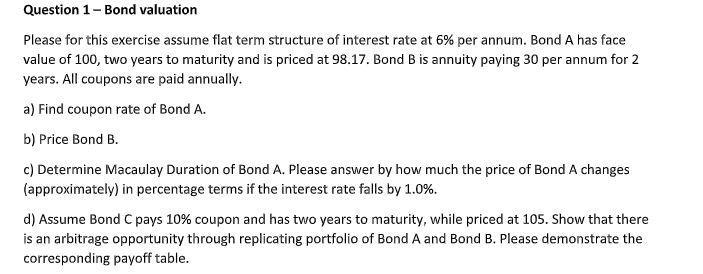

Question: Question 1 - Bond valuation Please for this exercise assume flat term structure of interest rate at 6% per annum. Bond A has face value

Question 1 - Bond valuation Please for this exercise assume flat term structure of interest rate at 6% per annum. Bond A has face value of 100, two years to maturity and is priced at 98.17. Bond B is annuity paying 30 per annum for 2 years. All coupons are paid annually. a) Find coupon rate of Bond A. b) Price Bond B. c) Determine Macaulay Duration of Bond A. Please answer by how much the price of Bond A changes (approximately) in percentage terms if the interest rate falls by 1.0%. d) Assume Bond C pays 10% coupon and has two years to maturity, while priced at 105. Show that there is an arbitrage opportunity through replicating portfolio of Bond A and Bond B. Please demonstrate the corresponding payoff table. Question 1 - Bond valuation Please for this exercise assume flat term structure of interest rate at 6% per annum. Bond A has face value of 100, two years to maturity and is priced at 98.17. Bond B is annuity paying 30 per annum for 2 years. All coupons are paid annually. a) Find coupon rate of Bond A. b) Price Bond B. c) Determine Macaulay Duration of Bond A. Please answer by how much the price of Bond A changes (approximately) in percentage terms if the interest rate falls by 1.0%. d) Assume Bond C pays 10% coupon and has two years to maturity, while priced at 105. Show that there is an arbitrage opportunity through replicating portfolio of Bond A and Bond B. Please demonstrate the corresponding payoff table

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts