Question: Question 1 Changes in Target Cash Balances Indicate the likely impact of each of the following on a company's target cash balance. Use the letter

Question 1

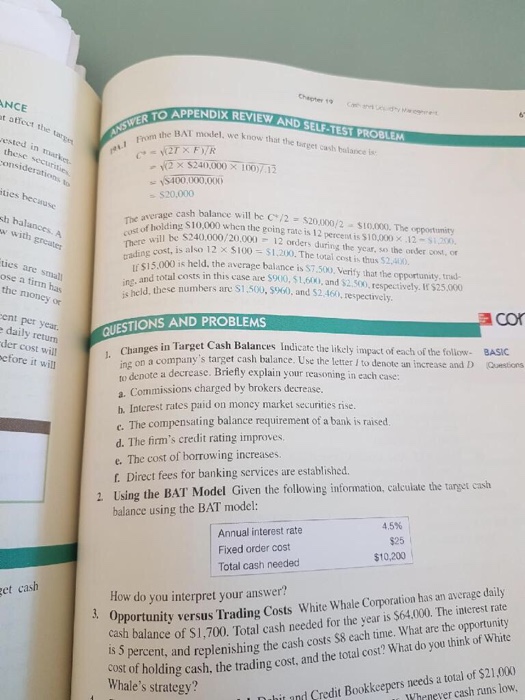

Question 1 Changes in Target Cash Balances Indicate the likely impact of each of the following on a company's target cash balance. Use the letter I to denote an increase and D to denote a decrease. Briefly explain your reasoning in each case: a. Commissions charged by brokers decrease. b. Interest rates paid on money market securities rise. c. The compensating balance requirement of a bank is raised. d. The firm's credit rating improves. e. The cost of borrowing increases. f. Direct fees for banking services are established. Using the BAT Model Given the following information, calculate the target cash balance using the BAT model: How do you interpret your answer? Opportunity versus Trading Costs White Whale Corporation has an average daily cash balance of $1, 700. Total cash needed for the year is $64,000. The interest rate is 5 percent, and replenishing the cash costs $8 each time. What are the opportunity cost of holding cash, the trading cost, and the total cast? What do you think of White Whale's strategy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts