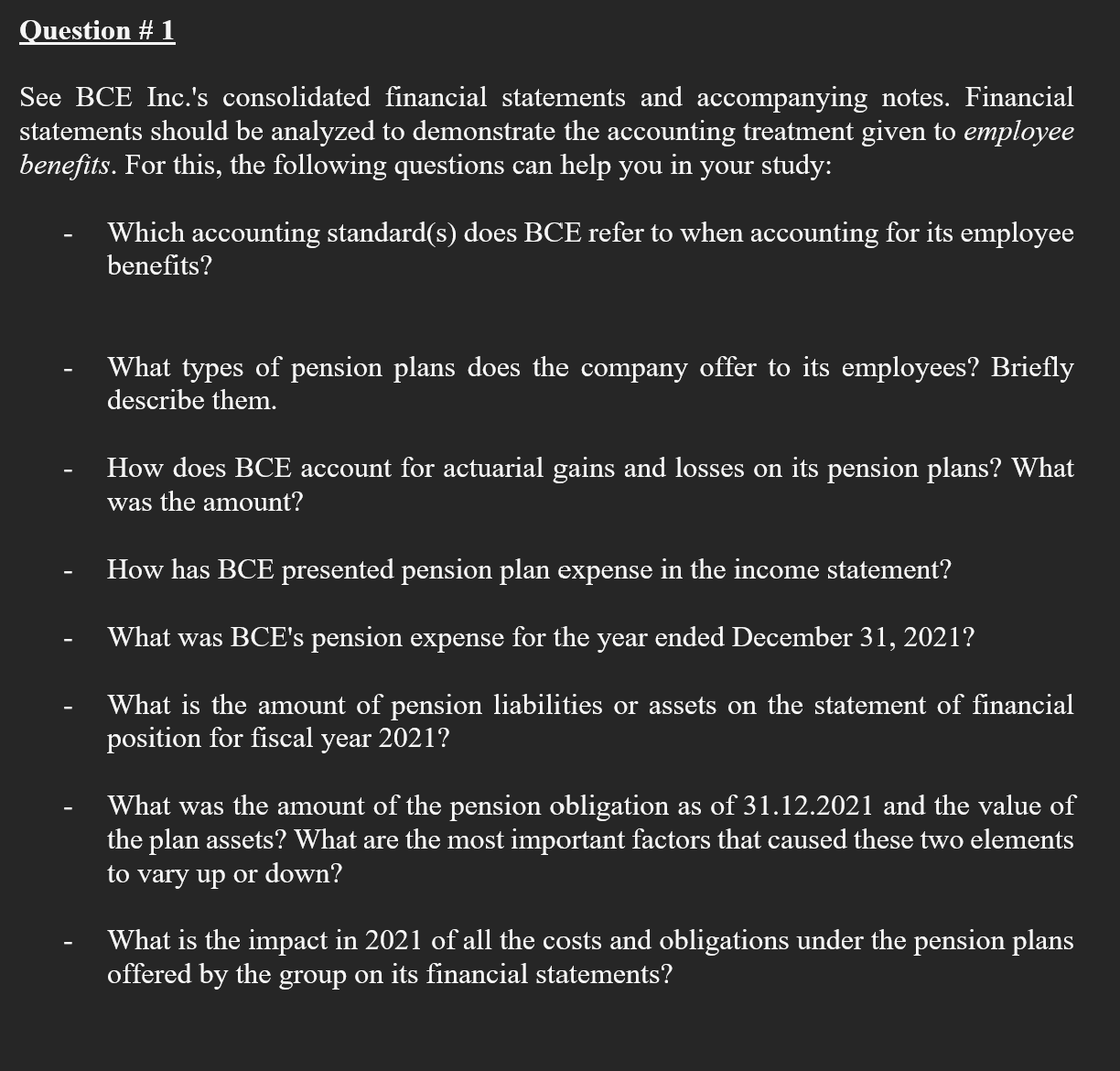

See BCE Inc.s consolidated financial statements and accompanying notes. Financial

statements should be analyzed to demonstrate the accounting treatment given to employee

benefits. For this, the following questions can help you in your study:

Which accounting standards does BCE refer to when accounting for its employee

benefits?

What types of pension plans does the company offer to its employees? Briefly

describe them.

How does BCE account for actuarial gains and losses on its pension plans? What

was the amount?

How has BCE presented pension plan expense in the income statement?

What was BCE's pension expense for the year ended December

What is the amount of pension liabilities or assets on the statement of financial

position for fiscal year

What was the amount of the pension obligation as of and the value of

the plan assets? What are the most important factors that caused these two elements

to vary up or down?

What is the impact in of all the costs and obligations under the pension plans

offered by the group on its financial statements?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock