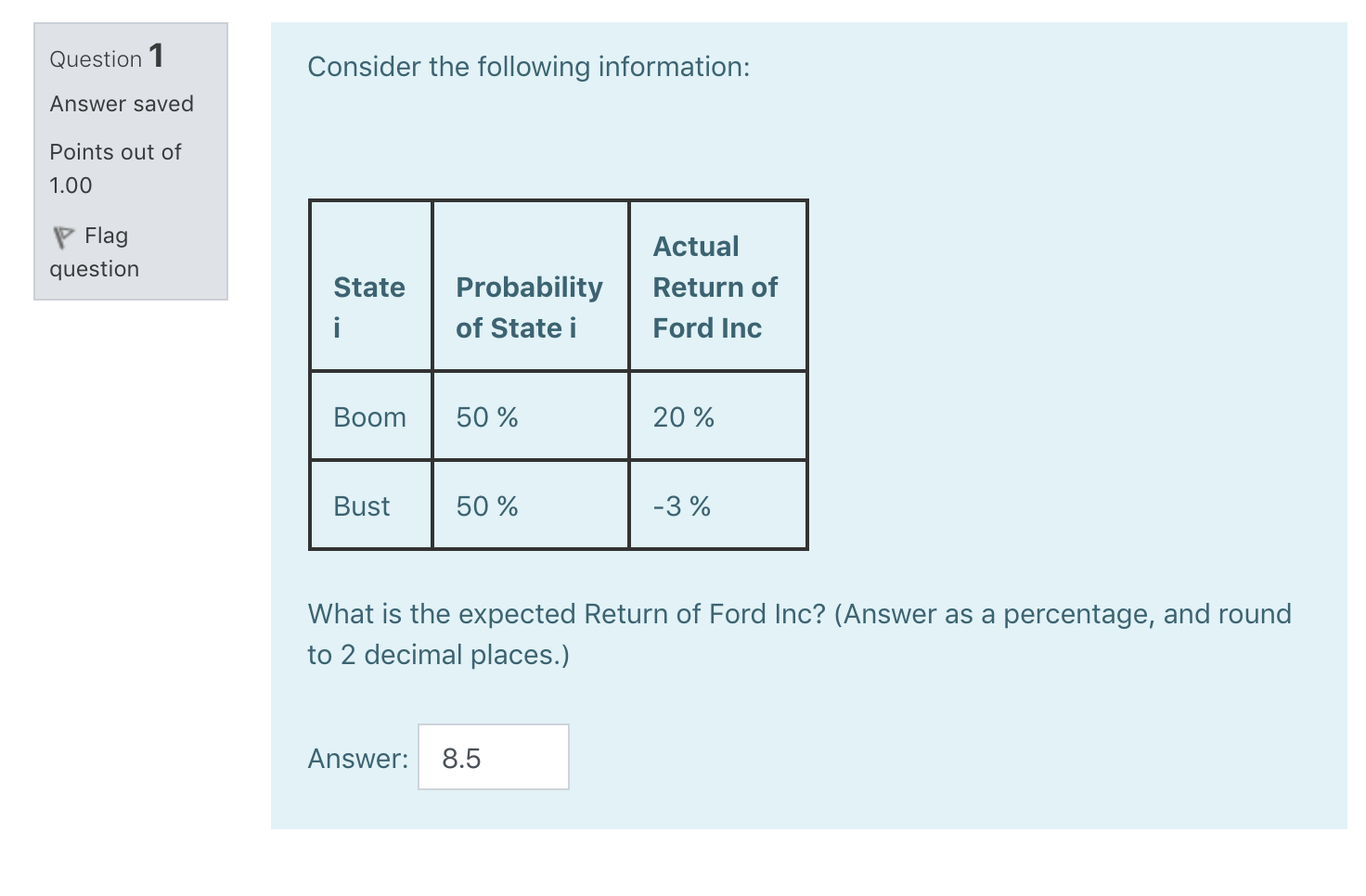

Question: Question 1 Consider the following information: Answer saved Points out of 1.00 Flag question State Probability of State i Actual Return of Ford Inc Boom

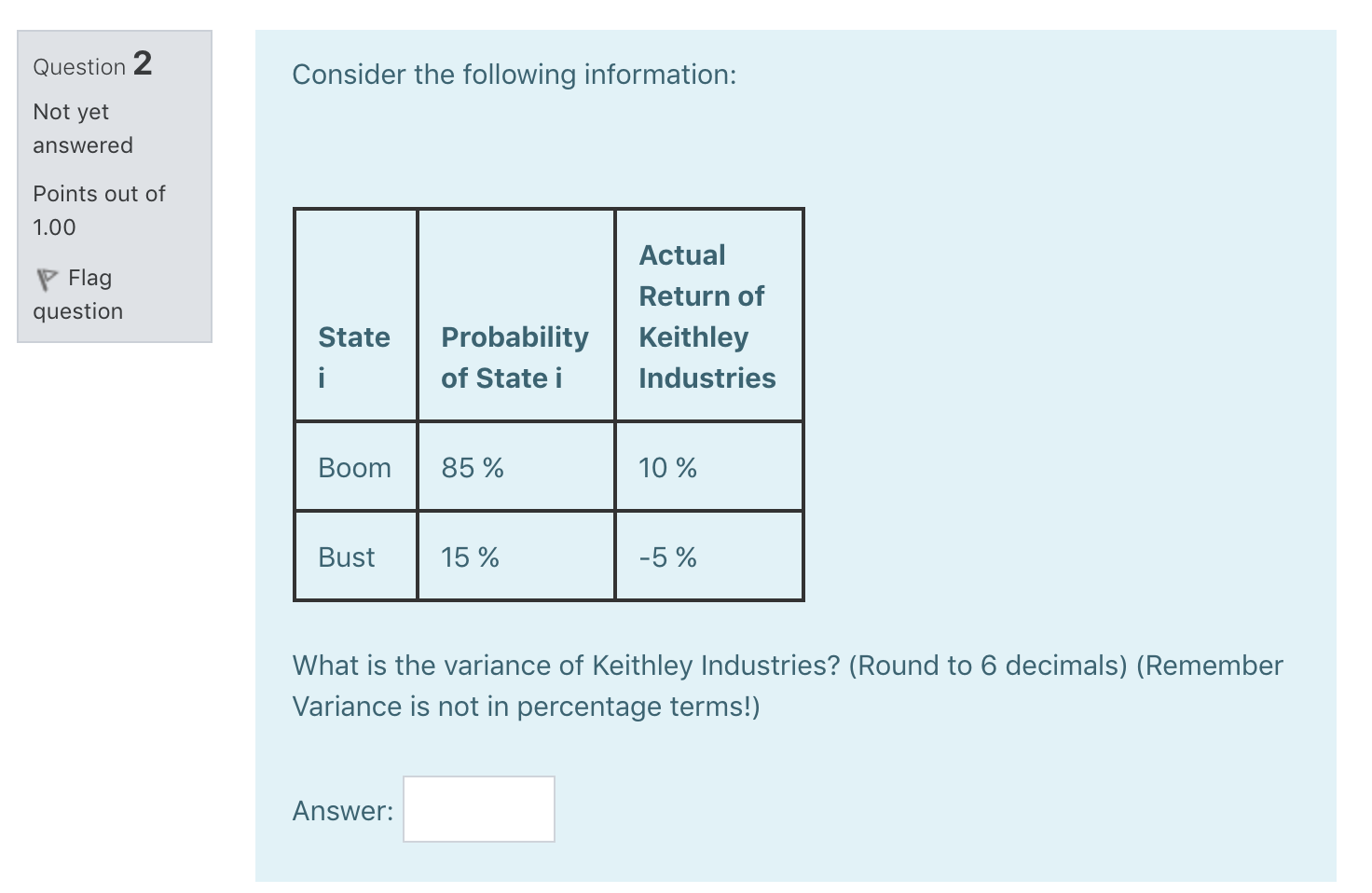

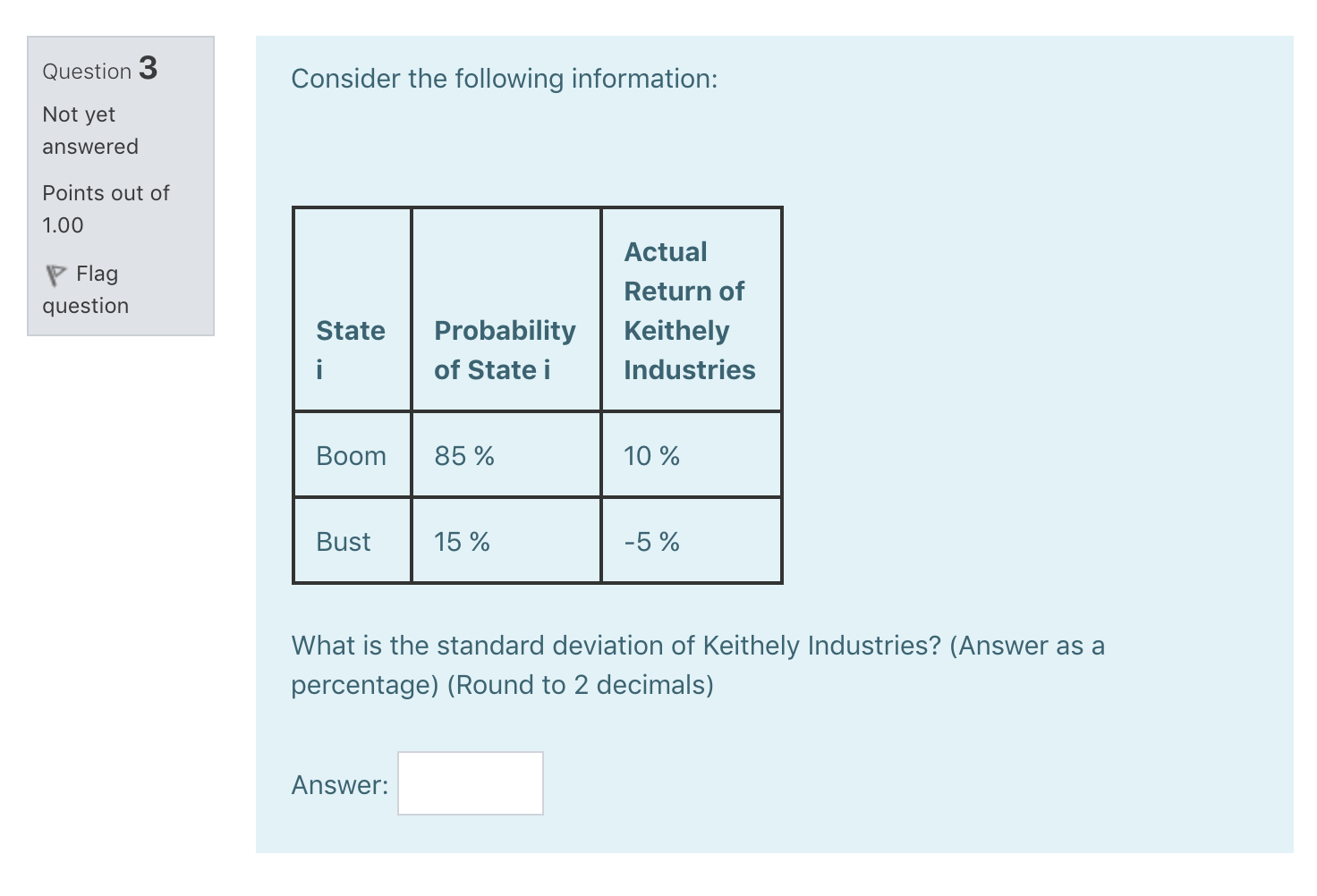

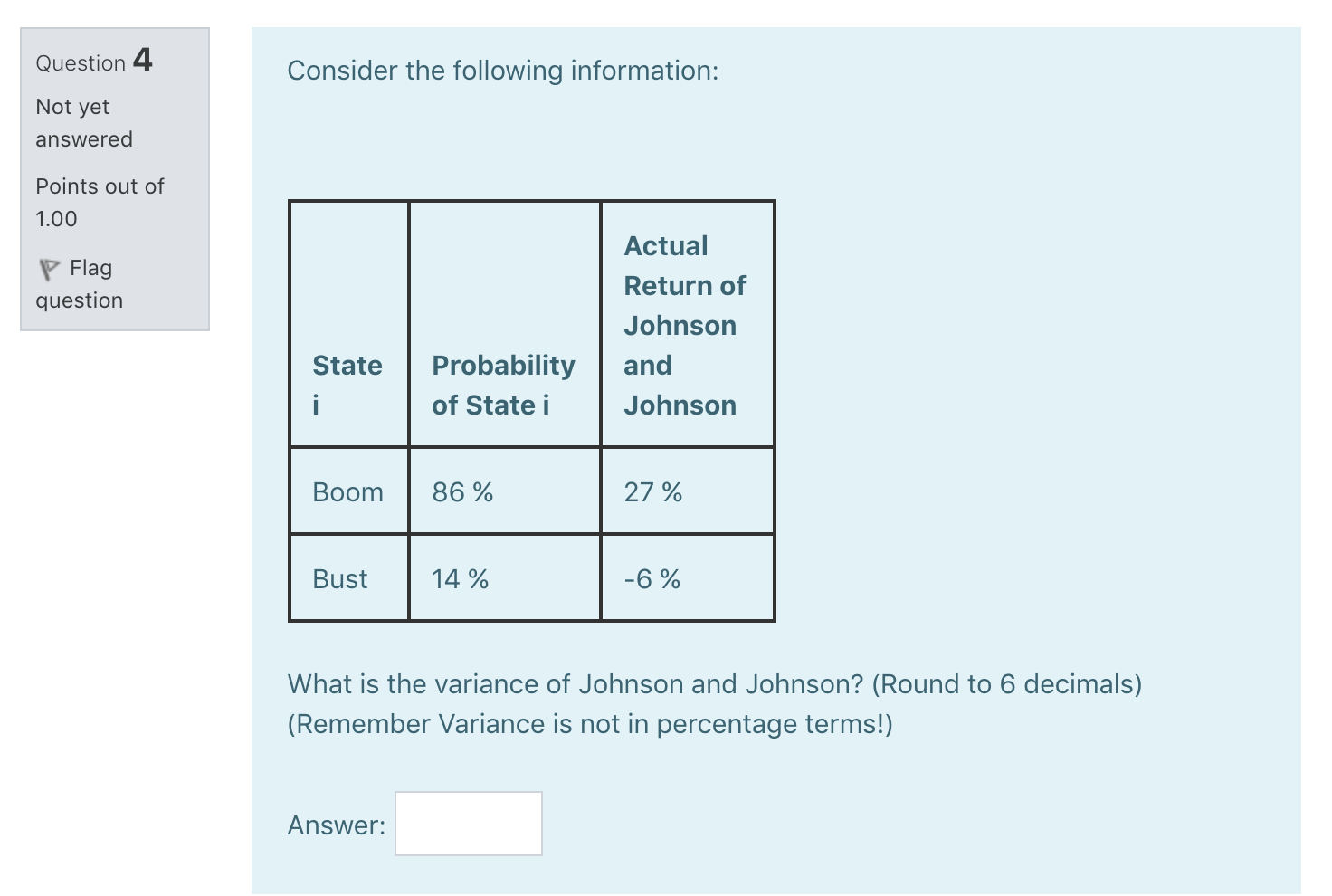

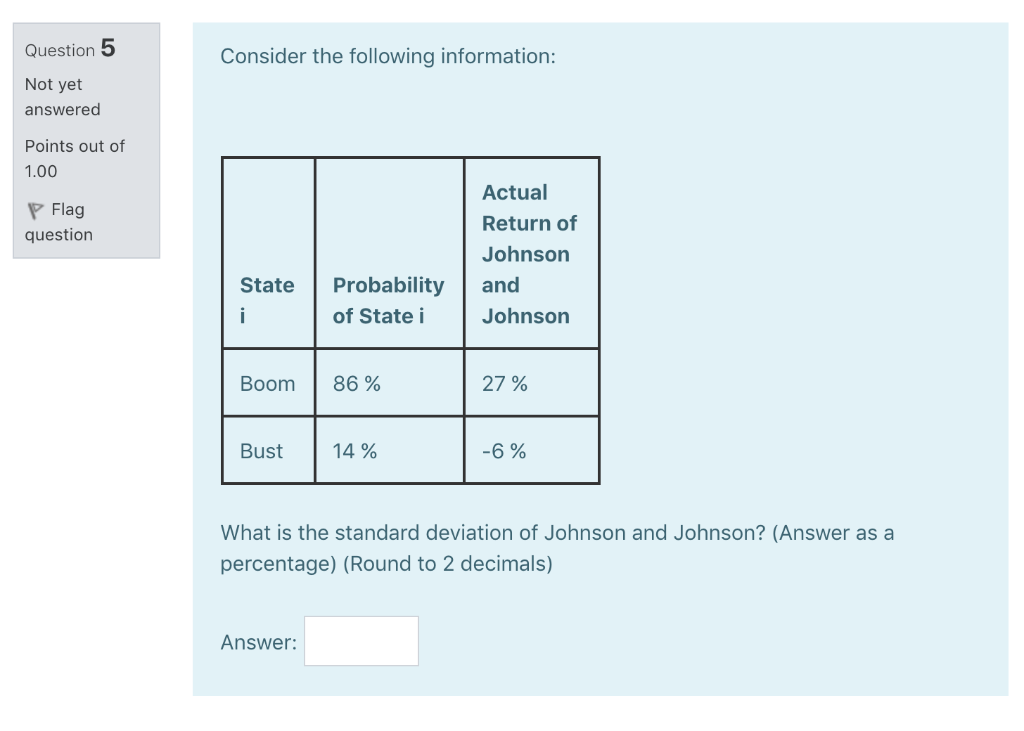

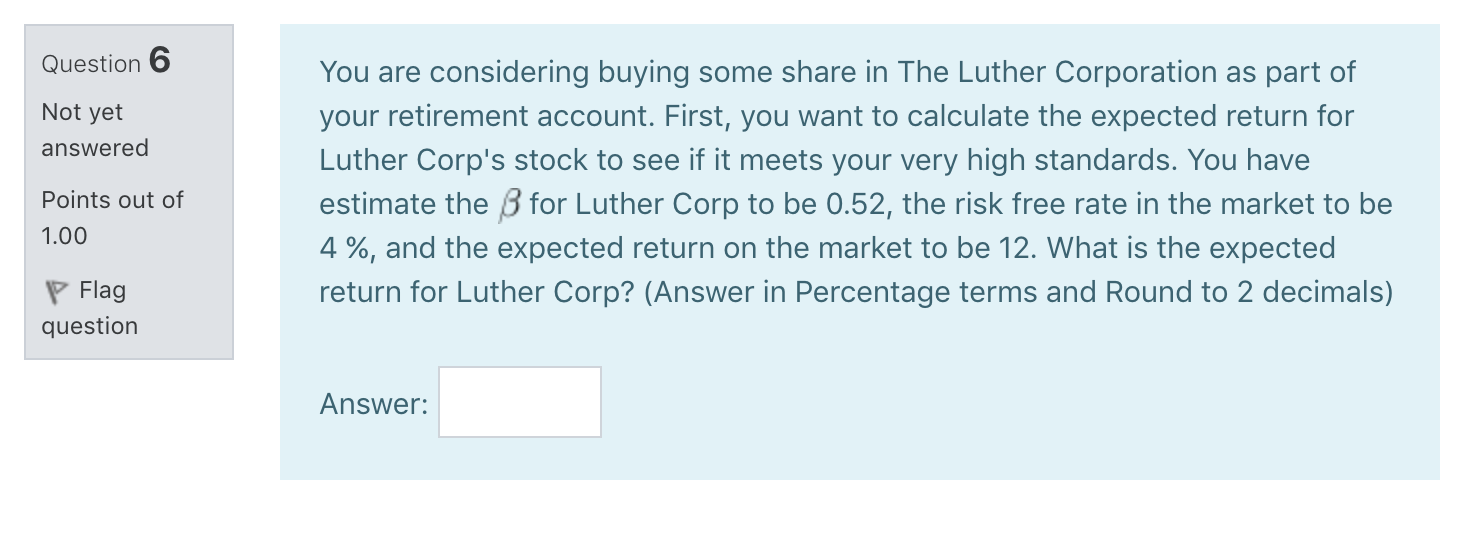

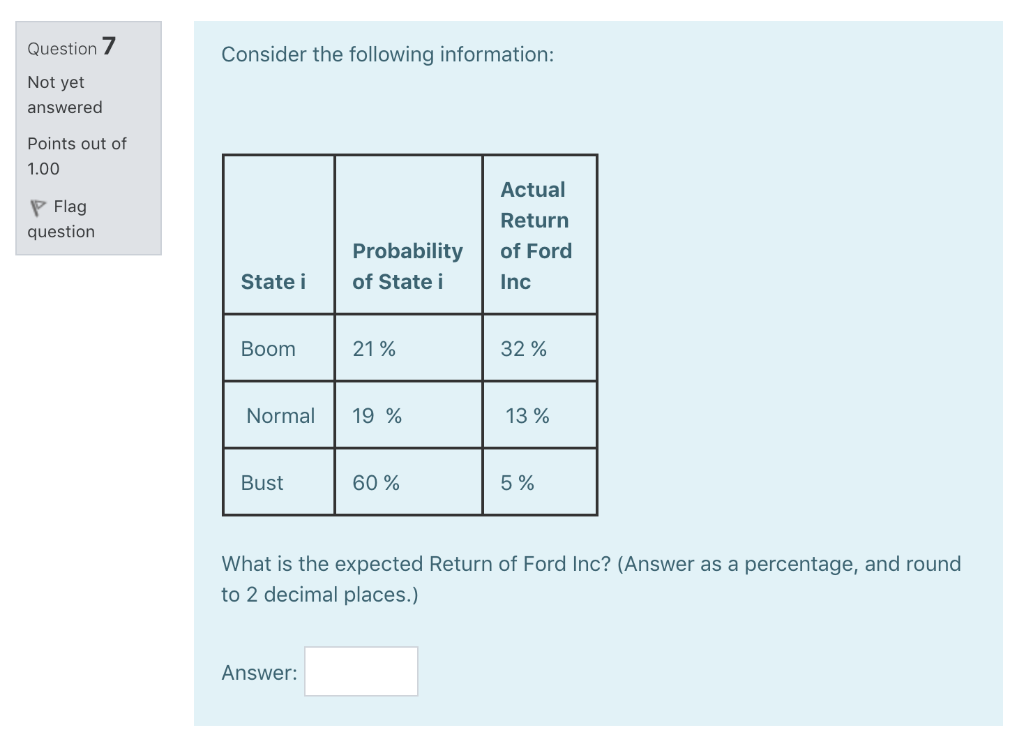

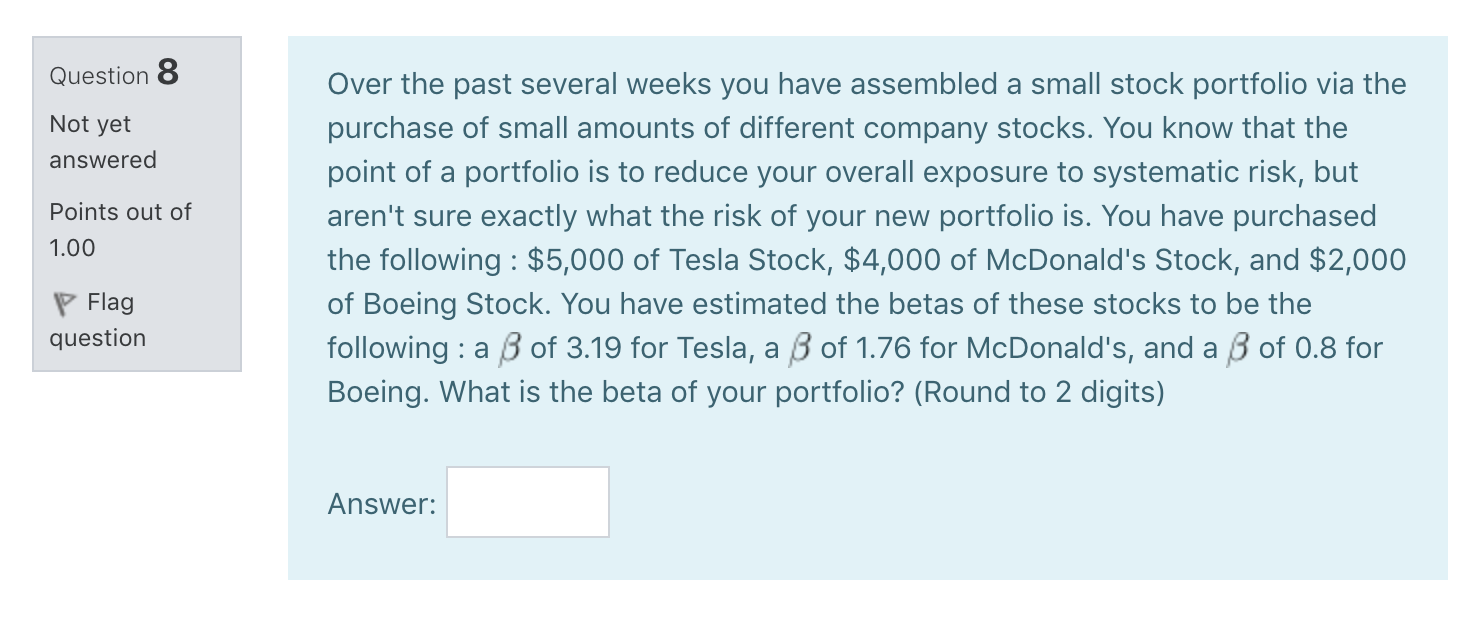

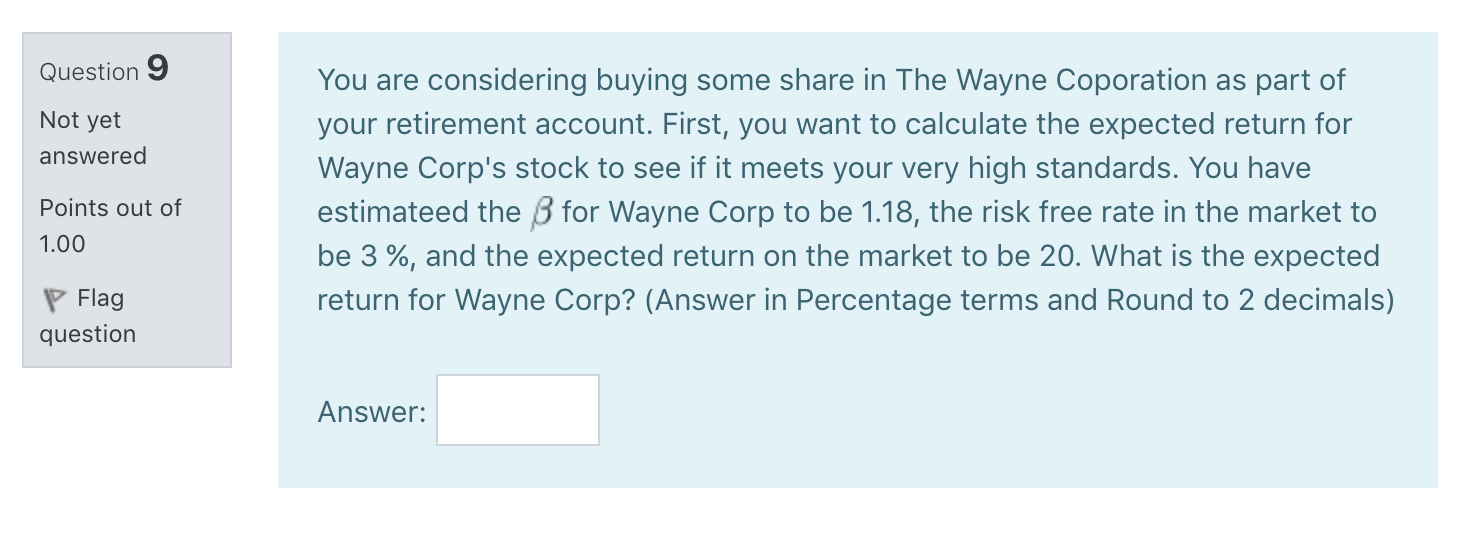

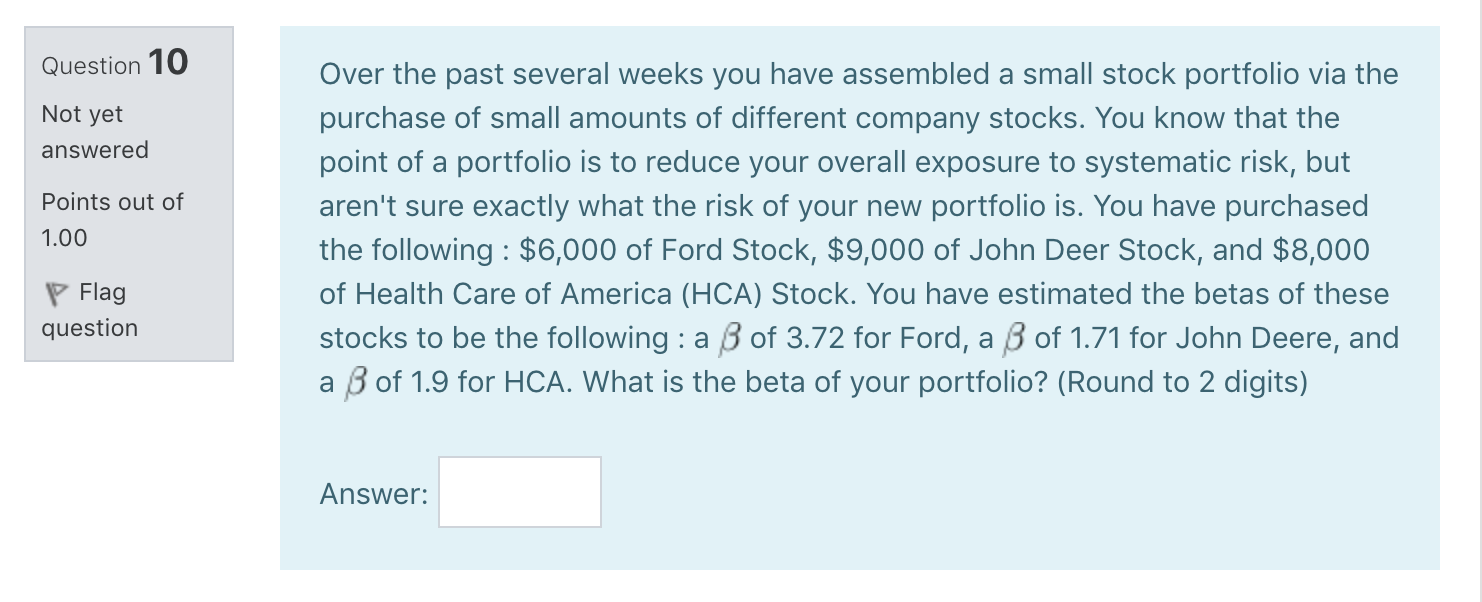

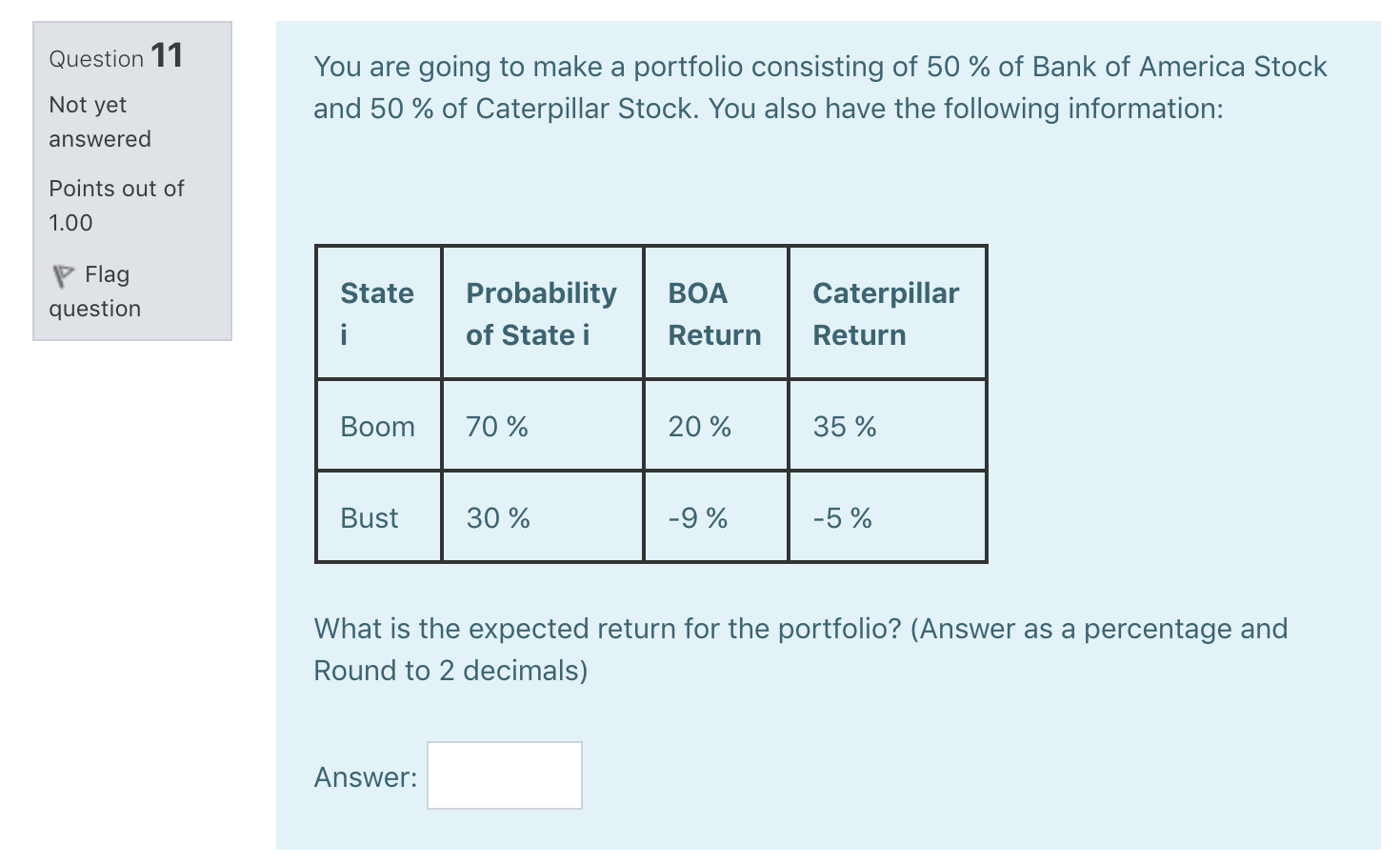

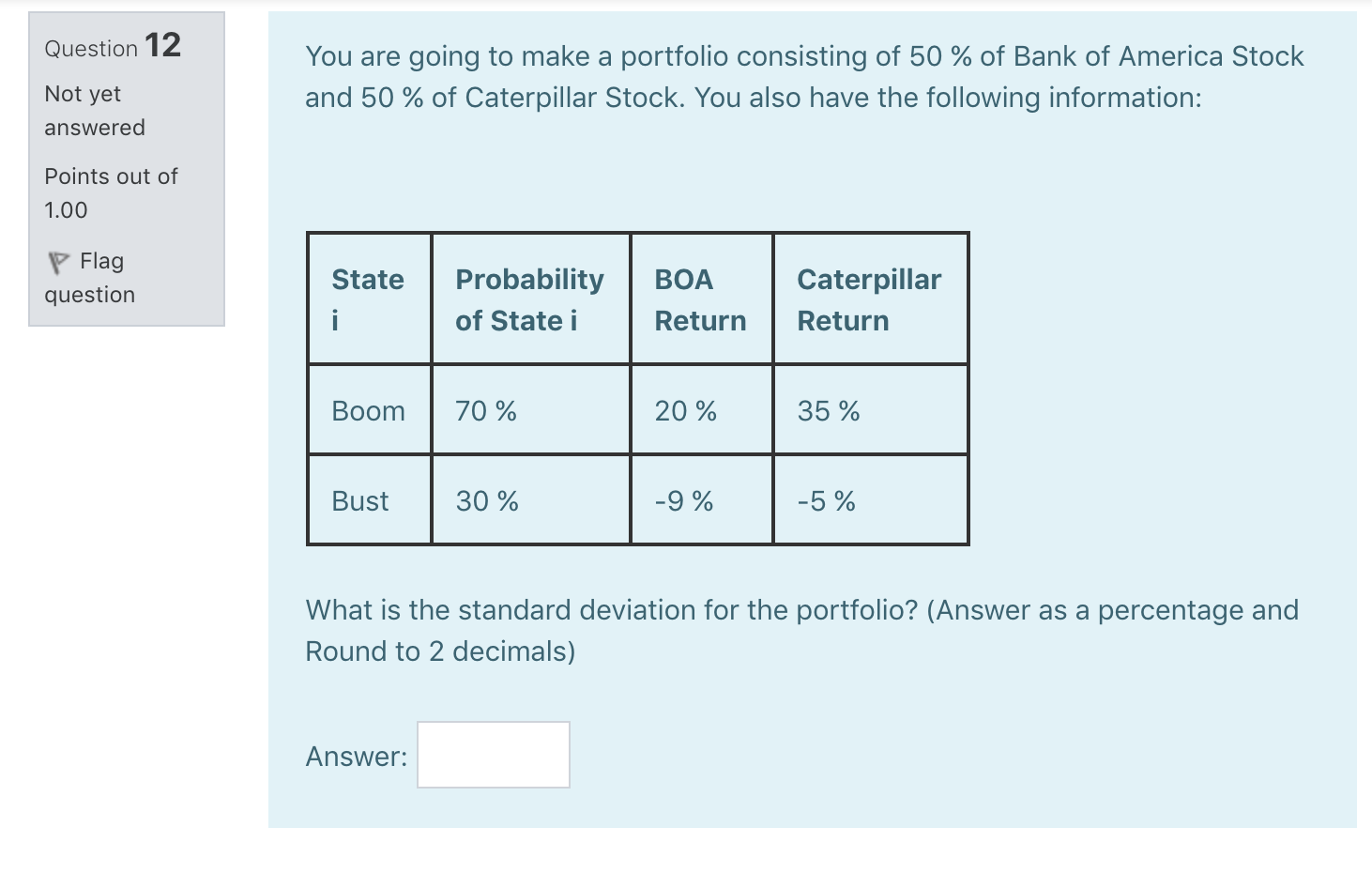

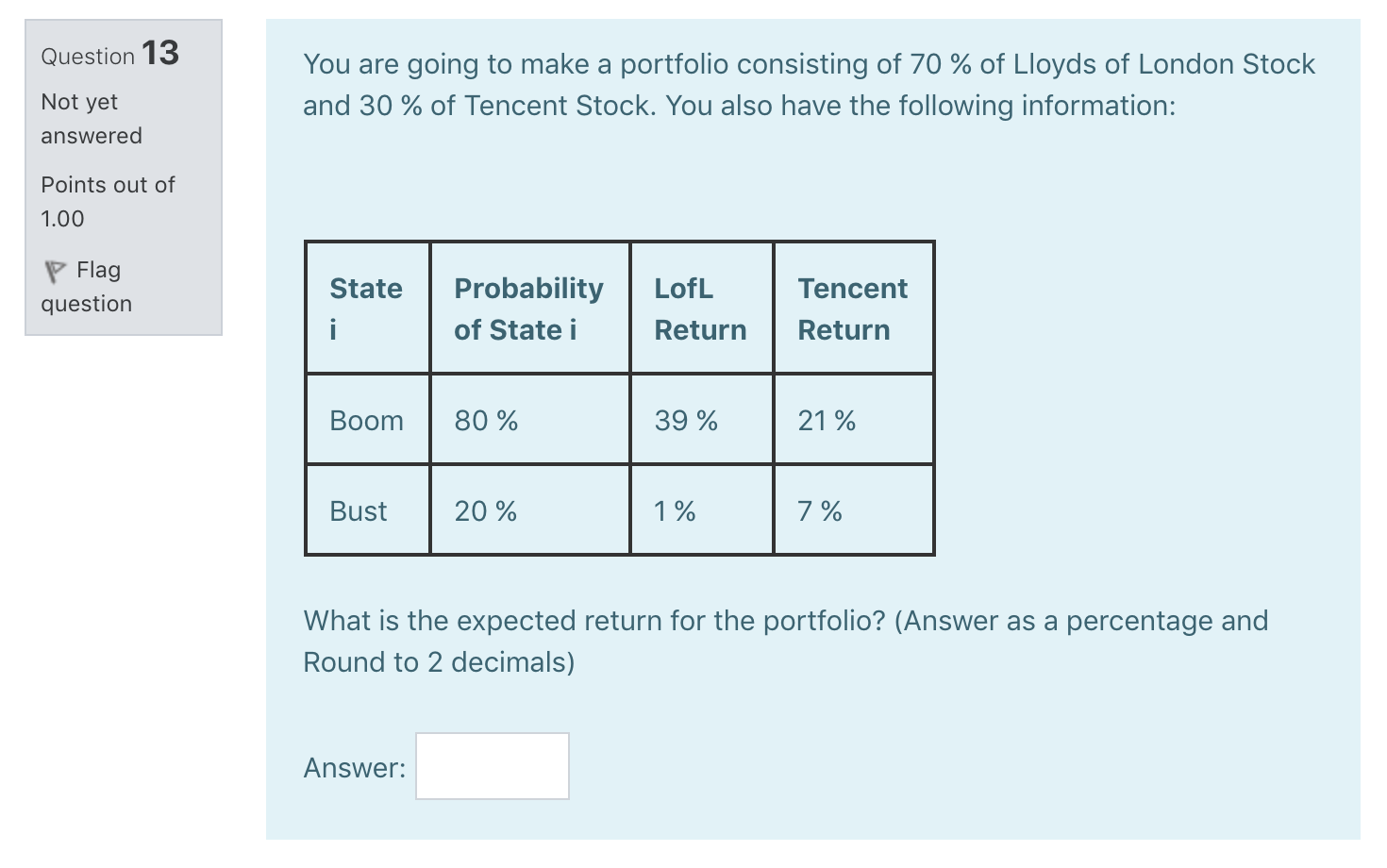

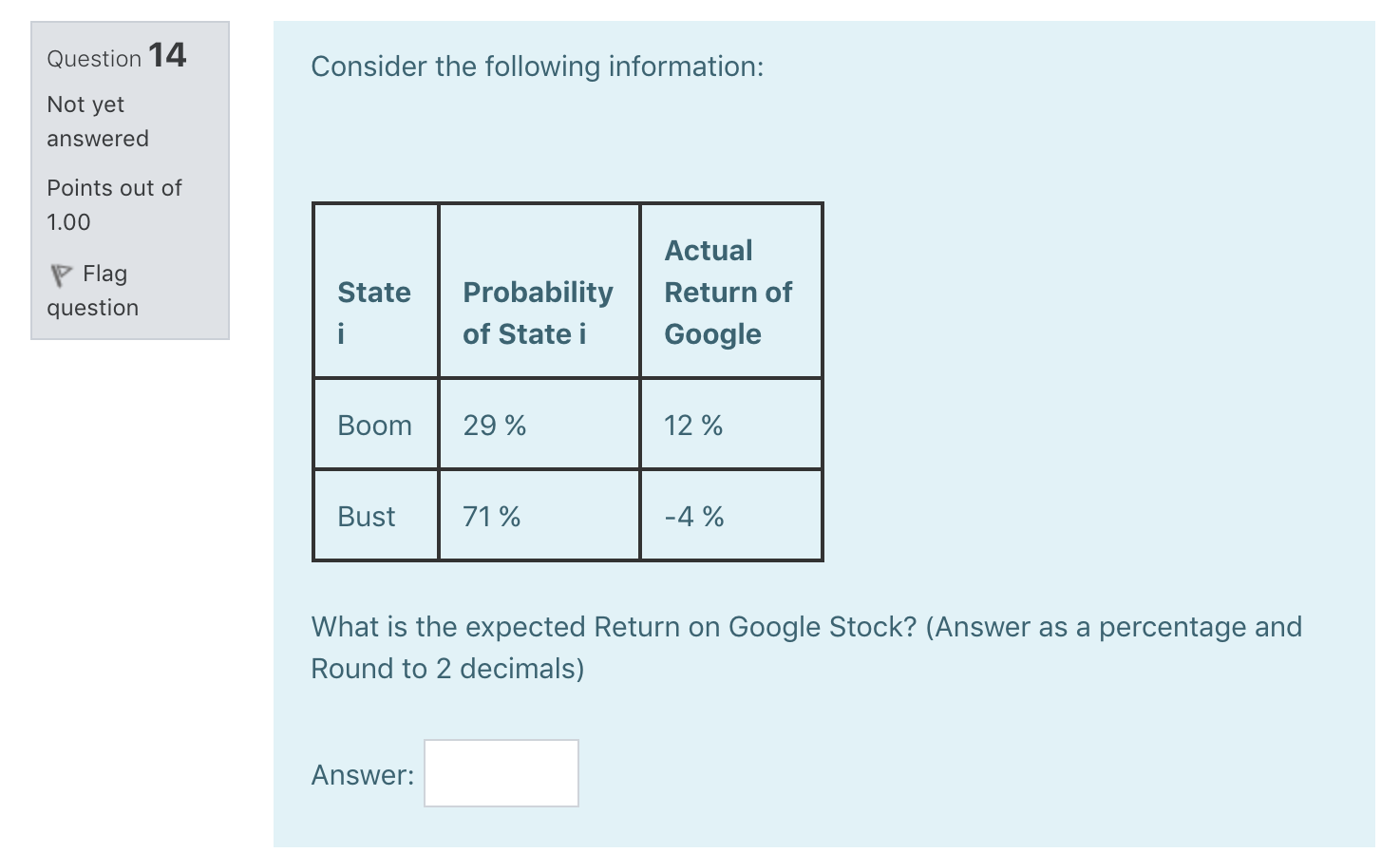

Question 1 Consider the following information: Answer saved Points out of 1.00 Flag question State Probability of State i Actual Return of Ford Inc Boom 50% 20% Bust 50% -3% What is the expected Return of Ford Inc? (Answer as a percentage, and round to 2 decimal places.) Answer: 8.5 Question 2 Consider the following information: Not yet answered Points out of 1.00 P Flag question Actual Return of Keithley Industries State Probability of State i Boom 85% 10% Bust 15% -5% What is the variance of Keithley Industries? (Round to 6 decimals) (Remember Variance is not in percentage terms!) Answer: Question 3 Consider the following information: Not yet answered Points out of 1.00 Actual P Flag question State Probability of State i Return of Keithely Industries Boom 85% 10 % Bust 15% -5% What is the standard deviation of Keithely Industries? (Answer as a percentage) (Round to 2 decimals) Answer: Question 4 Consider the following information: Not yet answered Points out of 1.00 Flag question Actual Return of Johnson and Johnson State Probability of State i Boom 86% 27 % Bust 14 % -6% What is the variance of Johnson and Johnson? (Round to 6 decimals) (Remember Variance is not in percentage terms!) Answer: Consider the following information: Question 5 Not yet answered Points out of 1.00 P Flag question Actual Return of Johnson and Johnson State Probability of State i Boom 86% 27% Bust 14% -6% What is the standard deviation of Johnson and Johnson? (Answer as a percentage) (Round to 2 decimals) Answer: Question 6 Not yet answered You are considering buying some share in The Luther Corporation as part of your retirement account. First, you want to calculate the expected return for Luther Corp's stock to see if it meets your very high standards. You have estimate the B for Luther Corp to be 0.52, the risk free rate in the market to be 4%, and the expected return on the market to be 12. What is the expected return for Luther Corp? (Answer in Percentage terms and Round to 2 decimals) Points out of 1.00 Flag question Answer: Question 7 Consider the following information: Not yet answered Points out of 1.00 P Flag question Actual Return of Ford Probability of State i State i Inc Boom 21% 32% Normal | 19 % 13% Bust 60% 5% What is the expected Return of Ford Inc? (Answer as a percentage, and round to 2 decimal places.) Answer: Question 8 Not yet answered Points out of 1.00 Over the past several weeks you have assembled a small stock portfolio via the purchase of small amounts of different company stocks. You know that the point of a portfolio is to reduce your overall exposure to systematic risk, but aren't sure exactly what the risk of your new portfolio is. You have purchased the following : $5,000 of Tesla Stock, $4,000 of McDonald's Stock, and $2,000 of Boeing Stock. You have estimated the betas of these stocks to be the following: a B of 3.19 for Tesla, a 8 of 1.76 for McDonald's, and a B of 0.8 for Boeing. What is the beta of your portfolio? (Round to 2 digits) P Flag question Answer: Question 9 Not yet answered You are considering buying some share in The Wayne Coporation as part of your retirement account. First, you want to calculate the expected return for Wayne Corp's stock to see if it meets your very high standards. You have estimateed the for Wayne Corp to be 1.18, the risk free rate in the market to be 3 %, and the expected return on the market to be 20. What is the expected return for Wayne Corp? (Answer in Percentage terms and Round to 2 decimals) Points out of 1.00 P Flag question Answer: Question 10 Not yet answered Points out of 1.00 Over the past several weeks you have assembled a small stock portfolio via the purchase of small amounts of different company stocks. You know that the point of a portfolio is to reduce your overall exposure to systematic risk, but aren't sure exactly what the risk of your new portfolio is. You have purchased the following : $6,000 of Ford Stock, $9,000 of John Deer Stock, and $8,000 of Health Care of America (HCA) Stock. You have estimated the betas of these stocks to be the following: a 8 of 3.72 for Ford, a 8 of 1.71 for John Deere, and a 8 of 1.9 for HCA. What is the beta of your portfolio? (Round to 2 digits) P Flag question Answer: Question 11 You are going to make a portfolio consisting of 50 % of Bank of America Stock and 50 % of Caterpillar Stock. You also have the following information: Not yet answered Points out of 1.00 P Flag question State Probability of State i BOA Return Caterpillar Return Boom 70% 20 % 35 % Bust 30 % -9 % -5% What is the expected return for the portfolio? (Answer as a percentage and Round to 2 decimals) Answer: Question 12 You are going to make a portfolio consisting of 50 % of Bank of America Stock and 50 % of Caterpillar Stock. You also have the following information: Not yet answered Points out of 1.00 Flag question State Probability of State i BOA Return Caterpillar Return Boom | 70% 20% 35% Bust 30 % -9% -5% What is the standard deviation for the portfolio? (Answer as a percentage and Round to 2 decimals) Answer: Question 13 You are going to make a portfolio consisting of 70 % of Lloyds of London Stock and 30 % of Tencent Stock. You also have the following information: Not yet answered Points out of 1.00 Flag question State Probability of State i LofL Return Tencent Return Boom | 80 % 39 % 21% Bust 20% 1% 7% What is the expected return for the portfolio? (Answer as a percentage and Round to 2 decimals) Answer: Question 14 Consider the following information: Not yet answered Points out of 1.00 P Flag question State Probability of State i Actual Return of Google Boom 29% 12% Bust 71% -4% What is the expected Return on Google Stock? (Answer as a percentage and Round to 2 decimals)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts