Question: Question 1 Case Study: Jack and Jill Jack is aged 39 and Jill is aged 41. Jill works a stay-at home mum whilst Jack runs

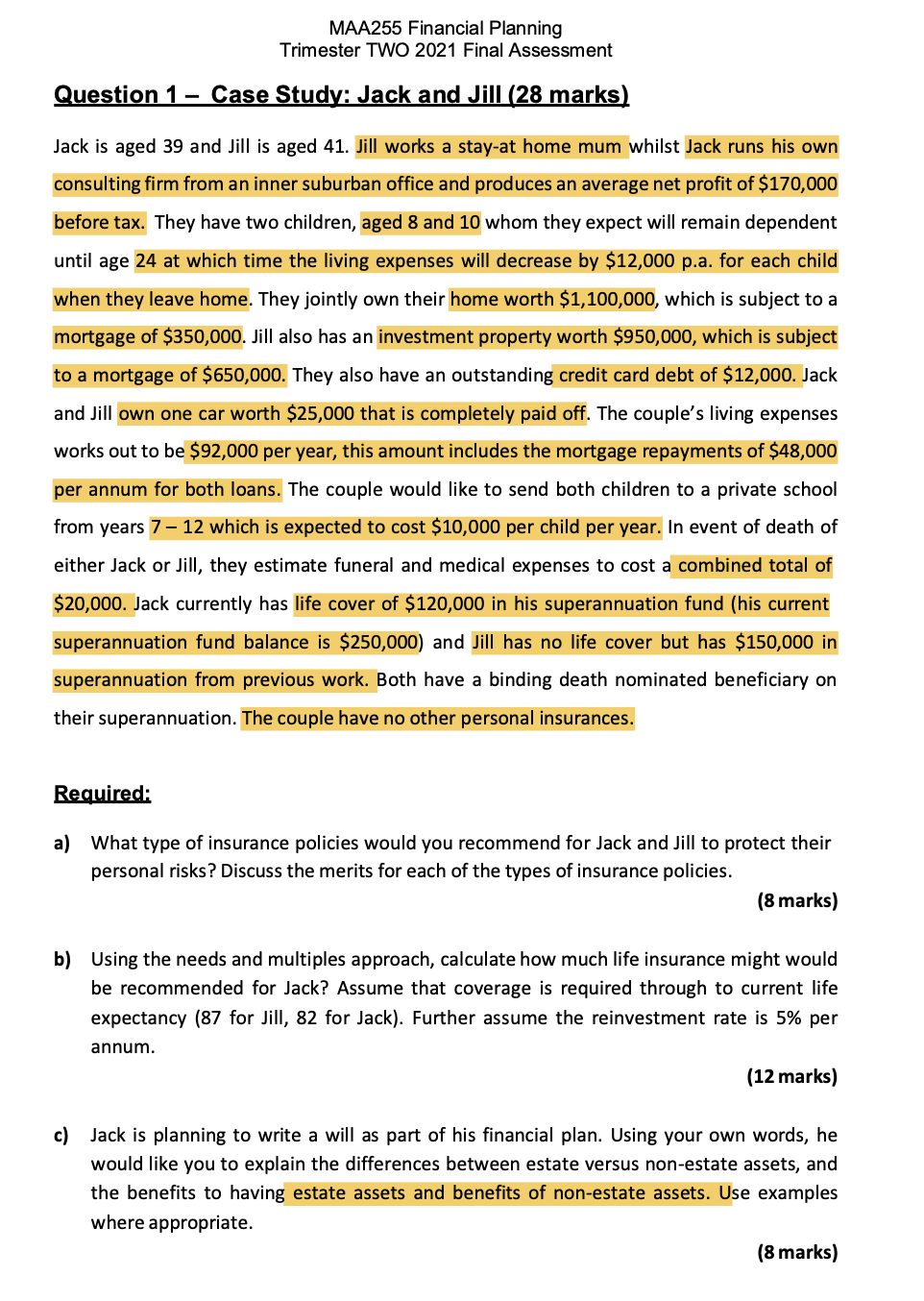

Question 1 Case Study: Jack and Jill

Jack is aged 39 and Jill is aged 41. Jill works a stay-at home mum whilst Jack runs his own consulting firm from an inner suburban office and produces an average net profit of $170,000 before tax. They have two children, aged 8 and 10 whom they expect will remain dependent until age 24 at which time the living expenses will decrease by $12,000 p.a. for each child when they leave home. They jointly own their home worth $1,100,000, which is subject to a mortgage of $350,000. Jill also has an investment property worth $950,000, which is subject to a mortgage of $650,000. They also have an outstanding credit card debt of $12,000. Jack and Jill own one car worth $25,000 that is completely paid off. The couples living expenses works out to be $92,000 per year, this amount includes the mortgage repayments of $48,000 per annum for both loans. The couple would like to send both children to a private school from years 7 12 which is expected to cost $10,000 per child per year. In event of death of either Jack or Jill, they estimate funeral and medical expenses to cost a combined total of $20,000. Jack currently has life cover of $120,000 in his superannuation fund (his current superannuation fund balance is $250,000) and Jill has no life cover but has $150,000 in superannuation from previous work. Both have a binding death nominated beneficiary on their superannuation. The couple have no other personal insurances.

b) Using the needs and multiples approach, calculate how much life insurance might would be recommended for Jack? Assume that coverage is required through to current life expectancy (87 for Jill, 82 for Jack). Further assume the reinvestment rate is 5% per annum.

(12 marks)

MAA255 Financial Planning Trimester TWO 2021 Final Assessment Question 1 - Case Study: Jack and Jill (28 marks) Jack is aged 39 and Jill is aged 41. Jill works a stay at home mum whilst Jack runs his own consulting firm from an inner suburban office and produces an average net profit of $170,000 before tax. They have two children, aged 8 and 10 whom they expect will remain dependent until age 24 at which time the living expenses will decrease by $12,000 p.a. for each child when they leave home. They jointly own their home worth $1,100,000, which is subject to a mortgage of $350,000. Jill also has an investment property worth $950,000, which is subject to a mortgage of $650,000. They also have an outstanding credit card debt of $12,000. Jack and Jill own one car worth $25,000 that is completely paid off. The couple's living expenses works out to be $92,000 per year, this amount includes the mortgage repayments of $48,000 per annum for both loans. The couple would like to send both children to a private school from years 7 - 12 which is expected to cost $10,000 per child per year. In event of death of either Jack or Jill, they estimate funeral and medical expenses to cost a combined total of $20,000. Jack currently has life cover of $120,000 in his superannuation fund (his current superannuation fund balance is $250,000) and Jill has no life cover but has $150,000 in superannuation from previous work. Both have a binding death nominated beneficiary on their superannuation. The couple have no other personal insurances. Required: a) What type of insurance policies would you recommend for Jack and Jill to protect their personal risks? Discuss the merits for each of the types of insurance policies. (8 marks) b) Using the needs and multiples approach, calculate how much life insurance might would be recommended for Jack? Assume that coverage is required through to current life expectancy (87 for Jill, 82 for Jack). Further assume the reinvestment rate is 5% per annum. (12 marks) c) Jack is planning to write a will as part of his financial plan. Using your own words, he would like you to explain the differences between estate versus non-estate assets, and the benefits to having estate assets and benefits of non-estate assets. Use examples where appropriate. (8 marks) MAA255 Financial Planning Trimester TWO 2021 Final Assessment Question 1 - Case Study: Jack and Jill (28 marks) Jack is aged 39 and Jill is aged 41. Jill works a stay at home mum whilst Jack runs his own consulting firm from an inner suburban office and produces an average net profit of $170,000 before tax. They have two children, aged 8 and 10 whom they expect will remain dependent until age 24 at which time the living expenses will decrease by $12,000 p.a. for each child when they leave home. They jointly own their home worth $1,100,000, which is subject to a mortgage of $350,000. Jill also has an investment property worth $950,000, which is subject to a mortgage of $650,000. They also have an outstanding credit card debt of $12,000. Jack and Jill own one car worth $25,000 that is completely paid off. The couple's living expenses works out to be $92,000 per year, this amount includes the mortgage repayments of $48,000 per annum for both loans. The couple would like to send both children to a private school from years 7 - 12 which is expected to cost $10,000 per child per year. In event of death of either Jack or Jill, they estimate funeral and medical expenses to cost a combined total of $20,000. Jack currently has life cover of $120,000 in his superannuation fund (his current superannuation fund balance is $250,000) and Jill has no life cover but has $150,000 in superannuation from previous work. Both have a binding death nominated beneficiary on their superannuation. The couple have no other personal insurances. Required: a) What type of insurance policies would you recommend for Jack and Jill to protect their personal risks? Discuss the merits for each of the types of insurance policies. (8 marks) b) Using the needs and multiples approach, calculate how much life insurance might would be recommended for Jack? Assume that coverage is required through to current life expectancy (87 for Jill, 82 for Jack). Further assume the reinvestment rate is 5% per annum. (12 marks) c) Jack is planning to write a will as part of his financial plan. Using your own words, he would like you to explain the differences between estate versus non-estate assets, and the benefits to having estate assets and benefits of non-estate assets. Use examples where appropriate. (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts