Question: Question 1 - Chapter 1 6 Grad Deferred Tax Liabilities Income Tax Journal Entries Course Hero On January 1 , 2 0 2 1 ,

Question Chapter Grad

Deferred Tax Liabilities

Income Tax Journal Entries

Course Hero

On January Ameen C

Dashboard

Log In

Mail Klase, Sarah..

Blackboard Learn

Sign In Connect S Environment and T

myctstate.edu

Home Microsoft... is Students: Find Wh

Free MLA Citation...

WileyPLUS

ChatGPT

All Bookmarks

S Back

This window shows your responses and what was marked correct and incorrect from your previous attempt.

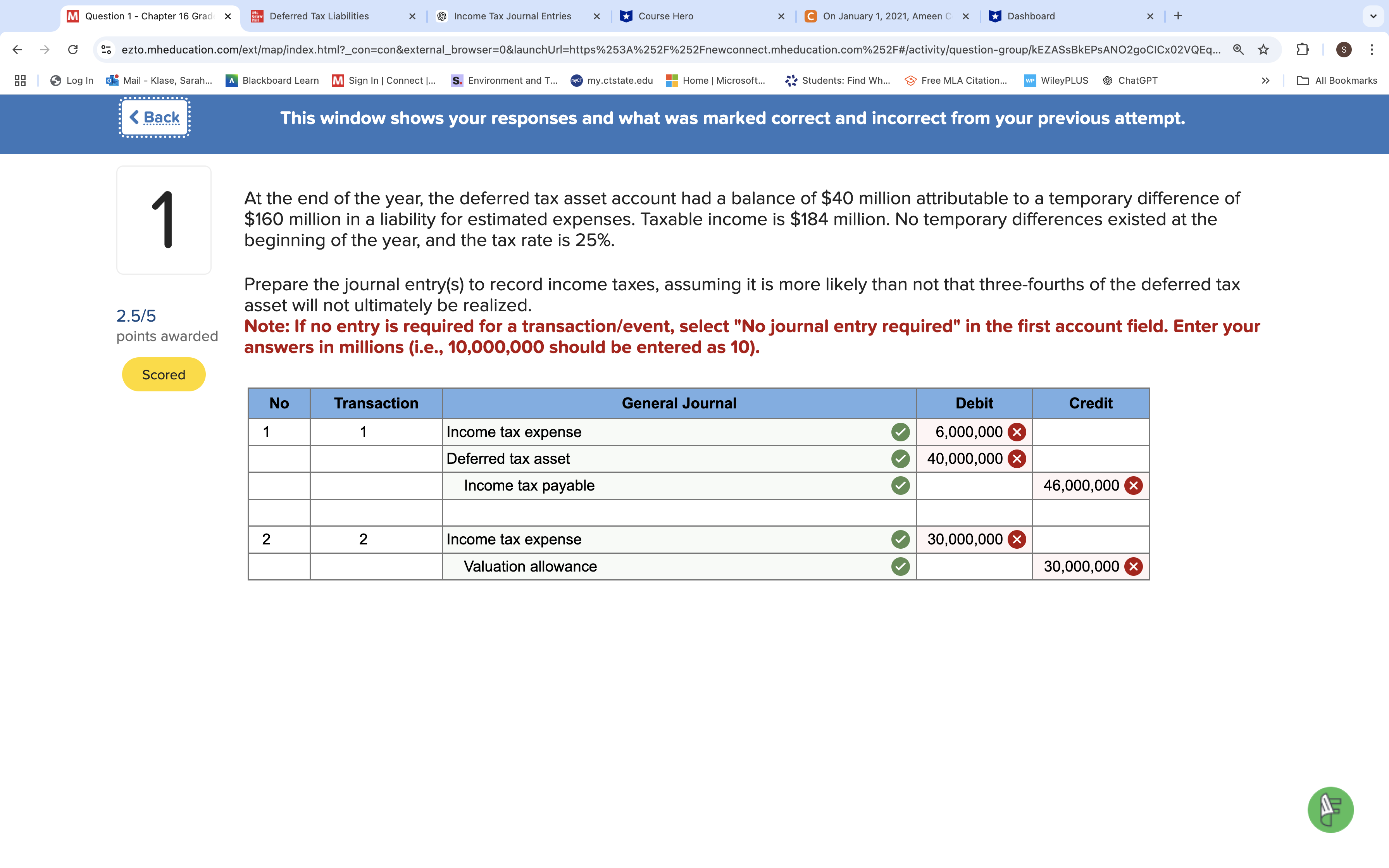

At the end of the year, the deferred tax asset account had a balance of $ million attributable to a temporary difference of $ million in a liability for estimated expenses. Taxable income is $ million. No temporary differences existed at the beginning of the year, and the tax rate is

points awarded

Scored

begintabularcccccc

hline No & Transaction & multicolumncGeneral Journal & Debit & Credit

hline & & Income tax expense & checkmark & &

hline & & Deferred tax asset & checkmark & X &

hline & & Income tax payable & v & &

hline & & Income tax expense & & X &

hline & & Valuation allowance & cdot & & times

hline

endtabular

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock