Question: Question 1 Compute the average return, Standard deviation, covariance and Beta for all the mutual funds. The comparative index can be Nifty 50. Question 2

Question 1

Compute the average return, Standard deviation, covariance and Beta for all the mutual funds. The comparative index can be Nifty 50.

Question 2

Do a performance evaluation of all the mutual funds through 3 measures Treynor, Sharpe and Jensens Alpha and analyse/interpret the measures with qualitative comments.

Qualitative comments NOT MORE THAN ONE PAGE

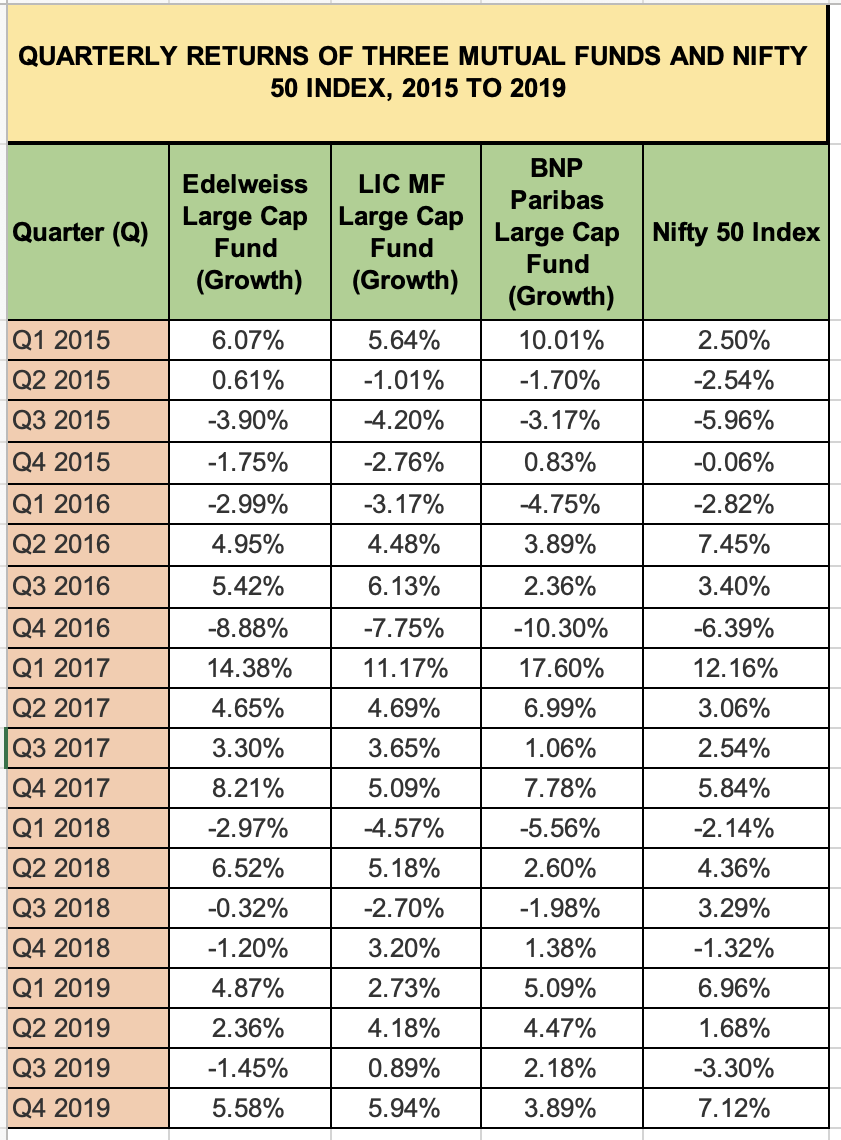

QUARTERLY RETURNS OF THREE MUTUAL FUNDS AND NIFTY 50 INDEX, 2015 TO 2019 \begin{tabular}{|l|c|c|c|c|} \hline Quarter (Q) & Edelweiss Large Cap Fund (Growth) & LIC MF Large Cap Fund (Growth) & BNP Paribas Large Cap Fund (Growth) & Nifty 50 Index \\ \hline Q1 2015 & 6.07% & 5.64% & 10.01% & 2.50% \\ \hline Q2 2015 & 0.61% & 1.01% & 1.70% & 2.54% \\ \hline Q3 2015 & 3.90% & 4.20% & 3.17% & 5.96% \\ \hline Q4 2015 & 1.75% & 2.76% & 0.83% & 0.06% \\ \hline Q1 2016 & 2.99% & 3.17% & 4.75% & 2.82% \\ \hline Q2 2016 & 4.95% & 4.48% & 3.89% & 7.45% \\ \hline Q3 2016 & 5.42% & 6.13% & 2.36% & 3.40% \\ \hline Q4 2016 & 8.88% & 7.75% & 10.30% & 6.39% \\ \hline Q1 2017 & 14.38% & 11.17% & 17.60% & 12.16% \\ \hline Q2 2017 & 4.65% & 4.69% & 6.99% & 3.06% \\ \hline Q3 2017 & 3.30% & 3.65% & 1.06% & 2.54% \\ \hline Q4 2017 & 8.21% & 5.09% & 7.78% & 5.84% \\ \hline Q1 2018 & 2.97% & 4.57% & 5.56% & 2.14% \\ \hline Q2 2018 & 6.52% & 5.18% & 2.60% & 4.36% \\ \hline Q3 2018 & 0.32% & 2.70% & 1.98% & 3.29% \\ \hline Q4 2018 & 1.20% & 3.20% & 1.38% & 1.32% \\ \hline Q1 2019 & 4.87% & 2.73% & 5.09% & 6.96% \\ \hline Q2 2019 & 2.36% & 4.18% & 4.47% & 1.68% \\ \hline Q3 2019 & 1.45% & 0.89% & 2.18% & 3.30% \\ \hline Q4 2019 & 5.58% & 5.94% & 3.89% & 7.12% \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts