Question: Question 1. Consider a call option selling for $4 in which the cxcrcise price is $50. Determine the value at expiration and the profile for

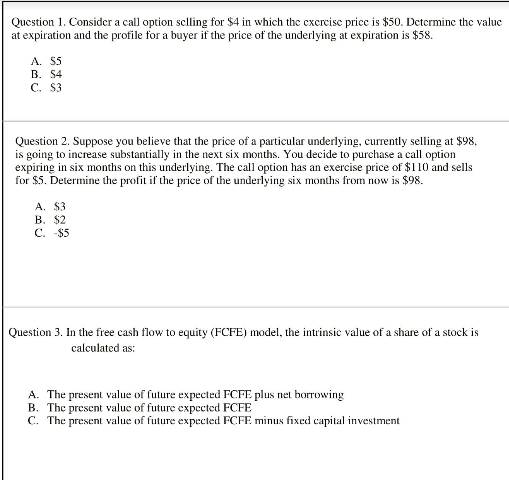

Question 1. Consider a call option selling for $4 in which the cxcrcise price is $50. Determine the value at expiration and the profile for a buyer if the price of the underlying at expiration is $58. A. SS B, S4 C. S3 Question 2. Suppose you believe that the price of a particular underlying, currently selling at $98. is going to increase substantially in the next six months. You decide to purchase a call option expiring in six months on this underlying. The call option has an exercise price of $110 and sells for $5. Determine the profit if the price of the underlying six months from now is $98. A. S3 B. $2 C. $5 Question 3. In the free cash flow to equity (FCFE) model, the intrinsic value of a share of a stock is calculated as: A. The present value of future expected FCFE plus net borrowing B. The present value of future expected FCFE C. The present value of future expected FCFE minus fixed capital investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts