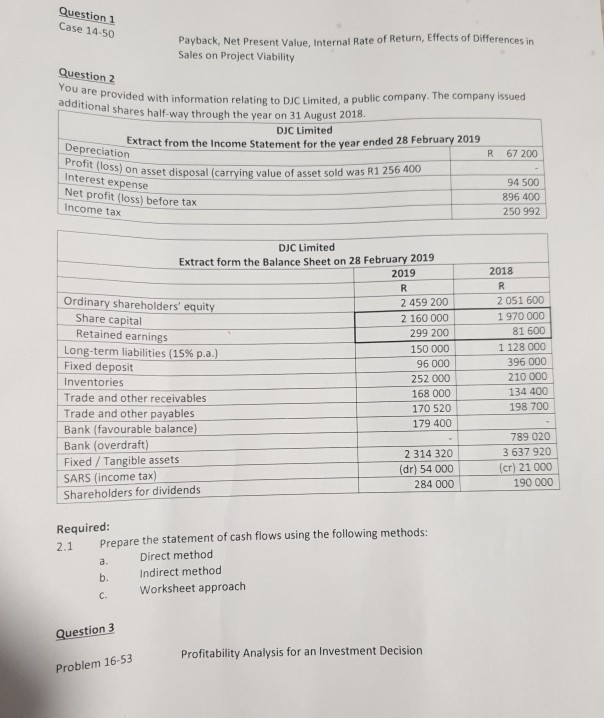

Question: Question 1 Case 14.50 Payback, Net Present Value Internal Rate of Return, Effects of Differences in Sales on Project Viability Question 2 You are provided

Question 1 Case 14.50 Payback, Net Present Value Internal Rate of Return, Effects of Differences in Sales on Project Viability Question 2 You are provided with in Depreciation Profit (loss) on asset dispo Interest expense Net profit (loss) before tax Income tax ded with information relating to DJC Limited, a public company. The company issued onal shares half-way through the year on 31 August 2018. DJC Limited Extract from the Income Statement for the year ended 28 February 2019 R67 200 on asset disposal (carrying value of asset sold was R1 256 400 94 500 896 400 250 992 DJC Limited Extract form the Balance Sheet on 28 February 2019 2019 2018 1 Ordinary shareholders' equity Share capital Retained earnings Long-term liabilities (15% p.a.) Fixed deposit Inventories Trade and other receivables Trade and other payables Bank (favourable balance) Bank (overdraft) Fixed / Tangible assets SARS (income tax) Shareholders for dividends 2459 200 2 160 000 299 200 150 000 96 000 252 000 168 000 170 520 179 400 - 2 314 320 (dr) 54 000 284 000 R 2051 600 1970 000 81 600 1128 000 396 000 210 000 134 400 198 700 789 020 3 637 920 (cr) 21 000 190 000 Required: 2.1 Prepare the statement of cash flows using the following methods: Direct method Indirect method Worksheet approach a. Question 3 Profitability Analysis for an Investment Decision Problem 16-53

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock