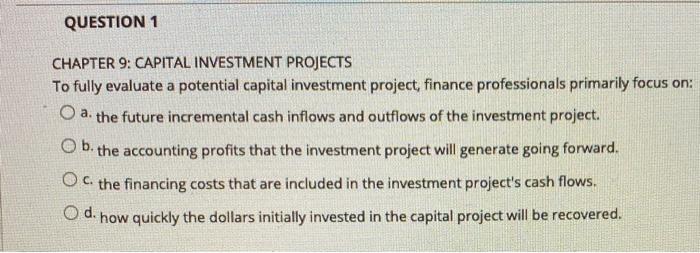

Question: QUESTION 1 CHAPTER 9: CAPITAL INVESTMENT PROJECTS To fully evaluate a potential capital investment project, finance professionals primarily focus on: a. the future incremental cash

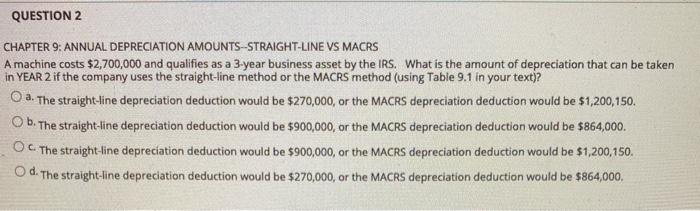

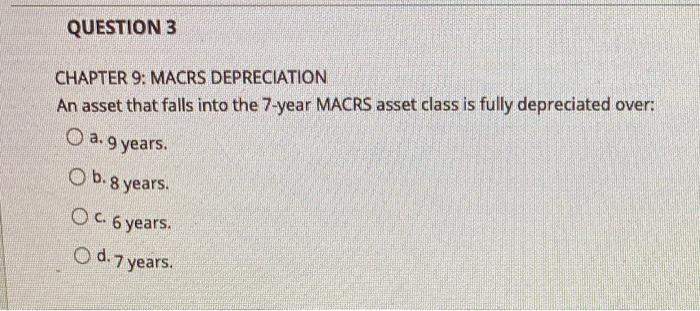

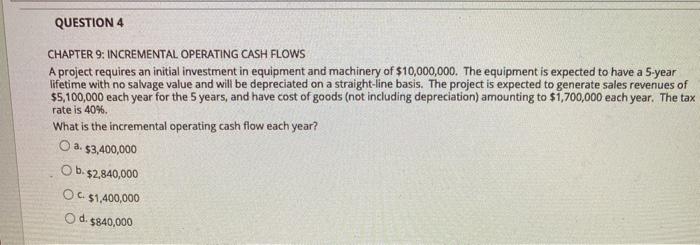

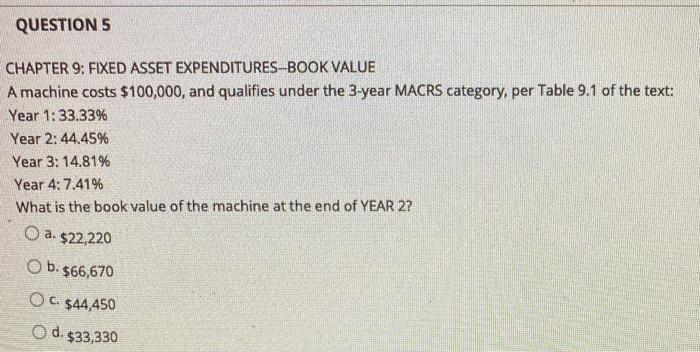

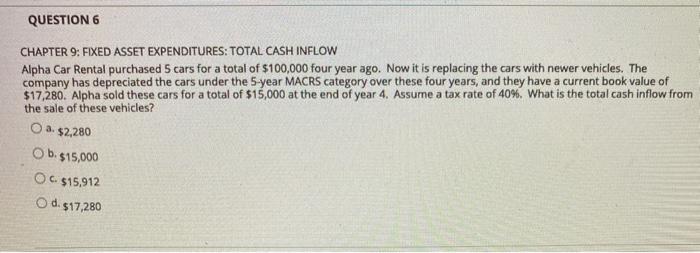

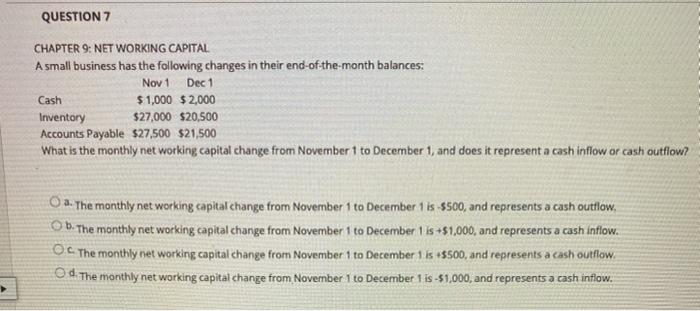

QUESTION 1 CHAPTER 9: CAPITAL INVESTMENT PROJECTS To fully evaluate a potential capital investment project, finance professionals primarily focus on: a. the future incremental cash inflows and outflows of the investment project. Ob. the accounting profits that the investment project will generate going forward. O the financing costs that are included in the investment project's cash flows. O d. how quickly the dollars initially invested in the capital project will be recovered. QUESTION 2 CHAPTER 9: ANNUAL DEPRECIATION AMOUNTS--STRAIGHT-LINE VS MACRS A machine costs $2,700,000 and qualifies as a 3-year business asset by the IRS. What is the amount of depreciation that can be taken in YEAR 2 if the company uses the straight-line method or the MACRS method (using Table 9.1 in your text)? O a. The straight-line depreciation deduction would be $270,000, or the MACRS depreciation deduction would be $1,200,150. O b. The straight-line depreciation deduction would be $900,000, or the MACRS depreciation deduction would be $864,000. OC The straight-line depreciation deduction would be $900,000, or the MACRS depreciation deduction would be $1,200,150. Od. The straight-line depreciation deduction would be $270,000, or the MACRS depreciation deduction would be $864,000. QUESTION 3 CHAPTER 9: MACRS DEPRECIATION An asset that falls into the 7-year MACRS asset class is fully depreciated over: O a. 9 years. O b.8 years. OC. 6 years. O d. 7 years. rate is 40%. QUESTION 4 CHAPTER 9: INCREMENTAL OPERATING CASH FLOWS A project requires an initial investment in equipment and machinery of $10,000,000. The equipment is expected to have a 5-year lifetime with no salvage value and will be depreciated on a straight-line basis. The project is expected to generate sales revenues of $5,100,000 each year for the 5 years, and have cost of goods (not including depreciation) amounting to $1,700,000 each year. The tax What is the incremental operating cash flow each year? O a. $3,400,000 Ob.$2,840,000 OC. $1,400,000 Od $840,000 QUESTIONS CHAPTER 9: FIXED ASSET EXPENDITURES-BOOK VALUE Amachine costs $100,000, and qualifies under the 3-year MACRS category, per Table 9.1 of the text: Year 1:33.33% Year 2:44.45% Year 3: 14.81% Year 4: 7.41% What is the book value of the machine at the end of YEAR 27 Oa. $22,220 O b. $66,670 OC. $44,450 O d. $33,330 QUESTION 6 CHAPTER 9: FIXED ASSET EXPENDITURES: TOTAL CASH INFLOW Alpha Car Rental purchased 5 cars for a total of $100,000 four year ago. Now it is replacing the cars with newer vehicles. The company has depreciated the cars under the 5-year MACRS category over these four years, and they have a current book value of $17,280. Alpha sold these cars for a total of $15,000 at the end of year 4. Assume a tax rate of 40%. What is the total cash inflow from the sale of these vehicles? a. $2,280 O b. $15,000 OC. $15,912 O d. 517,280 QUESTION 7 CHAPTER 9: NETWORKING CAPITAL A small business has the following changes in their end-of-the-month balances: Nov 1 Dec 1 Cash $1,000 $2,000 Inventory $27,000 $20,500 Accounts Payable $27,500 $21,500 What is the monthly net working capital change from November 1 to December 1, and does it represent a cash inflow or cash outflow? O a. The monthly networking capital change from November 1 to December 1 is $500, and represents a cash outflow, O b. The monthly net working capital change from November 1 to December 1 is +$1,000, and represents a cash inflow. 0.0 The monthly net working capital change from November 1 to December 115 $500, and represents a cash outflow. od the monthly net working capital change from November 1 to December 1 is -$1,000, and represents a cash inflow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts