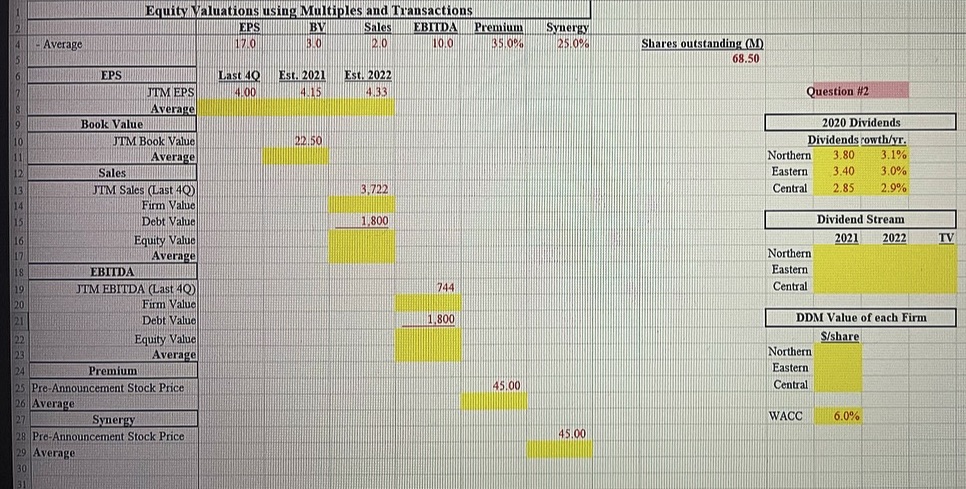

Question: QUESTION #1- calculate share price estimates using EPS, Sales, BV, EBITDA, premiums and synergies. EPS- weight 10%book value -weight 10%sales-weight 10%EBITDA-weight 50%Premium- weight 10%synergy -weight

QUESTION #1- calculate share price estimates using EPS, Sales, BV, EBITDA, premiums and synergies. EPS- weight 10%book value -weight 10%sales-weight 10%EBITDA-weight 50%Premium- weight 10%synergy -weight 10%QUESTION #2- Apply The weights used in this document to the six factors above to come up with a weighted price per share. QUESTION #3- use the dividend payments a projected growth rates provided to calculate the DDM-based prices per share for three firms. ********Include all formulas and show your work*******

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock