Question: Question 1 Consider a graph with the market beta on the horizontal axis and the expected return on the vertical axis . What is the

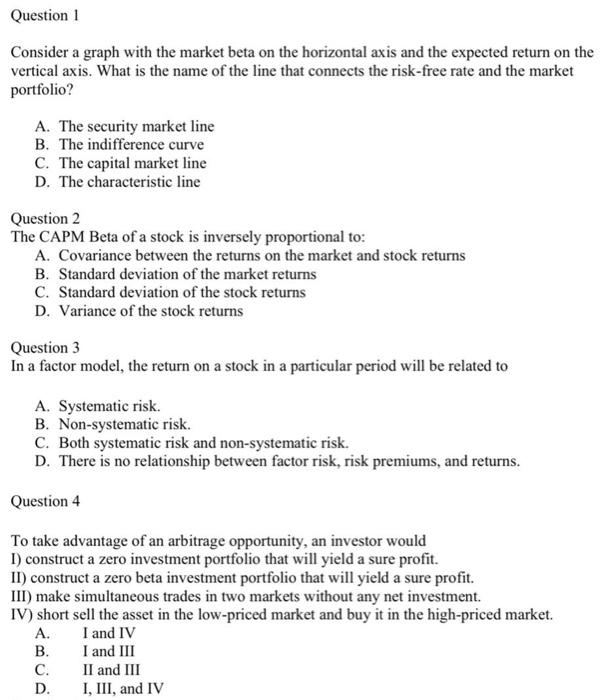

Question 1 Consider a graph with the market beta on the horizontal axis and the expected return on the vertical axis . What is the name of the line that connects the risk-free rate and the market portfolio? A. The security market line B. The indifference curve C. The capital market line D. The characteristic line Question 2 The CAPM Beta of a stock is inversely proportional to: A. Covariance between the returns on the market and stock returns B. Standard deviation of the market returns C. Standard deviation of the stock returns D. Variance of the stock returns Question 3 In a factor model, the return on a stock in a particular period will be related to A. Systematic risk. B. Non-systematic risk. C. Both systematic risk and non-systematic risk. D. There is no relationship between factor risk, risk premiums, and returns. Question 4 To take advantage of an arbitrage opportunity, an investor would 1) construct a zero investment portfolio that will yield a sure profit. II) construct a zero beta investment portfolio that will yield a sure profit. III) make simultaneous trades in two markets without any net investment. IV) short sell the asset in the low-priced market and buy it in the high-priced market. A. I and IV B. I and III C. II and III D. I, III, and IV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts