Question: QUESTION 1. Consider a project that requires an initial cash outflow of P500,000 with a life of eight years and a salvage value of

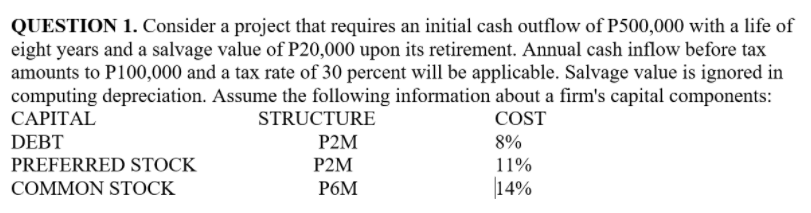

QUESTION 1. Consider a project that requires an initial cash outflow of P500,000 with a life of eight years and a salvage value of P20,000 upon its retirement. Annual cash inflow before tax amounts to P100,000 and a tax rate of 30 percent will be applicable. Salvage value is ignored in computing depreciation. Assume the following information about a firm's capital components: CAPITAL STRUCTURE DEBT PREFERRED STOCK COMMON STOCK P2M COST 8% P2M 11% P6M 14%

Step by Step Solution

3.48 Rating (151 Votes )

There are 3 Steps involved in it

To solve this problem we need to calculate the net present value NPV of the project using the given ... View full answer

Get step-by-step solutions from verified subject matter experts