Question: Question 1 Consider a 180-day forward contract on a certain commodity. The spot price of the commodity is Sh. 100. The commodity will attract a

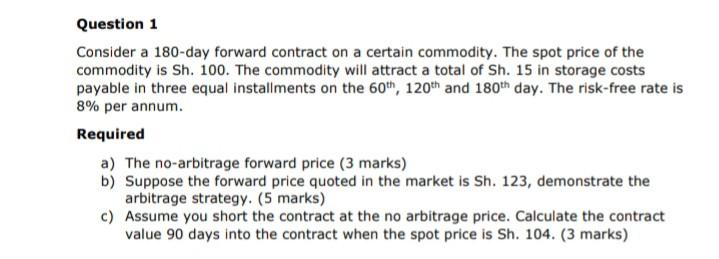

Question 1 Consider a 180-day forward contract on a certain commodity. The spot price of the commodity is Sh. 100. The commodity will attract a total of Sh. 15 in storage costs payable in three equal installments on the 60th, 120th and 180th day. The risk-free rate is 8% per annum. Required a) The no-arbitrage forward price (3 marks) b) Suppose the forward price quoted in the market is Sh. 123, demonstrate the arbitrage strategy. (5 marks) c) Assume you short the contract at the no arbitrage price. Calculate the contract value 90 days into the contract when the spot price is Sh. 104. (3 marks) Question 1 Consider a 180-day forward contract on a certain commodity. The spot price of the commodity is Sh. 100. The commodity will attract a total of Sh. 15 in storage costs payable in three equal installments on the 60th, 120th and 180th day. The risk-free rate is 8% per annum. Required a) The no-arbitrage forward price (3 marks) b) Suppose the forward price quoted in the market is Sh. 123, demonstrate the arbitrage strategy. (5 marks) c) Assume you short the contract at the no arbitrage price. Calculate the contract value 90 days into the contract when the spot price is Sh. 104

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts