Question: Question 1- Basic Savings Plan - Suppose you save $300 a month, putting the cash into a nice secure piggy-bank (with no interest). How much

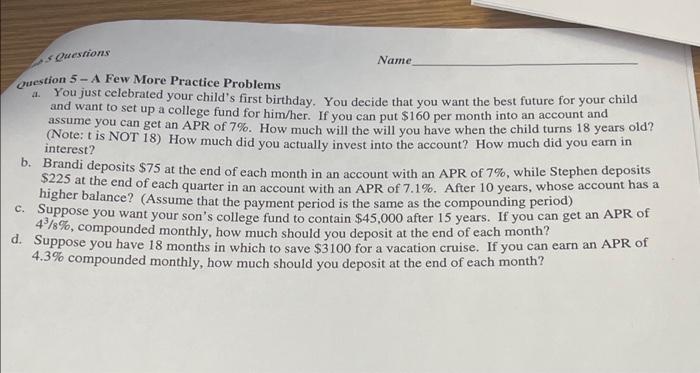

Question 1- Basic Savings Plan - Suppose you save $300 a month, putting the cash into a nice secure piggy-bank (with no interest). How much will you have in 11 months? b. Instead of a piggy bank, suppose you put $300 a month into a Christmas club that earns 8.75% interest compounded monthly. You start Dec. 30th and take out the money on Nov. 20th. How much did you invest in the Christmas club over 11 months? How much did you earn in interest? c. Suppose you have $150 taken out of your paycheck at the end of each month and will earn 74% interest . Assume you are 25 and the annuity will come to term when you are 65 years old. How much will the annuity be worth? d. How much did you contribute? How much did you earn in interest? e. Name Lab 5 Questions Question 2 - Solving for Payment 2. Suppose you want to save $30,000 to help pay for your child's education. How much needs to be taken out of your bi-weekly paychecks in order to have the proper amount in 18 years if you can invest in an account that offers 4'/s%, interest. How much did you actually invest? How much did you earn in interest b. Let's revisit an old problem. The old problem was "Suppose you want to take a trip to Florida in 2 years with some friends and you estimate you will need to save up $1000. To achieve this value, how much must be invested now, as a one-time lump sum investment, at 6%% APR, compounded monthly?" and we found that you needed to invest $882.78. But what if we change it up and now want to invest money" each month for the next 2 years. How much will you need in contribute each month and still reach the goal of $1000? How much did you actually invest? c. Let's revisit another old problem. The old problem was "Suppose you want to be a millionaire when you retire. how much money needs to be invested right now at 3% APR, compounded monthly, for th investment to be worth $1,000,000 in 40 years?" We determined you needed to invest $223,652.65 int an account. But what if we change it up and now want to determine how much you should invest each month in order to achieve the same goal. Lab 5 Questions Name - Question 3 - Savings Plan a. A friend creates an IRA (Individual retirement account) with an interest rate of 6.25%. She starts the IRA at age 25 and deposits $50 per month. How much will her IRA contain when she retires at age 652 How much did she invest into the account? How much interest did the savings account accrue (carn)? b. At age 35 you start saving for retirement. Your investment plan pays an APR of 6% and you want to have $2 million when you retire in 30 years. How much should you deposit monthly? How much did you invest into the account? How much interest did the savings account accrue (earn)? Name Lab 5 Questions Question 4 - Compound Interest vs. Savings Plan or you want to have $50,000 as a down payment on a house and you found an account that has an APR order to compounded monthly, how much will you have to deposit now, as a onetime investment, in order to reach your goal in 7 years? It is a one-time investment, so use the compound interest formula.) of 6%% compounded monthly, how muey will you have to deposit into a savings account, with of you want to have $50,000 as a down payment on a house and you found an account that has an APR periodic payments, in order to reach your goal in Pyears? How much did you actually pay into this c. State at least one advantage for each of the two options a) and b) listed above. Questions Name Question 5 - A Few More Practice Problems 1. You just celebrated your child's first birthday. You decide that you want the best future for your child and want to set up a college fund for him/her. If you can put $160 per month into an account and assume you can get an APR of 7%. How much will the will you have when the child turns 18 years old? (Note: tis NOT 18) How much did you actually invest into the account? How much did you earn in interest2 b. Brandi deposits $75 at the end of each month in an account with an APR of 7%, while Stephen deposits $225 at the end of each quarter in an account with an APR of 7.1%. After 10 years, whose account has a higher balance? (Assume that the payment period is the same as the compounding period) c. Suppose you want your son's college fund to contain $45,000 after 15 years. If you can get an APR of 4/8%, compounded monthly, how much should you deposit at the end of each month? d. Suppose you have 18 months in which to save $3100 for a vacation cruise. If you can earn an APR of 4.3% compounded monthly, how much should you deposit at the end of each month? Question 1- Basic Savings Plan - Suppose you save $300 a month, putting the cash into a nice secure piggy-bank (with no interest). How much will you have in 11 months? b. Instead of a piggy bank, suppose you put $300 a month into a Christmas club that earns 8.75% interest compounded monthly. You start Dec. 30th and take out the money on Nov. 20th. How much did you invest in the Christmas club over 11 months? How much did you earn in interest? c. Suppose you have $150 taken out of your paycheck at the end of each month and will earn 74% interest . Assume you are 25 and the annuity will come to term when you are 65 years old. How much will the annuity be worth? d. How much did you contribute? How much did you earn in interest? e. Name Lab 5 Questions Question 2 - Solving for Payment 2. Suppose you want to save $30,000 to help pay for your child's education. How much needs to be taken out of your bi-weekly paychecks in order to have the proper amount in 18 years if you can invest in an account that offers 4'/s%, interest. How much did you actually invest? How much did you earn in interest b. Let's revisit an old problem. The old problem was "Suppose you want to take a trip to Florida in 2 years with some friends and you estimate you will need to save up $1000. To achieve this value, how much must be invested now, as a one-time lump sum investment, at 6%% APR, compounded monthly?" and we found that you needed to invest $882.78. But what if we change it up and now want to invest money" each month for the next 2 years. How much will you need in contribute each month and still reach the goal of $1000? How much did you actually invest? c. Let's revisit another old problem. The old problem was "Suppose you want to be a millionaire when you retire. how much money needs to be invested right now at 3% APR, compounded monthly, for th investment to be worth $1,000,000 in 40 years?" We determined you needed to invest $223,652.65 int an account. But what if we change it up and now want to determine how much you should invest each month in order to achieve the same goal. Lab 5 Questions Name - Question 3 - Savings Plan a. A friend creates an IRA (Individual retirement account) with an interest rate of 6.25%. She starts the IRA at age 25 and deposits $50 per month. How much will her IRA contain when she retires at age 652 How much did she invest into the account? How much interest did the savings account accrue (carn)? b. At age 35 you start saving for retirement. Your investment plan pays an APR of 6% and you want to have $2 million when you retire in 30 years. How much should you deposit monthly? How much did you invest into the account? How much interest did the savings account accrue (earn)? Name Lab 5 Questions Question 4 - Compound Interest vs. Savings Plan or you want to have $50,000 as a down payment on a house and you found an account that has an APR order to compounded monthly, how much will you have to deposit now, as a onetime investment, in order to reach your goal in 7 years? It is a one-time investment, so use the compound interest formula.) of 6%% compounded monthly, how muey will you have to deposit into a savings account, with of you want to have $50,000 as a down payment on a house and you found an account that has an APR periodic payments, in order to reach your goal in Pyears? How much did you actually pay into this c. State at least one advantage for each of the two options a) and b) listed above. Questions Name Question 5 - A Few More Practice Problems 1. You just celebrated your child's first birthday. You decide that you want the best future for your child and want to set up a college fund for him/her. If you can put $160 per month into an account and assume you can get an APR of 7%. How much will the will you have when the child turns 18 years old? (Note: tis NOT 18) How much did you actually invest into the account? How much did you earn in interest2 b. Brandi deposits $75 at the end of each month in an account with an APR of 7%, while Stephen deposits $225 at the end of each quarter in an account with an APR of 7.1%. After 10 years, whose account has a higher balance? (Assume that the payment period is the same as the compounding period) c. Suppose you want your son's college fund to contain $45,000 after 15 years. If you can get an APR of 4/8%, compounded monthly, how much should you deposit at the end of each month? d. Suppose you have 18 months in which to save $3100 for a vacation cruise. If you can earn an APR of 4.3% compounded monthly, how much should you deposit at the end of each month

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts