Question: Question 1 - Compute modified duration for the 2-year, 5-year, and 10-year bond. 3. Part 3 Butterfly Strategy A common strategy in fixed income is

Question 1 - Compute modified duration for the 2-year, 5-year, and 10-year bond.

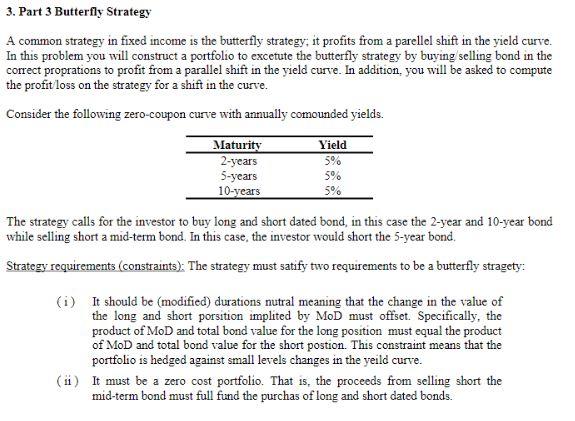

3. Part 3 Butterfly Strategy A common strategy in fixed income is the butterfly strategy, it profits from a parellel shift in the yield curve. In this problem you will construct a portfolio to excetute the butterfly strategy by buying selling bond in the correct proprations to profit from a parallel shift in the yield curve. In addition, you will be asked to compute the profit loss on the strategy for a shift in the curve. Consider the following zero-coupon curve with annually comounded yields. Maturity Yield 2-years 5-years 10-years 5% The strategy calls for the investor to buy long and short dated bond, in this case the 2-year and 10-year bond while selling short a mid-term bond. In this case, the investor would short the 5-year bond, Strategy requirements (constraints). The strategy must satify two requirements to be a butterfly stragety: 5% 5% (1) It should be modified) durations nutral meaning that the change in the value of the long and short porsition implied by MOD must offset. Specifically, the product of MoD and total bond value for the long position must equal the product of MoD and total bond value for the short postion. This constraint means that the portfolio is hedged against small levels changes in the yeild curve. (i) It must be a zero cost portfolio. That is, the proceeds from selling short the mid-term bond must full fund the purchas of long and short dated bonds. 3. Part 3 Butterfly Strategy A common strategy in fixed income is the butterfly strategy, it profits from a parellel shift in the yield curve. In this problem you will construct a portfolio to excetute the butterfly strategy by buying selling bond in the correct proprations to profit from a parallel shift in the yield curve. In addition, you will be asked to compute the profit loss on the strategy for a shift in the curve. Consider the following zero-coupon curve with annually comounded yields. Maturity Yield 2-years 5-years 10-years 5% The strategy calls for the investor to buy long and short dated bond, in this case the 2-year and 10-year bond while selling short a mid-term bond. In this case, the investor would short the 5-year bond, Strategy requirements (constraints). The strategy must satify two requirements to be a butterfly stragety: 5% 5% (1) It should be modified) durations nutral meaning that the change in the value of the long and short porsition implied by MOD must offset. Specifically, the product of MoD and total bond value for the long position must equal the product of MoD and total bond value for the short postion. This constraint means that the portfolio is hedged against small levels changes in the yeild curve. (i) It must be a zero cost portfolio. That is, the proceeds from selling short the mid-term bond must full fund the purchas of long and short dated bonds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts