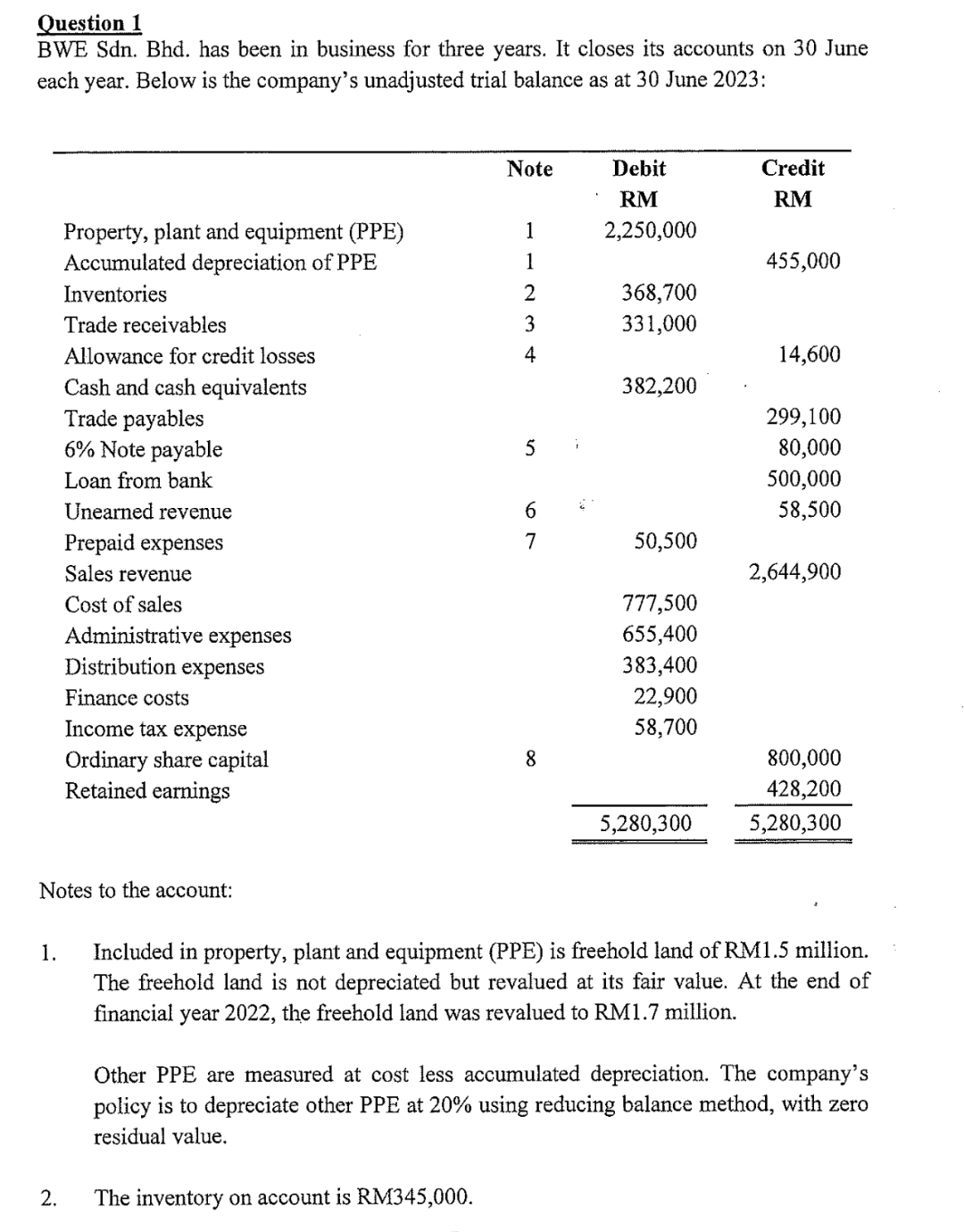

Question: Question 1 BWE Sdn . Bhd . has been in business for three years. It closes its accounts on 3 0 June each year. Below

Question

BWE Sdn Bhd has been in business for three years. It closes its accounts on June each year. Below is the company's unadjusted trial balance as at June :

tableNote,Debit RMCredit RMProperty plant and equipment PPEAccumulated depreciation of PPE,InventoriesTrade receivables,Allowance for credit losses,Cash and cash equivalents,,Trade payables,,, Note payable,Loan from bank,,,Unearned revenue,Prepaid expenses,Sales revenue,,,Cost of sales,,Administrative expenses,,Distribution expenses,,Finance costs,,Income tax expense,,Ordinary share capital,Retained earnings,,,

Notes to the account:

Included in property, plant and equipment PPE is freehold land of RM million. The freehold land is not depreciated but revalued at its fair value. At the end of financial year the freehold land was revalued to RM million.

Other PPE are measured at cost less accumulated depreciation. The company's policy is to depreciate other PPE at using reducing balance method, with zero residual value.

The inventory on account is RM

After various attempts to collect overdue receivables, the company decided to writeoff RM of the trade receivables.

Allowance for credit losses is expected to be of the remaining trade receivables.

The interest expense on the note payable for the year is due on June No payment has been made yet. Any interest expense is recognised as finance costs.

RM of the unearned revenue has been earned.

Prepaid expenses included security services payment for a period of twelve months commencing January Security services is recognised as part of administrative expenses.

Ordinary dividend approved and declared during the year is RM Payment will be made in September

Required:

Prepare the following financial statements:

a Statement of Profit or Loss and Other Comprehensive Income for the year ended June

b Statement of Changes in Equity for the year ended June

c Statement of Financial Position as at June

Note: Show all necessary workings.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock