Question: Question 1 Calculate the net present value and internal rate of return of each building assuming that net operating income will be received in

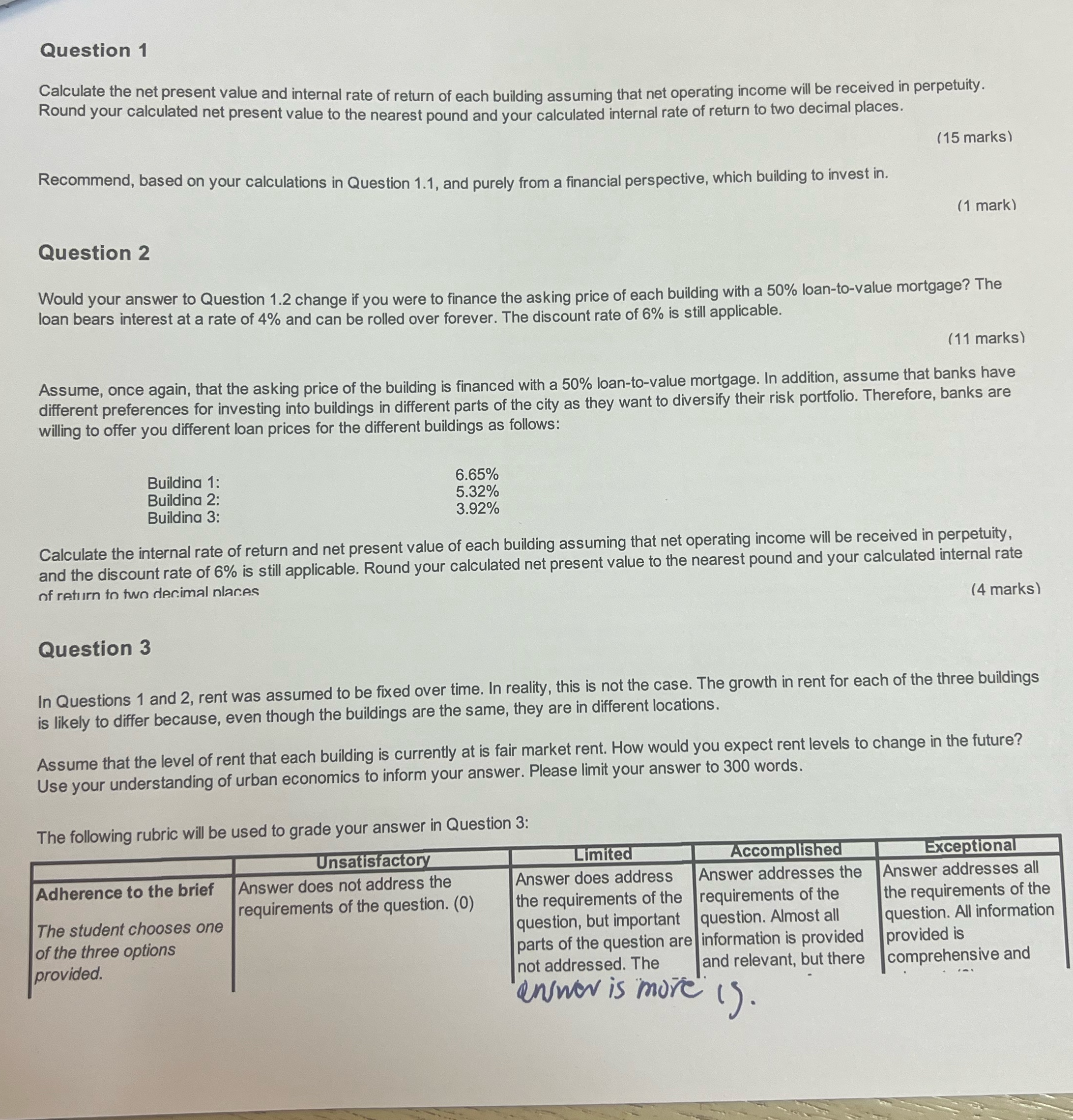

Question 1 Calculate the net present value and internal rate of return of each building assuming that net operating income will be received in perpetuity. Round your calculated net present value to the nearest pound and your calculated internal rate of return to two decimal places. Recommend, based on your calculations in Question 1.1, and purely from a financial perspective, which building to invest in. Question 2 Would your answer to Question 1.2 change if you were to finance the asking price of each building with a 50% loan-to-value mortgage? The loan bears interest at a rate of 4% and can be rolled over forever. The discount rate of 6% is still applicable. Buildina 1: Buildina 2: Buildina 3: (11 marks) Assume, once again, that the asking price of the building is financed with a 50% loan-to-value mortgage. In addition, assume that banks have different preferences for investing into buildings in different parts of the city as they want to diversify their risk portfolio. Therefore, banks are willing to offer you different loan prices for the different buildings as follows: Question 3 6.65% 5.32% 3.92% Calculate the internal rate of return and net present value of each building assuming that net operating income will be received in perpetuity, and the discount rate of 6% is still applicable. Round your calculated net present value to the nearest pound and your calculated internal rate (4 marks) of return to two decimal places (15 marks) (1 mark) In Questions 1 and 2, rent was assumed to be fixed over time. In reality, this is not the case. The growth in rent for each of the three buildings is likely to differ because, even though the buildings are the same, they are in different locations. The following rubric will be used to grade your answer in Question 3: Unsatisfactory Answer does not address the requirements of the question. (0) Adherence to the brief The student chooses one of the three options provided. Assume that the level of rent that each building is currently at is fair market rent. How would you expect rent levels to change in the future? Use your understanding of urban economics to inform your answer. Please limit your answer to 300 words. Limited Answer does address the requirements of the question, but important parts of the question are not addressed. The "answer is more Accomplished Answer addresses the requirements of the question. Almost all information is provided and relevant, but there 19. Exceptional Answer addresses all the requirements of the question. All information provided is comprehensive and

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts