Question: QUESTION 1 CLASSIFICATION OPTIONS QUESTION 2 Classifying Relevant and Irrelevant Items The law firm of Greenberg Traurig LLP has been asked to represent a local

QUESTION 1

CLASSIFICATION OPTIONS

QUESTION 2

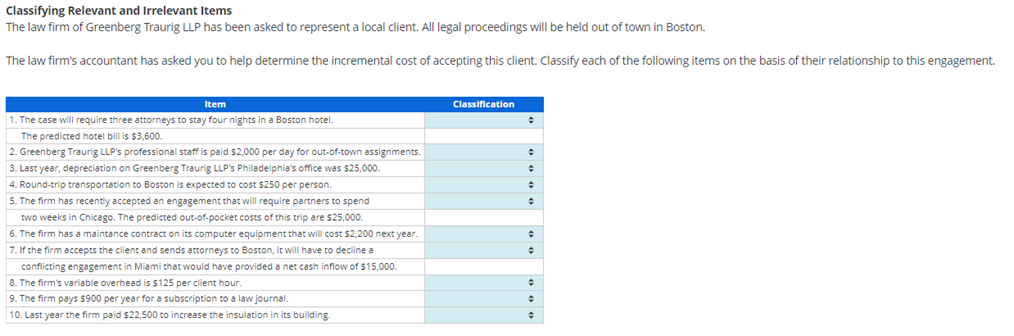

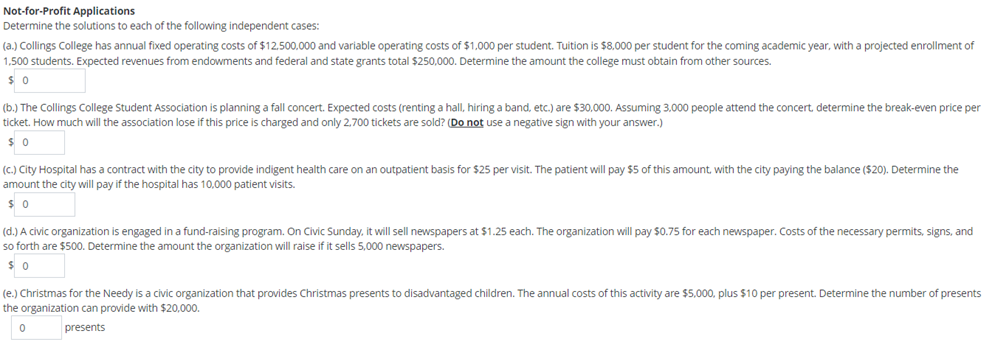

Classifying Relevant and Irrelevant Items The law firm of Greenberg Traurig LLP has been asked to represent a local client. All legal proceedings will be held out of town in Boston. The law firm's accountant has asked you to help determine the incremental cost of accepting this client. Classify each of the following items on the basis of their relationship to this engagement. Item 1. The case will require three attorneys to stay four nights in a Boston hotel. The predicted hotel bill is $3,600. 2. Greenberg Traurig LLP's professional staff is paid $2,000 per day for out-of-town assignments. 3. Last year, depreciation on Greenberg Traurig LLP's Philadelphia's office was $25,000. 4. Round-trip transportation to Boston is expected to cost $250 per person. 5. The firm has recently accepted an engagement that will require partners to spend two weeks in Chicago. The predicted out-of-pocket costs of this trip are $25,000. 6. The firm has a maintance contract on its computer equipment that will cost $2,200 next year. 7. If the firm accepts the client and sends attorneys to Boston, it will have to decline a conflicting engagement in Miami that would have provided a net cash inflow of $15,000. 8. The firm's variable overhead is $125 per client hour. 9. The firm pays $900 per year for a subscription to a law journal. 10. Last year the firm paid $22,500 to increase the insulation in its building. Classification + + Relevant cost-opportunity Relevant cost-outlay Irrelevant cost-outlay Irrelevant cost-sunk Not-for-Profit Applications Determine the solutions to each of the following independent cases: (a.) Collings College has annual fixed operating costs of $12.500.000 and variable operating costs of $1,000 per student. Tuition is $8,000 per student for the coming academic year, with a projected enrollment of 1,500 students. Expected revenues from endowments and federal and state grants total $250,000. Determine the amount the college must obtain from other sources. $0 (b.) The Collings College Student Association is planning a fall concert. Expected costs (renting a hall, hiring a band, etc.) are $30,000. Assuming 3.000 people attend the concert, determine ticket. How much will the association lose if this price is charged and only 2.700 tickets are sold? (Do not use a negative sign with your answer.) $0 break-even price per (c.) City Hospital has a contract with the city to provide indigent health care on an outpatient basis for $25 per visit. The patient will pay $5 of this amount, with the city paying the balance ($20). Determine the amount the city will pay if the hospital has 10,000 patient visits. $0 (d.) A civic organization is engaged in a fund-raising program. On Civic Sunday, it will sell newspapers at $1.25 each. The organization will pay $0.75 for each newspaper. Costs of the necessary permits, signs, and so forth are $500. Determine the amount the organization will raise if it sells 5,000 newspapers. $0 (e.) Christmas for the Needy is a civic organization that provides Christmas presents to disadvantaged children. The annual costs of this activity are $5,000, plus $10 per present. Determine the number of presents the organization can provide with $20,000. 0 presents

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts