Question: Question 1 - Chapter 7, Learning Objective 3 5 points each, total of 20 points This question has several individual parts. For each part, answer

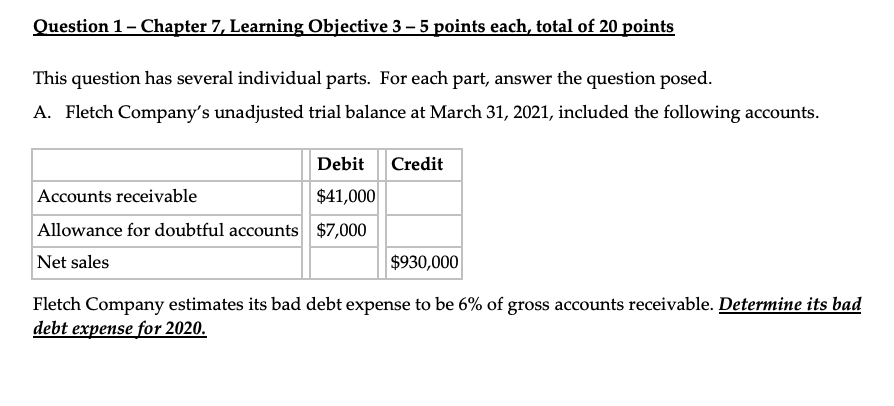

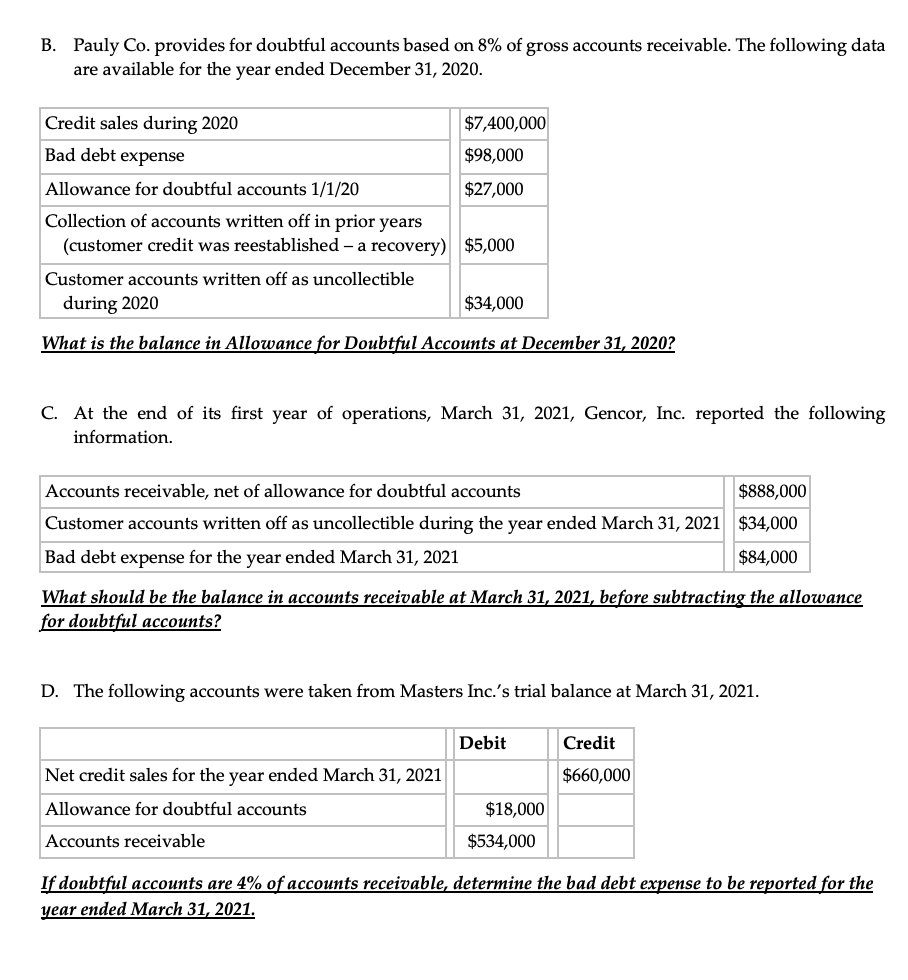

Question 1 - Chapter 7, Learning Objective 3 5 points each, total of 20 points This question has several individual parts. For each part, answer the question posed. A. Fletch Company's unadjusted trial balance at March 31, 2021, included the following accounts. Debit Credit Accounts receivable $41,000 Allowance for doubtful accounts $7,000 Net sales $930,000 Fletch Company estimates its bad debt expense to be 6% of gross accounts receivable. Determine its bad debt expense for 2020. B. Pauly Co. provides for doubtful accounts based on 8% of gross accounts receivable. The following data are available for the year ended December 31, 2020. Credit sales during 2020 $7,400,000 Bad debt expense $98,000 Allowance for doubtful accounts 1/1/20 $27,000 Collection of accounts written off in prior years (customer credit was reestablished - a recovery) $5,000 Customer accounts written off as uncollectible during 2020 $34,000 What is the balance in Allowance for Doubtful Accounts at December 31, 2020? C. At the end of its first year of operations, March 31, 2021, Gencor, Inc. reported the following information. Accounts receivable, net of allowance for doubtful accounts $888,000 Customer accounts written off as uncollectible during the year ended March 31, 2021 $34,000 Bad debt expense for the year ended March 31, 2021 $84,000 What should be the balance in accounts receivable at March 31, 2021, before subtracting the allowance for doubtful accounts? D. The following accounts were taken from Masters Inc.'s trial balance at March 31, 2021. Debit Credit $660,000 Net credit sales for the year ended March 31, 2021 Allowance for doubtful accounts $18,000 $534,000 Accounts receivable If doubtful accounts are 4% of accounts receivable, determine the bad debt expense to be reported for the year ended March 31, 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts