Question: Question 1 (CAPM) Consider the following data representing security analyst's estimates of the expected return on two stocks, A and D, as well as the

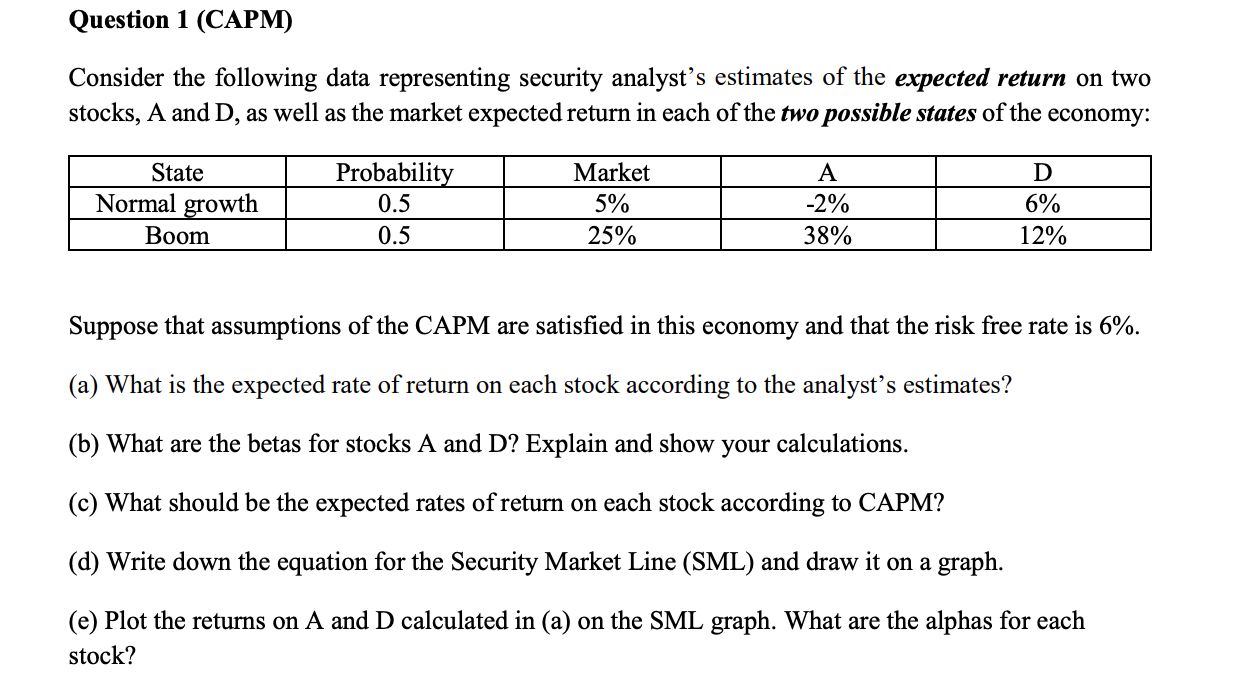

Question 1 (CAPM) Consider the following data representing security analyst's estimates of the expected return on two stocks, A and D, as well as the market expected return in each of the two possible states of the economy: State Normal growth Boom Probability 0.5 0.5 Market 5% 25% A -2% 38% D 6% 12% Suppose that assumptions of the CAPM are satisfied in this economy and that the risk free rate is 6%. (a) What is the expected rate of return on each stock according to the analyst's estimates? (b) What are the betas for stocks A and D? Explain and show your calculations. (c) What should be the expected rates of return on each stock according to CAPM? (d) Write down the equation for the Security Market Line (SML) and draw it on a graph. (e) Plot the returns on A and D calculated in (a) on the SML graph. What are the alphas for each stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts