Question: Question 1 Collateralized Mortgage Obligations (CMOs) differ from MBS pass-throughs because Selected Answer: Answers: all these answers are correct CMOs are tranched by prepayment risk

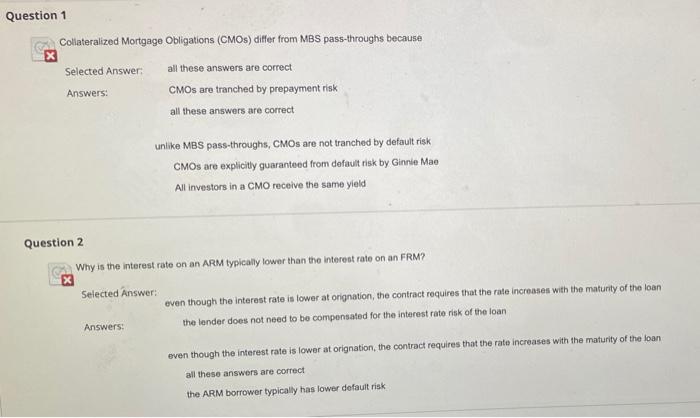

Question 1 Collateralized Mortgage Obligations (CMOs) differ from MBS pass-throughs because Selected Answer: Answers: all these answers are correct CMOs are tranched by prepayment risk all these answers are correct unlike MBS pass-throughs, CMOs are not tranched by default risk CMOs are explicitly guaranteed from default risk by Ginnie Mae All investors in a CMO receive the same yield Question 2 Why is the interest rate on an ARM typically lower than the interest rate on an FRM? Selected Answer: even though the interest rate is lower at orignation, the contract requires that the rate increases with the maturity of the loan the tender does not need to be compensated for the interest rato risk of the loan Answers: even though the interest rate is lower at orignation, the contract requires that the rate increases with the maturity of the loan all these answers are correct the ARM borrower typically has lower default risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts