Question: Question 1 Consider the following mutually exclusive projects, X and Y. Project X costs $600000 and has cash flows of $400000 in each of the

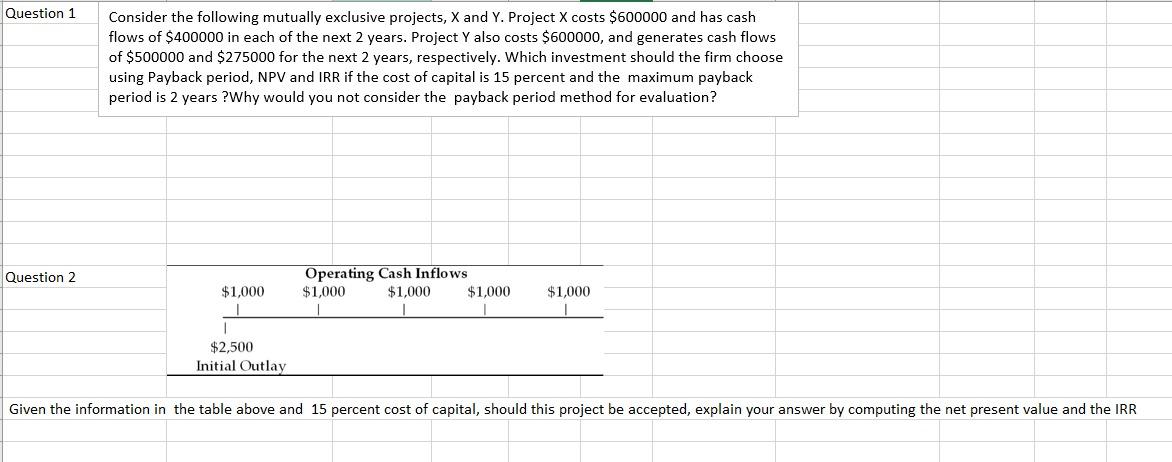

Question 1 Consider the following mutually exclusive projects, X and Y. Project X costs $600000 and has cash flows of $400000 in each of the next 2 years. Project Y also costs $600000, and generates cash flows of $500000 and $275000 for the next 2 years, respectively. Which investment should the firm choose using Payback period, NPV and IRR if the cost of capital is 15 percent and the maximum payback period is 2 years ? Why would you not consider the payback period method for evaluation? Question 2 $1,000 Operating Cash Inflows $1,000 $1,000 $1,000 $1,000 $2,500 Initial Outlay Given the information in the table above and 15 percent cost of capital, should this project be accepted, explain your answer by computing the net present value and the IRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts