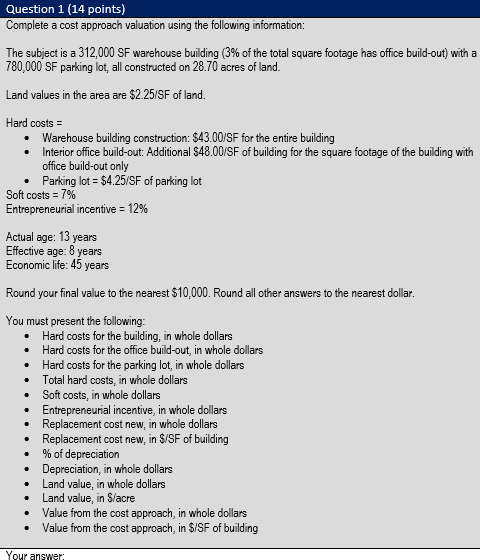

Question: Question 1 : Complete a cost approach valuation using the following information: The subject is a 3 1 2 , 0 0 0 SF warehouse

Question :

Complete a cost approach valuation using the following information:

The subject is a SF warehouse building of the total square footage has office buildout with a SF parking lot, all constructed on acres of land.

Land values in the area are $SF of land.

Hard costs

Warehouse building construction: $SF for the entire building

Interior office buildout: Additional $SF of building for the square footage of the building with office buildout only

Parking lot $SF of parking lot

Soft costs

Entrepreneurial incentive

Actual age: years

Effective age: years

Economic life: years

Round your final value to the nearest $ Round all other answers to the nearest dollar.

You must present the following:

Hard costs for the building, in whole dollars

Hard costs for the office buildout, in whole dollars

Hard costs for the parking lot, in whole dollars

Total hard costs, in whole dollars

Soft costs, in whole dollars

Entrepreneurial incentive, in whole dollars

Replacement cost new, in whole dollars

Replacement cost new, in $SF of building

of depreciation

Depreciation, in whole dollars

Land value, in whole dollars

Land value, in $acre

Value from the cost approach, in whole dollars

Value from the cost approach, in $SF of building

Question :

Complete a sales comparison approach using the following information and data:

In your adjustment grid on the following page, round all adjustments to the nearest whole percentage eg round to

Include a or to indicate the direction of each adjustment.

Make the market conditions adjustment first and independent of all other adjustments.

At the end, add together the locationphysical adjustments because they are cumulative dont forget to consider the direction of adjustments

Not all items will require adjustment.

Remember, comparables are adjusted to the subject, so a superior characteristic would be adjusted downward, and an inferior characteristic would be adjusted upward.

Subject property: SF warehouse

Sales AD are all warehouses.

Market conditions adjustment

Market conditions adjustments are applied before all the other adjustments, after which you should calculate a semiadjusted $SF before proceeding with the locationphysical adjustments.

From the beginning of Q until the end of Q market conditions improved per quarter on a straightline basis NOT compounding due to demand for warehouse space for ecommerce. From the end of Q until the present beginning of Q market conditions have declined per quarter on a straightline basis NOT compounding due to oversupply.

All sales must be adjusted to reflect market conditions as of the beginning of Q

Make all adjustments from the beginning of the quarter when the comparable sold to the beginning of Q

Location adjustment

Whitestown is considered to be superior to Indianapolis.

Greenwood is considered to be inferior to Whitestown.

Plainfield is considered to be inferior to Whitestown

Size adjustment

Buildings in this market require a adjustment per SF of difference you can adjust for smaller and largerpartial differences Smaller buildings are considered superior, and larger buildings are considered inferior.

Agecondition adjustment

An adjustment for age is per year of effective age difference. Older buildings are considered inferior, and newer buildings are considered superior.

Remember the market conditions adjustment is performed prior to locationphysical adjustments. Locationphysical adjustments are added up and can net each other out.

Last, present the indicated values for the subject, based on each comparables adjusted $SF and the subject building size, in whole dollars, rounded to the nearest $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock