Question: Question 1. Consider a probability space with N = {1,2,3}, the power sigma algebra F = P(2) and uniform probability. On this space, we define

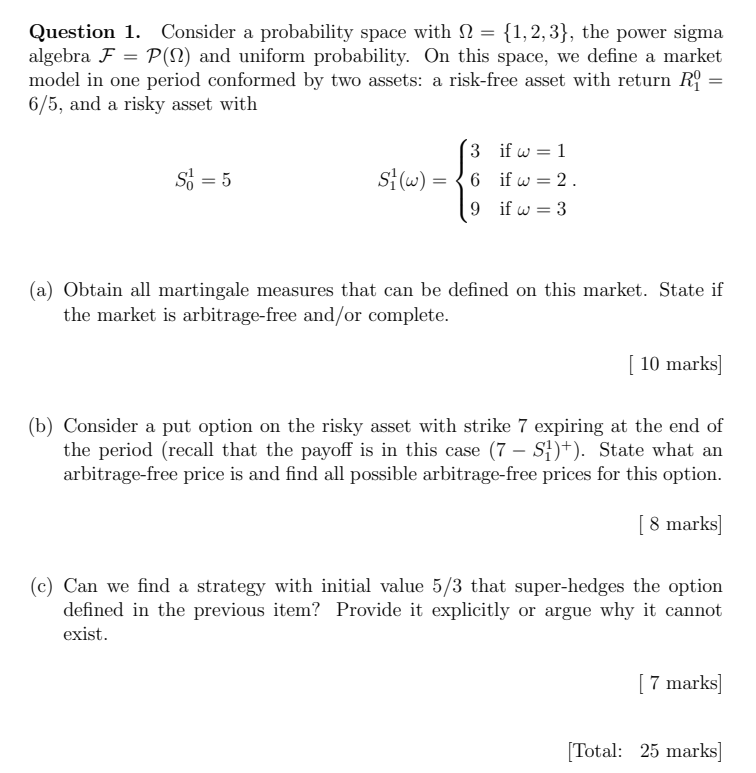

Question 1. Consider a probability space with N = {1,2,3}, the power sigma algebra F = P(2) and uniform probability. On this space, we define a market model in one period conformed by two assets: a risk-free asset with return R = 6/5, and a risky asset with Si = 5 (3 if w=1 Sw) = { 6 if w = 2. 9 if w=3 (a) Obtain all martingale measures that can be defined on this market. State if the market is arbitrage-free and/or complete. [ 10 marks] (b) Consider a put option on the risky asset with strike 7 expiring at the end of the period (recall that the payoff is in this case (7 S])+). State what an arbitrage-free price is and find all possible arbitrage-free prices for this option. [ 8 marks] (c) Can we find a strategy with initial value 5/3 that super-hedges the option defined in the previous item? Provide it explicitly or argue why it cannot exist. [ 7 marks] [Total: 25 marks] Question 1. Consider a probability space with N = {1,2,3}, the power sigma algebra F = P(2) and uniform probability. On this space, we define a market model in one period conformed by two assets: a risk-free asset with return R = 6/5, and a risky asset with Si = 5 (3 if w=1 Sw) = { 6 if w = 2. 9 if w=3 (a) Obtain all martingale measures that can be defined on this market. State if the market is arbitrage-free and/or complete. [ 10 marks] (b) Consider a put option on the risky asset with strike 7 expiring at the end of the period (recall that the payoff is in this case (7 S])+). State what an arbitrage-free price is and find all possible arbitrage-free prices for this option. [ 8 marks] (c) Can we find a strategy with initial value 5/3 that super-hedges the option defined in the previous item? Provide it explicitly or argue why it cannot exist. [ 7 marks] [Total: 25 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts