Question: Question 1 Based on the below ratios Prepare a report for the banks risk manager in which you compare liquidity, and profitability of the two

Question 1

Based on the below ratios Prepare a report for the banks risk manager in which you compare liquidity, and profitability of the two companies. Your report must be based on and limited to the ratios calculated below.

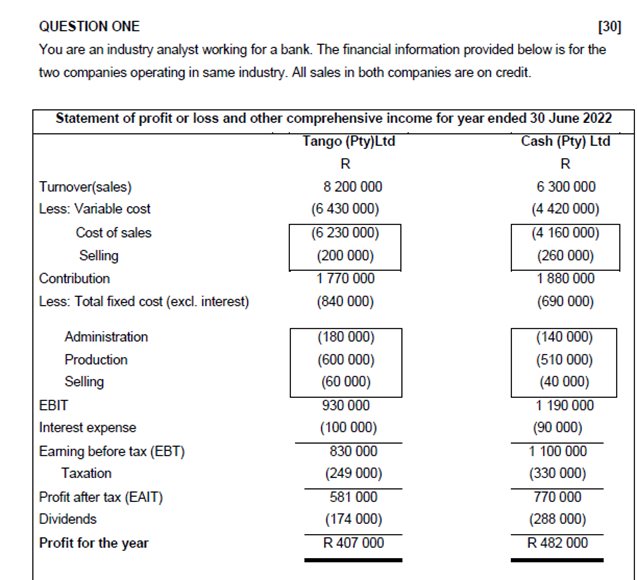

# Debt / Equity Ratio = Long term Debt / Equity

Tango (Pty) = 600000 / 6600000 = 0.091 : 1

Cash (Pty) = 700000 / 8700000 = 0.080 : 1

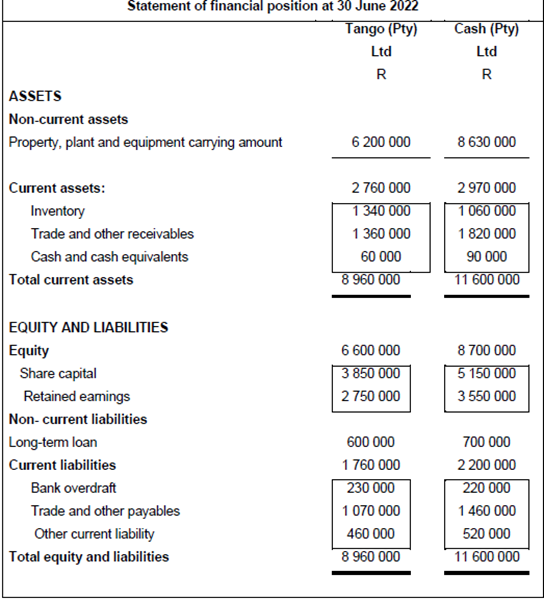

# Current Ratio = Current assets / Current Liability

Tango (Pty) = 2760000 / 1760000 = 1.568 : 1

Cash (Pty) = 2970000 / 2200000 = 1.35 : 1

# Acid Test Ratio = (Current assets - Inventory ) / Current Liability

Tango (Pty) = (2760000-1340000) / 1760000 = 0.807 : 1

Cash (Pty) = (2970000 - 1060000) / 2200000 = 0.868 : 1

# Inventory turnover ratio = Cost of goods sold / Inventory

Tango (Pty) = 6830000 / 1340000 = 5.097 Times

Cash (Pty) = 4670000 / 1060000 = 4.406 Times

Note : Cost of goods sold include all variable cost and fixed cost except administration and selling overhead.

Tango (Pty) = 6230000 + 600000 = 6830000

Cash (Pty) = 4160000 + 510000 = 4670000

#Debtor Collection Period = (Average Debtors / Credit Sales) x 365

Particulars Tango (Pty) Ltd Cash (Pty) Ltd

Debtors 1,360,000 1,820,000

Sales 8,200,000 6,300,000

(D Collection Period) 61 105

QUESTION ONE [30] You are an industry analyst working for a bank. The financial information provided below is for the two companies operating in same industry. All sales in both companies are on credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts