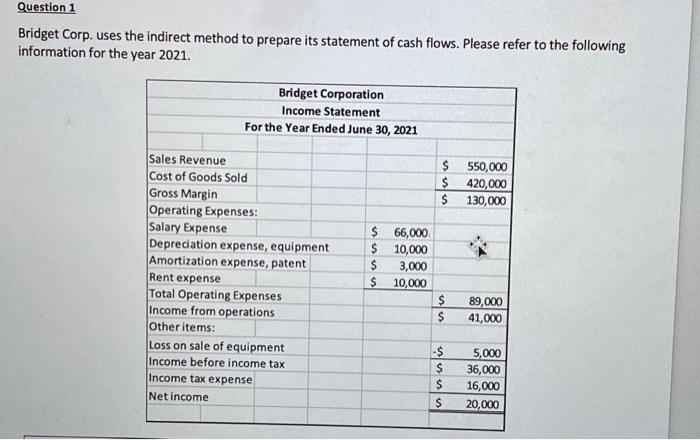

Question: Question 1 Bridget Corp. uses the indirect method to prepare its statement of cash flows. Please refer to the following information for the year 2021.

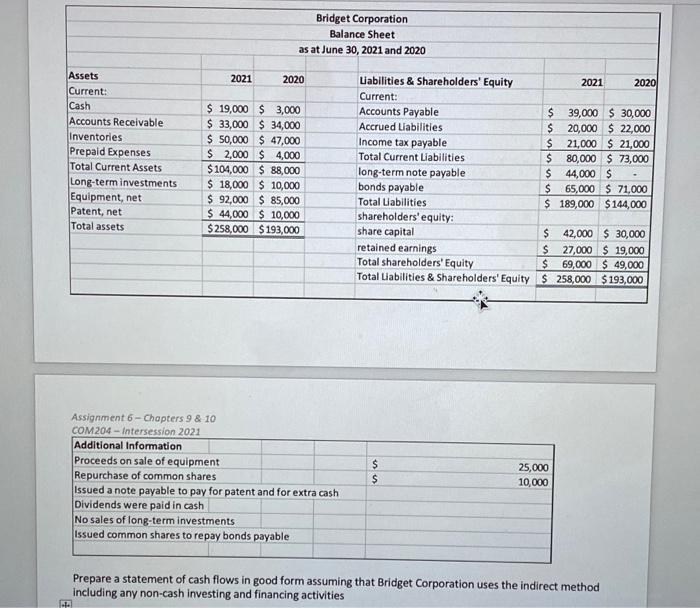

Question 1 Bridget Corp. uses the indirect method to prepare its statement of cash flows. Please refer to the following information for the year 2021. Bridget Corporation Income Statement For the Year Ended June 30, 2021 $ 550,000 $ 420,000 $ 130,000 Sales Revenue Cost of Goods Sold Gross Margin Operating Expenses: Salary Expense Depreciation expense, equipment Amortization expense, patent Rent expense Total Operating Expenses Income from operations Other items: Loss on sale of equipment Income before income tax Income tax expense Net income $ 66,000 $ 10,000 $ 3,000 10,000 $ $ $ 89,000 41,000 -$ nisi 5,000 36,000 16,000 20,000 Bridget Corporation Balance Sheet as at June 30, 2021 and 2020 2021 2020 Assets Current: Cash Accounts Receivable Inventories Prepaid Expenses Total Current Assets Long-term investments Equipment, net Patent, net Total assets $ 19,000 $ 3,000 $ 33,000 $ 34,000 $ 50,000 $ 47,000 $ 2,000 $ 4,000 $ 104,000 $ 88,000 $ 18,000 $ 10,000 $ 92,000 $ 85,000 $ 44,000 $10,000 $ 258,000 $ 193,000 Liabilities & Shareholders' Equity 2021 2020 Current: Accounts Payable $ 39,000 $30,000 Accrued Liabilities $ 20,000 $ 22,000 Income tax payable $ 21,000 $ 21,000 Total Current Liabilities $ 80,000 $ 73,000 long-term note payable $ 44,000 $ bonds payable $ 65,000 $ 71,000 Total Liabilities $ 189,000 $144,000 shareholders' equity: share capital $ 42,000 $ 30,000 retained earnings $ 27,000 $ 19,000 Total shareholders' Equity $ 69,000 $ 49,000 Total Liabilities & Shareholders' Equity $ 258,000 $193,000 Assignment 6 - Chapters 9 & 10 COM 204-Intersession 2021 Additional Information Proceeds on sale of equipment Repurchase of common shares Issued a note payable to pay for patent and for extra cash Dividends were paid in cash No sales of long-term investments Issued common shares to repay bonds payable $ $ 25,000 10,000 Prepare a statement of cash flows in good form assuming that Bridget Corporation uses the indirect method including any non-cash investing and financing activities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts