Question: Jackson Company purchased $ 50,000 in equipment on July 1 , 2021. The equipment had a 10 - year useful life ( no salvage )

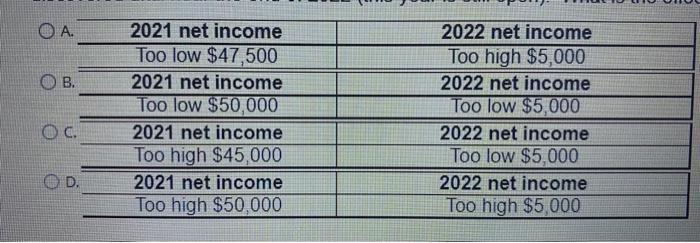

Jackson Company purchased $ 50,000 in equipment on July 1 , 2021. The equipment had a 10 - year useful life ( no salvage ) and Jackson normally used the straight - line method of depreciation with no special first year conventions . The equipment was written off to office expense when purchased, but the error was not the discovered until near the end of 2022 (this year is still open) What is the effect of the error on the 2021 and 2022 net income ? A, B, C, or D

A. B. OC. OD. 2021 net income Too low $47,500 2021 net income Too low $50,000 2021 net income Too high $45,000 2021 net income Too high $50,000 2022 net income Too high $5,000 2022 net income Too low $5,000 2022 net income Too low $5,000 2022 net income Too high $5,000

Step by Step Solution

3.57 Rating (154 Votes )

There are 3 Steps involved in it

ANSWER B 2021 net income Too ... View full answer

Get step-by-step solutions from verified subject matter experts